FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

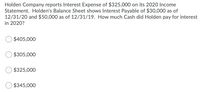

Transcribed Image Text:Holden Company reports Interest Expense of $325,000 on its 2020 Income

Statement. Holden's Balance Sheet shows Interest Payable of $30,000 as of

12/31/20 and $50,000 as of 12/31/19. How much Cash did Holden pay for interest

in 2020?

$405,000

$305,000

$325,000

$345,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Income Statement: The income statement of Taco Bell company is given for the years 2020 & 2019. 2020 2019 General and administrative expenses 25,000 24,000 Interest expense 1,200 1,500 Net sales $124,000 S138,000 Selling expenses 11,880 12,720 Income taxes $1,109.5 1,883 108 000 95,000 COGS 450 600 Gain on Sale of land l2020 andarrow_forwardConsider the following financial statement information for Hi-Tech Instruments: 2020 (Thousands of Dollars, except Earnings per Share) Sales revenue $210,000 Cost of goods sold 125,000 Net income 8,300 Dividends 2,600 Earnings per share 4.15 HI-TECH INSTRUMENTS, INC. Balance Sheets (Thousands of Dollars) Dec. 31, 2020 Dec. 31, 2019 Assets Cash $18,300 $18,000 Accounts receivable (net) 46,000 41,000 Inventory 39,500 43,700 Total Current Assets 103,800 102,700 Plant assets (net) 52,600 50,500 Other assets 15,600 13,800 Total Assets $172,000 $167,000 Liabilities and Stockholders’ Equity Notes payable—banks $6,000 $6,000 Accounts payable 22,500 18,700 Accrued liabilities 16,500 21,000 Total Current Liabilities 45,000 45,700 9% Bonds payable 40,000 40,000 Total Liabilities 85,000 85,700 Common stock* 50,000 50,000 Retained earnings 37,000 31,300 Total Stockholders’ Equity 87,000 81,300 Total Liabilities and…arrow_forwardBALANCE SHEET AT END OF YEAR (Figures in $ millions) Assets 2021 2022 Liabilities and Shareholders' Equity 2021 2022 Current assets $ 102 $ 200 Current liabilities $ 74 $ 96 Net fixed assets 920 1,020 Long-term debt 660 870 INCOME STATEMENT, 2022 (Figures in $ millions) Revenue $ 2,010 Cost of goods sold 1,090 Depreciation 410 Interest expense 252 g. Net fixed assets increased from $920 million to $1,020 million during 2022. What must have been South Sea’s gross investment in fixed assets during 2022?........... (M1)arrow_forward

- Financing Deficit Garlington Technologies Inc.'s 2019 financial statements are shown below: Income Statement for December 31, 2019 Sales $4,000,000 Operating costs 3,200,000 EBIT $ 800,000 Interest 120,000 Pre-tax earnings $ 680,000 Taxes (25%) 170,000 Net income 510,000 Dividends $ 190,000 Balance Sheet as of December 31, 2019 Cash $ 160,000 Accounts payable $ 360,000 Receivables 360,000 Line of credit 0 Inventories 720,000 Accruals 200,000 Total CA $1,240,000 Total CL $ 560,000 Fixed assets 4,000,000 Long-term bonds 1,000,000 Total Assets $5,240,000 Common stock 1,100,000 RE 2,580,000 Total L&E $5,240,000 Suppose that in 2020 sales increase to $4.2 million and that 2020 dividends will increase to $244,000. Forecast the financial statements using the forecasted financial statement method. Assume the firm operated at full capacity in 2019. The long-term bonds have an interest rate of 9%.arrow_forward4. PG Merchandising, a general partnership earned a net profit of P98,000 for the calendar year 2020. The capital account of the partners for the year ended December 31, 2020 is shown below: Pinto Capital (Mar 1) P25,000 (Jan 1) P150,000 (Nov 1) P37,000 (Jul 1) 50,000 (Oct 1) 50,000arrow_forwardThe financial information on Lazy Day, Inc. is as follows: 2019 2020 Cash $ 138 $ 97 Sales 10,204 11,317 Inventory 5,209 5,138 Depreciation 956 948 Cost of goods sold 4,207 4,618 Accounts payable 3,338 3,209 Long-term debt 4,200 3,800 Shareholders’ equity 9,229 9,906 Accounts receivable 2,780 2,960 Net fixed assets 8,640 8,720 Interest expense 350 320 Selling and administrative expenses 1,015 984 Taxes 1,250 1,512 What is the cash flow to creditors for 2020?arrow_forward

- The current asset section of the Moorcroft Outboard Motor Company's balance sheet reported the following amounts: Accounts receivable, net The average collection period for 2021 is 50 days. 12/31/2021 12/31/2020 $500,000 $400,000 Required: Determine net sales for 2021. (Use 365 days in a year. Do not round intermediate calculations.) Net sales $ 450,000arrow_forwardssume General Motors announced a quarterly profit of $119 million for 4th quarter 2019. Below Is a portion of its Conduct a horizontal analysis of the following line items. (Negative answers should be indicated by a minus sige percent" answers to the nearest hundredth percent.) 2018 (dollars in millions) Difference % CHG 2019 (dollars in millions) $ 086 9,222 Cash and cash equivalents 16,148 14,324 Marketable securities 13.642 Inventories 144,603 Total lablites and equity F5 F6 F8 F10 F1 F12 Homearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education