FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

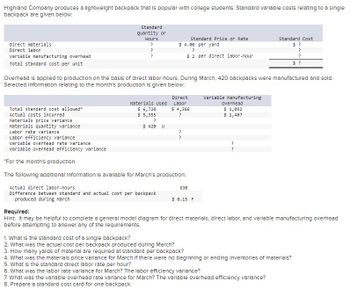

Transcribed Image Text:Highland Company produces a lightweight backpack that is popular with college students. Standard variable costs relating to a single

backpack are given below:

Direct materials

Direct labor

variable manufacturing overhead

Total standard cost per unit

Standard

Quantity or

Hours

?

?

?

Materials Used

$ 6,720

$ 5,355

standard Price or Rate

$4.00 per yard

Overhead is applied to production on the basis of direct labor-hours. During March, 420 backpacks were manufactured and sold.

Selected Information relating to the month's production is given below:

?

$ 420 U

Total standard cost allowed*

Actual costs incurred.

Materials price variance

Materials quantity variance

Labor rate variance

Labor efficiency variance

Variable overhead rate variance

Variable overhead efficiency variance

*For the month's production.

The following additional Information is available for March's production:

Actual direct labor-hours

Difference between standard and actual cost per backpack

produced during March

?

$2 per direct labor-hour

Direct

Labor

$ 4,368

?

?

?

630

$ 0.15 F

Variable Manufacturing

Overhead

$ 1,092

$ 1,407

standard Cost

$?

?

?

$?

?

?

Required:

Hint: It may be helpful to complete a general model diagram for direct materials, direct labor, and variable manufacturing overhead

before attempting to answer any of the requirements.

1. What is the standard cost of a single backpack?

2. What was the actual cost per backpack produced during March?

3. How many yards of material are required at standard per backpack?

4. What was the materials price variance for March if there were no beginning or ending inventories of materials?

5. What is the standard direct labor rate per hour?

6. What was the labor rate variance for March? The labor efficiency variance?

7. What was the variable overhead rate variance for March? The variable overhead efficiency varlance?

8. Prepare a standard cost card for one backpack.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Subject: acountingarrow_forwardAnswer complete question please, otherwise skip it, answer in text form please (without image)arrow_forwardBarley Hopp, Incorporated, manufactures custom-ordered commemorative beer steins. Its standard cost information follows: Required: 1 & 2. Calculate the fixed overhead spending variance and volume variance for Barley Hopp. 3. Calculate the total over- or underapplied fixed manufacturing overhead for Barley Hopp Please avoid answers in image format thank youarrow_forward

- Lamp Light Limited (LLL) manufactures lampshades. It applies variable overhead on the basis of direct labor hours. Information from LLL’s standard cost card follows: Standard Quantity Standard Rate Standard Unit Cost Variable manufacturing overhead 0.6 $0.80 $0.48 During August, LLL had the following actual results: Units produced and sold 26,300 Actual variable overhead $ 9,590 Actual direct labor hours 17,000 Required:Compute LLL’s variable overhead rate variance, variable overhead efficiency variance, and over- or underapplied variable overhead. (Do not round intermediate calculations. Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance).) How do I figure out the variable overhead rate variance? I thought it's AH*(SR-AR) 17,000 * (.80- 9,590/17000=.56) 17000 * (.80-.56)= 4,080?? It says not correct?arrow_forwardManny Gill is an entrepreneur who started West Secure, a business that provides a number of security guard services. West Secure incurred the following transactions during July 2023, its first month of operations: July 1 The owner, Manny Gill, invested $4,600 cash. 10 Purchased $2,100 worth of security equipment on credit. 12 Performed security services for a sold-out concert and received $12,000 cash from the client. 14 Paid for expenses; $3,100. 15 Completed security services for a graduation event and sent the client a bill for $1,300. 31 The owner withdrew $210 cash for personal use. Required: 2. Record the journal entries for the month of July, View transaction list Journal entry worksheet 1 2 3 Record the Investment by owner. 5 6 4>arrow_forwardAngle Max Industries produces a product which goes through two operations, Assembly and Finishing, before it is ready to be shipped. Next year's expected costs and activities are shown below. Direct labor hours Machine hours Overhead costs Multiple Choice Assume that the Assembly Department allocates overhead using a plantwide overhead rate based on machine hours. How much total overhead will be assigned to a product that requires 2 direct labor hour and 3.30 machine hours in the Assembly Department, and 4.50 direct labor hours and 0.4 machine hours in the Finishing Department? O$17.60. Assembly 180,000 DLH 380,000 MH $380,000 $20.40. Finishing 148,000 DLH 91, 200 MH $562, 400arrow_forward

- please give answer step by steparrow_forwardHardevarrow_forwardHighland Company produces a lightweight backpack that is popular with college students. Standard variable costs relating to a single backpack are given below: Standard Quantity or Hours Standard Price or Rate Standard Cost Direct materials ? $ 4.00 per yard $ ? Direct labor ? ? ? Variable manufacturing overhead ? $ 2 per direct labor-hour ? Total standard cost per unit $ ? Overhead is applied to production on the basis of direct labor-hours. During March, 700 backpacks were manufactured and sold. Selected information relating to the month’s production is given below: Materials Used Direct Labor Variable Manufacturing Overhead Total standard cost allowed* $ 11,200 $ 10,500 $ 2,100 Actual costs incurred $ 8,925 ? $ 4,032 Materials price variance ? Materials quantity variance $ 700 U Labor rate variance ? Labor efficiency variance ? Variable overhead rate variance ? Variable overhead efficiency variance ? *For…arrow_forward

- Kelly Fabrics manufactures a specialty monogrammed blanket. The following are the cost standards for this blanket: (Click the icon to view the standards.) Actual results from last month's production of 2,500 blankets are as follows: (Click the icon to view the actual results.) Read the requirements. Requirement 1. What is the standard direct material cost for one blanket? (Round your answer to the nearest cent.) The standard direct material cost for one blanket is Requirements 1. What is the standard direct material cost for one blanket? 2. What is the actual cost per yard of fabric purchased? 3. Calculate the direct material price and quantity variances. 4. What is the standard direct labor cost for one blanket? 5. What is the actual direct labor cost per hour? 6. Calculate the direct labor rate and efficiency variances. 7. Analyze each variance and speculate as to what may have caused that variance. 8. Look at all four variances together (the big picture). How might they all be…arrow_forwardBatCo makes baseball bats. Each bat requires 1.00 pounds of wood at $18 per pound and 0.35 direct labor hour at $30 per hour. Overhead is assigned at the rate of $60 per direct labor hour.arrow_forwardAngler Industries produces a product which goes through two operations, Assembly and Finishing, before it is ready to be shipped. Next year's expected costs and activities are shown below. Direct labor hours Machine hours Overhead costs Multiple Choice O $15.60. O Assume that the Assembly Department allocates overhead based on machine hours, and the Finishing Department allocates overhead based on direct labor hours. How much total overhead will be assigned to a product that requires 1 direct labor hour and 3.4 machine hours in the Assembly Department, and 4.0 direct labor hours and 0.6 machine hours in the Finishing Department? $3.40 Assembly 190,000 DLH 390,000 MH $16.10. $ 390,000 Finishing) 149,000 DLH: 95,550 MH $ 581,100arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education