FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

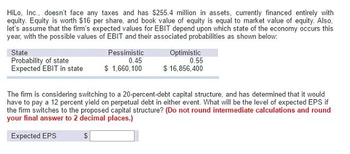

Transcribed Image Text:HiLo, Inc., doesn't face any taxes and has $255.4 million in assets, currently financed entirely with

equity. Equity is worth $16 per share, and book value of equity is equal to market value of equity. Also,

let's assume that the firm's expected values for EBIT depend upon which state of the economy occurs this

year, with the possible values of EBIT and their associated probabilities as shown below:

State

Probability of state

Expected EBIT in state

Pessimistic

0.45

$ 1,660,100

$

Optimistic

0.55

$ 16,856,400

The firm is considering switching to a 20-percent-debt capital structure, and has determined that it would

have to pay a 12 percent yield on perpetual debt in either event. What will be the level of expected EPS if

the firm switches to the proposed capital structure? (Do not round intermediate calculations and round

your final answer to 2 decimal places.)

Expected EPS

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Similar questions

- Assume an M&M world with taxes. Your company's EBIT is currently $20,000,000, and EBIT is expected to remain constant over time (zero growth). The company pays out all of its earnings each year, so its earnings per share equals its dividends per share. The firm has 6,000,000 shares outstanding. The risk-free rate in the economy is 2.5 percent, and the market risk premium is 5.0 percent. The company's beta is currently 1.50. And, of course, the tax rate is 40%. Currently, the firm as no debt outstanding. The company decided to issue $X million worth of debt, and to use the proceeds to repurchase shares in the open market. When the announcement of the debt issue was made yesterday, the stock price reacted appropriately, increasing by 8%. The firm then issued the debt and repurchased the shares as planned. What is the final beta of the firm's equity? You should use all M&M assumptions for this answer. Answer in X.XX format. For example, a final beta of 1.0356 should be entered as 1.04.arrow_forwardYou have the following cash flows for the firm; What is NPV, if discount rate is 10% ? CF0 = -467 (CF0 is always negative. It is your initial investment) CF1 = 625 CF2 = 684 CF3 = 666 CF4 = 753 CF5 = 976arrow_forwardConsider a two-date binomial model. A company has both debt and equity in its capital structure. The value of the company is 100 at Date 0. At Date 1, it is equally like that the value of the company increases by 20% or decreases by 10%. The total promised amount to the debtholders is 100 at Date 1. The riskfree interest rate is 10%. a. What are the possible payoffs to the equityholders at date 1? What kind of financial product has the same payoffs? Please describe the detailed characteristics of the financial product. b. What are the possible payoffs to the bondholders at date 1? Are they riskfree? What kind of financial product/portfolio has the same payoffs? Please describe the detailed characteristics of the financial product/portfolio.arrow_forward

- Please solve using excel and explain formulas.arrow_forwardAn unlevered firm has a value of $850 million. An otherwise identical but levered firm has $80 million in debt at a 3% interest rate, which is its pre-tax cost of debt. Its unlevered cost of equity is 10%. After Year 1, free cash flows and tax savings are expected to grow at a constant rate of 4%. Assuming the corporate tax rate is 25%, use the compressed adjusted present value model to determine the value of the levered firm. (Hint: The interest expense at Year 1 is based on the current level of debt.) Enter your answer in millions. For example, an answer of $10,550,000 should be entered as 10.55. Do not round intermediate calculations. Round your answer to two decimal places.arrow_forwardYou have the following cash flows for the firm; What is NPV, if discount rate is 10% ? CF0 = -467 (CF0 is always negative. It is your initial investment) CF1 = 625 CF2 = 684 CF3 = 666 CF4 = 753 CF5 = 976arrow_forward

- Problem 10-1 Zenith Investment Company is considering the purchase of an office property. It has done an extensive market analysis and has estimated that based on current market supply or demand relationships, rents, and its estimate of operating expenses, annual NOI will be as follows: Year NOI 1 $ 1,285,000 2 1,285,000 3 1,285,000 4 1,295,000 5 1,345,000 6 1,395,000 7 1,434,000 8 1,474,170 A market that is currently oversupplied is expected to result in cash flows remaining flat for the next three years at $1,285,000. During years 4, 5, and 6, market rents are expected to be higher. It is further expected that beginning in year 7 and every year thereafter, NOI will tend to reflect a stable, balanced market should grow at 3 percent per year indefinitely. Zenith believes that investors should earn a 12 percent return (r) on an investment of this kind. ?arrow_forwardWolfrum Technology (WT) has no debt. Its assets will be worth $467 million one year from now if the economy is strong, but only $295 million in one year if the economy is weak. Both events are equally likely. The market value today of its assets is $291 million. a. What is the expected return of WT stock without leverage? b. Suppose the risk-free interest rate is 5%. If WT borrows $139 million today at this rate and uses the proceeds to pay an immediate cash dividend, what will be the market value of its equity just after the dividend is paid, according to MM? c. What is the expected return of WT stock after the dividend is paid in part (b)? a. The unievered expected return of WT stock is (Round to two decimal places)arrow_forwardYou have the following cash flows for the firm; What is NPV, if discount rate is 10% ? CF0 = -477 (CF0 is always negative. It is your initial investment) CF1 = 710 CF2 = 699 CF3 = 752 CF4 = 734 CF5 = 937arrow_forward

- Your company doesn't face any taxes and has $755 million in assets, currently financed entirely with equity. Equity is worth $50.50 per share, and book value of equity is equal to market value of equity. Also, let's assume that the firm's expected values for EBIT depend upon which state of the economy occurs this year, with the possible values of EBIT and their associated probabilities as shown below: State Recession Average Boom Probability of State .20 .60 .20 Expect EBIT in State $105 million $180 million $240 million The firm is considering switching to a 20-percent debt capital structure, and has determined that they would have to pay a 10 percent yield on perpetual debt in either event. What will be the standard deviation in EPS if they switch to the proposed capital structure? (Round your intermediate calculations and final answer to 2 decimal places except calculation of number of shares which should be rounded to nearest whole number.)arrow_forwardces NoNuns Companies has a 21 percent tax rate and has $350 million in assets, currently financed entirely with equity. Equity is worth $37 per share, and book value of equity is equal to market value of equity. Also, let's assume that the firm's expected values for EBIT depend upon which state of the economy occurs this year, with the possible values of EBIT and their associated probabilities as shown below: State Probability of state Expected EBIT in state Recession 0.25 $ 5 million EBIT Average 0.55 $ 10 million Boom 0.20 $ 17 million The firm is considering switching to a 20-percent-debt capital structure, and has determined that it would have to pay an 8 percent yield on perpetual debt in either event. What will be the break-even level of EBIT? Note: Round intermediate calculations. Enter your answer in dollars not millions and round your final answer to the nearest whole dollar amount.arrow_forwardSuppose Goodyear Tire and Rubber Company is considering divesting one of its manufacturing plants. The plant is expected to generate free cash flows of 51.54 million per year, growing at a rate of 2.4% per year. Goodyear has an equity cost of capital of 8,7%, a debt cost of capital of 6.7%, a marginal corporate tax rate of 38%, and a debt- equity ratio of 2.6. If the plant has average risk and Goodyear plans to maintain a constant debt equity ratio, what after tax amount must it receive for the plant for the divestiture to be profitable?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education