Home Entertainment is a small, family-owned business that purchases LCD televisions from a reputable manufacturer and sells them at the retail level. The televisions sell, on average, for $2,060 each. The average cost of a television from the manufacturer is $1,330.

Home Entertainment has always kept careful accounting records, and the costs that it incurs in a typical month are as follows:

| Costs | Cost Formula | ||

| Selling: | |||

| Advertising | $ | 1,090 | per month |

| Delivery of televisions | $ | 50 | per television sold |

| Sales salaries and commissions | $ | 3,040 | per month, plus 5% of sales |

| Utilities | $ | 404 | per month |

| |

$ | 3,160 | per month |

| Administrative: | |||

| Executive salaries | $ | 11,500 | per month |

| Depreciation of office equipment | $ | 805 | per month |

| Clerical | $ | 1,860 | per month, plus $49 per television sold |

| Insurance | $ | 720 | per month |

During April, the company sold and delivered 219 televisions.

Required:

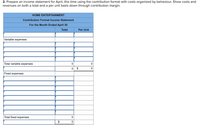

1. Prepare an income statement for April using the traditional format with costs organized by function.

2. Prepare an income statement for April, this time using the contribution format with costs organized by behaviour. Show costs and revenues on both a total and a per unit basis down through contribution margin.

Step by stepSolved in 2 steps with 2 images

- Espresso Express operates a number of espresso coffee stands in busy suburban malls. The fixed weekly expense of a coffee stand is $500 and the variable cost per cup of coffee served is $0.49. Required: Fill in the following table with your estimates of the company's total cost and average cost per cup of coffee at the indicated levels of activity. Does the average cost per cup of coffee served increase, decrease, or remain the same as the number of cups of coffee served in a week increases?arrow_forwardMicrohard produces tablets, laptops and televisions. Microhard typically sells 1,000 tablets a year. The tablet information is as follows: Selling price per unit $70 Direct material cost per unit $30 Direct labor cost per unit $10 Total unavoidable allocated overhead $47,000 How much would Operating Income decrease if Microhard were to eliminate the tablets? DO NOT INCLUDE PARENTHESES OR NEGATIVE SIGNS IN YOUR ANSWER.arrow_forwardSandhill Traders is one of the largest RV dealers in Austin, Texas, and sells about 2,800 recreational vehicles a year. The cost of placing an order with Sandhill's supplier is $500, and the inventory carrying costs are $260 for each RV. Management likes to maintain safety stock of 12 RVs. Most of its sales are made in either the spring or the fall. How many orders should the firm place this year? (Round intermediate calculations to 1 decimal place, e.g. 15.5 and final answer to 0 decimal places, e.g. 15.)arrow_forward

- Betsy's Gift Baskets sells gift baskets, on average, for $125; each gift basket costs, on average, $60. Betsy pays salaries each month of $1,300 and her store rent is $1,000 per month. She also pays sales commissions of 5% of the sales price. In May, 140 gift baskets were sold. Required: a. Prepare a traditional income statement for the month of May. b. Prepare a contributioarrow_forwardThe Home Style Eats has two restaurants that are open 24 hours a day. Fixed costs for the two restaurants together total $430,500 per year. Service varies from a cup of coffee to full meals. The average sales check per customer is $8.75. The average cost of food and other variable costs for each customer is $3.50. The income tax rate is 36%. Target net income is $117,600. Q1. Compute the revenues needed to earn the target net income. Q2. How many customers are needed to break even? To earn net income of $117,600? Q3. Compute net income if the number of customers is 170,000.arrow_forwardDogarrow_forward

- Easley-O'Hara Office Equipment sells furniture and technology solutions to consumers and to businesses. Most consumers pay for their purchases with credit cards and business customers make purchases on open account with terms 1/10, net 30. Costs of furniture Inventory purchases have generally been rising and costs of computer Inventory purchases have generally been declining. The company's Income tax rate is 20 percent. Casey Easley, the general manager, was particularly Interested in the financial statement effects of the following facts related to first quarter operations. a. Credit card sales (discount 2 percent) were $39,000. b. Sales on account were $116,000. The company expects one-half of the accounts to be paid within the discount period. c. The company computed cost of goods sold for the transactions in (a) and (b) above under FIFO and LIFO for Its two product lines and chose the method for each product that minimizes Income taxes: Furniture Computer equipment FIFO $ 28,600…arrow_forwardQT, Inc. and Elppa Computers, Inc. compete with each other in the personal computer market. QT assembles computers to customer orders, building and delivering a computer within four days of a customer entering an order online. Elppa, on the other hand, builds computers for inventory prior to receiving an order. These computers are sold from inventory once an order is received. Selected financial information for both companies from recent financial statements follows (in millions): QT Elppa Sales $35,040 $46,400 Cost of goods sold 29,200 43,800 Inventory, beginning of period 932 4,028 Inventory, end of period 1,132 4,828 a. Determine for both companies (1) the inventory turnover and (2) the number of days' sales in inventory. Round your calculations and answers to one decimal place. Assume 365 days a year. (refer to image) b. QT has a ______ (higher/lower) inventory turnover ratio than does Elppa Company. Likewise, QT has a _____ (larger/smaller) number…arrow_forwardTim's Bicycle Shop sells 21-speed bicycles. For purposes of a cost-volume-profit analysis, the shop owner has divided sales into two categories, as follows: product type high quality medium quality price invoice cost 840 620 sales commission sales price 1850 920 100 40 Three-quarters of the shop's sales are medium-quality bikes. The shop's annual fixed expenses are $270,400. (In the following requirements, ignore income taxes.) a. What is the shop's break-even sales volume in dollars? Assume a constant sales mix. b. How many bicycles of each type must be sold to earn a target net income of $126,750? Assume a constant sales mix.arrow_forward

- Polarix is a retailer of ATVs (all-terrain vehicles) and accessories. An income statement for its Consumer ATV Department for the current year follows. ATVs sell for $4,400 each. Variable selling expenses are $280 per ATV. The remaining selling expenses are fixed. Administrative expenses are 30% variable and 70% fixed. The company does not manufacture its own ATVs; it purchases them from a supplier for $1,850 each. POLARIXIncome Statement—Consumer ATV DepartmentFor Year Ended December 31 Sales $ 633,600 Cost of goods sold 266,400 Gross margin 367,200 Operating expenses Selling expenses $ 160,000 Administrative expenses 40,800 200,800 Net income $ 166,400 Required: 1. Prepare an income statement for the current year using the contribution margin format. (Do not round intermediate calculations. Round contribution margin per ATV value to the nearest whole number.)arrow_forwardThe Cycle Shoppe has decided to offer credit to its customers during the spring selling season. Sales are expected to be 330 bicycles. The average cost to the shop of a bicycle is $300. The owner knows that only 93 percent of the customers will be able to make their payments. To identify the remaining 7 percent, she is considering subscribing to a credit agency. The initial charge for this service is $540, with an additional charge of $6 per individual report. What is the amount of the net savings from subscribing to the credit agency? A. $3,790 B. $3,920 C. $4,080 D. $4,410 E. $4,950arrow_forwardWheels N Cogs is a small business that designs gear for a variety clients including those that produce lawnmower equipment. According to the financial profle, the company spends $960k each on rent and utites One of the reasons why the company is so successful is that it can produce gear at a relatively low price ($1.72/gear) and can sell them for $9.34. Based on the information conceming this company, how many gears would Wheels N Cogs need to produce for them to break even? Oa 50,000 per year Ob 125.000 per year Oc 100,000 per year O 75.000 per yeararrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education