Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Mf6.

Please give only typed answer.

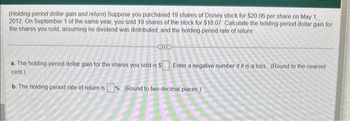

Transcribed Image Text:(Holding-period dollar gain and return) Suppose you purchased 19 shares of Disney stock for $20.06 per share on May 1,

2012. On September 1 of the same year, you sold 19 shares of the stock for $18.07 Calculate the holding-period dollar gain for

the shares you sold, assuming no dividend was distributed, and the holding-period rate of return.

a. The holding-period dollar gain for the shares you sold is $ Enter a negative number if it is a loss. (Round to the nearest

cent.)

2

b. The holding-period rate of return is% (Round to two decimal places.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- How would I calculate this problem? I just guessed on which answer made sense to me. Please help. thank you in advance.arrow_forwardne File Edit View History Bookmarks Profiles Tab Window Help M Inbox (2 x MACC101 x (4726) || X Account x| Account X WiConnec× M Question X Content c ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fbb.mwcc.edu%2 Chapter 7 Quiz i 7 7.58 points Ask Mc Graw Hill Saved QS 7-13 (Algo) Indicating journals used for posting LO P1, P2, P3, P4 The following T-accounts show postings of selected transactions. Indicate the journal used in recording each of these postings a through e. Cash Accounts Receivable Inventory Debit (d) 700 Credit (e) Debit 340 (b) 1,700 Credit (d) Debit Credit 700 (a) 1,520 (c) 1,040 Accounts Payable Sales Debit (e) 340 Credit (a) Debit 1,520 Credit (b) Cost of Goods Sold Credit Debit 1,700 (c) 1,040 Transaction a. b. C. d. e. Journal 12.020 ANE 18 tv Aarrow_forwardPLEASE, WRITE THE SOLUTIONS ON PAPER, EXPLAINING THE ENTIRE PROCESS, THE ONLY AND CORRECT ANSWERS ARE FOR (i) V(t) = exp (-2e^0.02t + 2 ) for 0 15 (i) Derive, and simplify as far as possible, expressions in terms of t for V(t), where V(t) is the present value of a unit sum of cash flow made at time t. You should derive separate expressions for the three sub-intervals. (ii) Hence, making use of the result in part (i), calculate the value at time t = 3 of a payment of £2,500 made at time t = 15. (iii) Calculate, to the nearest 0.01%, the constant nominal annual rate of interest convertible half-yearly implied by the transaction in part (ii). (iv) Making use of the result in part (i), calculate the present value of a payment stream p(t) paid continuously from time t = 15 to t = 20 at a rate of payment at time t given by: p(t) = 300e 0.02tarrow_forward

- Question 3 Listen What are the values of r and r² for the below table of data? Hint: Make sure your diagnostics are turned on. Enter the data into L1 and L2. Click STAT, CALC, and choose option 8: Lin Reg(a+bx). A r = -0.862 r2=0.743 B r=0.673 2=0.820 X y 5 C r=0.743 r2=-0.862 8 22 23.9 14 9 14 17 20 5.2arrow_forwardTopic: Uni X U2_AS i Topic: Uni X M Question X M Question x M Question √x ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https% 253A%252F%252Flms.mheducation.com%252Fmghmiddle Complete this question by entering your answers in the tabs below. Required 1 Required 2 F2 Moab Incorporated manufactures and distributes high-tech biking gadgets. It has decided to streamline some of its operations so that it will be able to be more productive and efficient. Because of this decision it has entered into several transactions during the year. a. Moab Incorporated sold a machine that it used to make computerized gadgets for $30,600 cash. It originally bought the machine for $21,400 three years ago and has taken $8,000 in depreciation. b. Moab Incorporated held stock in ABC Corporation, which had a value of $23,000 at the beginning of the year. That same stock had a value of $26,230 at the end of the year. c. Moab Incorporated sold some of its inventory for $9,200…arrow_forwardAny help is appreciated, here is the question. https://drive.google.com/file/d/0B-AOAJtLKPhfOEJhR0RWRWtmT3BGVVljQUZaRko0Zkh2NDRr/view?usp=sharingarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education