FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

Transcribed Image Text:High Desert Potteryworks makes a varlety of pottery products that It sells to retalers. The company uses a Job-order costing system Iin

which departmental predetermined overhead rates are used to apply manufacturing overhead cost to Jobs. The predetermined

overhead rate In the Molding Department Is based on machine-hours, and the rate In the Palnting Department Is based on direct labor-

hours. At the beglnning of the year, the company provided the following estimates:

Department

Molding Painting

33,000

82,000

$229,600 $494,700

Direct labor-hours

51,000

35,000

Machine-hours

Fixed manufacturing overhead cost

Variable manufacturing overhead per machine-hour

variable manufacturing overhead per direct labor-hour

2.40

24

4.40

Job 205 was started on August 1 and completed on August 10. The company's cost records show the following Information concerning

the job:

Department

Molding Painting

Direct labor-hours

78

126

Machine-hours

370

73

Direct materials

$ 950

$ 700

$1,300

$1,810

Direct labor cost

Requlred:

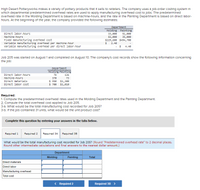

1. Compute the predetermined overhead rates used Iin the Molding Department and the Palnting Department.

2. Compute the total overhead cost applied to Job 205.

3-a. What would be the total manufacturing cost recorded for Job 205?

3-b. If the job contalned 31 units, what would be the unit product cost?

Complete this question by entering your answers in the tabs below.

Required 1

Required 2

Required 3A Required 38

What would be the total manufacturing cost recorded for Job 205? (Round "Predetermined overhead rate" to 2 decimal places.

Round other intermediate calculations and final answers to the nearest dollar amount.)

Department

Molding

Painting

Total

Direct materials

Direct labor

Manufacturing overhead

Total cost

< Required 2

Required 3B >

Transcribed Image Text:High Desert Potteryworks makes a varlety of pottery products that It sells to retalers. The company uses a Job-order costing system Iin

which departmental predetermined overhead rates are used to apply manufacturing overhead cost to Jobs. The predetermined

overhead rate In the Molding Department Is based on machine-hours, and the rate In the Palnting Department Is based on direct labor-

hours. At the beglnning of the year, the company provided the following estimates:

Department

Molding Painting

33,000

82,000

$229,600 $494,700

Direct labor-hours

51,000

35,000

Machine-hours

Fixed manufacturing overhead cost

Variable manufacturing overhead per machine-hour

Variable manufacturing overhead per direct labor-hour

2.40

24

4.40

Job 205 was started on August 1 and completed on August 10. The company's cost records show the following Information concerning

the Job:

Department

Molding Painting

Direct labor-hours

78

126

Machine-hours

370

73

Direct materials

$ 950

$ 700

$1,300

$1,010

Direct labor cost

Requlred:

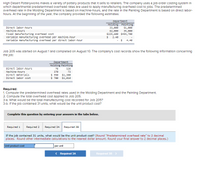

1. Compute the predetermined overhead rates used in the Molding Department and the Palnting Department.

2. Compute the total overhead cost applied to Job 205.

3-a. What would be the total manufacturing cost recorded for Job 205?

3-b. If the Job contalned 31 units, what would be the unit product cost?

Complete this question by entering your answers in the tabs below.

Required 1

Required 2 Required 3A Required 3B

If the job contained 31 units, what would be the unit product cost? (Round "Predetermined overhead rate" to 2 decimal

places. Round other intermediate calculations to the nearest dollar amount. Round your final answer to 2 decimal places.)

Unit product cost

per unit

< Required 3A

Required 3B >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Garza Corporation has two production departments, Casting and Customizing. The company uses a job-order costing system and computes a predetermined overhead rate in each production department. The Casting Department’s predetermined overhead rate is based on machine-hours and the Customizing Department’s predetermined overhead rate is based on direct labor-hours. At the beginning of the current year, the company had made the following estimates: Casting Customizing Machine-hours 23,000 15,000 Direct labor-hours 7,000 7,000 Total fixed manufacturing overhead cost $ 82,800 $ 30,100 Variable manufacturing overhead per machine-hour $ 1.40 Variable manufacturing overhead per direct labor-hour $ 4.70 The estimated total manufacturing overhead for the Customizing Department is closest to:arrow_forwardCarver Test Systems manufactures automated testing equipment. The company uses a job-order costing system and applies overhead on the basis of machine-hours. At the beginning of the year, estimated manufacturing overhead was P1,960,000 and the estimated machine-hours was 98,000. Data regarding several jobs at Carver are presented below. Beginning Direct Direct MachineJob Number Balance Materials Labor HoursXJ-107 ................... P118,600 P4,000 P8,400 150ST-211 ................... P121,450 P2,500 P12,160 300XD-108.................. P21,800 P86,400 P36,650 3,100SL-205 ................... P34,350 P71,800 P32,175 2,700RX-115 .................. P0 P18,990 P21,845 1,400By the end of the first month (January), all jobs but RX-115 were completed, and all completed jobs had been delivered to customers except for SL-205. How much is the Cost of Goods Sold per job?arrow_forwardped Dok int ences High Desert Potteryworks makes a variety of pottery products that it sells to retailers. The company's job-order costing system uses departmental predetermined overhead rates to apply manufacturing overhead cost to jobs. The predetermined overhead rate in the Molding Department is based on machine-hours, and the rate in the Painting Department is based on direct labor-hours. At the beginning of the year, the company provided the following estimates: Direct labor-hours Machine-hours Fixed manufacturing overhead cost Variable manufacturing overhead per machine-hour Variable manufacturing overhead per direct labor-hour Direct labor-hours Machine-hours Direct materiale Direct labor cont Department Holding 75 330 $938 5600 Job 205 was started on August 1 and completed on August 10. The company's cost records show the following information concerning the job: Painting 130 71 Department $1,160 $ 960 Molding 39,500 83,000 $ 240,700 $2.40 0 Painting 54,700 30,000 $ 519,650 0…arrow_forward

- I need all solution please .arrow_forwardEchenko Corporation uses a job-order costing system and applies overhead to jobs using a predetermined overhead rate. During the year the company's Finished Goods inventory account was debited for $380,000 and credited for $335,500. The ending balance in the Finished Goods inventory account was $62,300. At the end of the year, manufacturing overhead was overapplied by $2,900. The balance in the Finished Goods inventory account at the beginning of the year was?arrow_forwardGitano Products operates a job-order costing system and applies overhead cost to jobs on the basis of direct materials used in production (not on the basis of raw materials purchased). Its predetermined overhead rate was based on a cost formula that estimated $105,600 of manufacturing overhead for an estimated allocation base of $88,000 direct material dollars to be used in production. The company has provided the following data for the just completed year: Purchase of raw materials Direct labor cost Manufacturing overhead costs: Indirect labor Property taxes Depreciation of equipment Maintenance Insurance Rent, building $ 137,000 $ 84,000 $ 98,200 $ 8,400 $ 16,000 $ 15,000 $ 8,300 $ 40,000 Ending Beginning Raw Materials $30,000 $ 15,000 Work in Process $ 47,000 $ 37,000 Finished Goods $ 71,000 $ 55,000 Required: 1. Compute the predetermined overhead rate for the year. 2. Compute the amount of underapplied or overapplied overhead for the year. 3. Prepare a schedule of cost of goods…arrow_forward

- Swiss Corporation is a manufacturing firm that uses job-order costing. The company's inventory balances were as follows at the beginning and end of the year: Beginning BalanceEnding Balance Raw materials$ 44,800 $ 70,400 Work in process $ 86,400 $ 28,800 Finished Goods $ 198,400 $ 214,400 The company applies overhead to jobs using a predetermined overhead rate based on machine-hours. At the beginning of the year, the company estimated that it would work 105,600 machine-hours and incur $739,200 in fixed manufacturing overhead cost and $7.20 variable manufacturing overhead per direct machine hour. The following transactions were recorded for the year: 1. Raw materials were purchased on account, $1,008,000. 2. Raw materials were requisitioned for use in production, $982,400 ($899,200 direct and $83,200 indirect). 3. The following employee costs were incurred: direct labor, $1,206,400; indirect labor, $307,200; and administrative salaries, $422,400.…arrow_forwardSpeedy Auto Repairs uses job-order costing. Its direct materials consist of replacement parts installed in customer vehicles, and its direct labor consists of the mechanics' hourly wages. Speedy's overhead costs include various items, such as the shop manager's salary, depreciation of equipment, utilities, insurance, and magazine subscriptions and refreshments for the waiting room. The company applies all of its overhead costs to jobs based on direct labor-hours. At the beginning of the year, it made the following estimates: Direct labor-hours required to support estimated output Fixed overhead cost Variable overhead cost per direct labor-hour Required: 1. Compute the predetermined overhead rate. 2. During the year, Mr. Wilkes brought in his vehicle to replace his brakes, spark plugs, and tires. The following information pertains to his job: Direct materials Direct labor cost Direct labor-hours used 36,000 $ 540,000 $ 1.00 $ 685 $ 153 7 Compute Mr. Wilkes' total job cost. 3. If Speedy…arrow_forwardHigh Desert Potteryworks makes a variety of pottery products that it sells to retailers. The company’s job-order costing system uses departmental predetermined overhead rates to apply manufacturing overhead costs to jobs. The predetermined overhead rate in the Molding Department is based on machine hours, and the rate in the Painting Department is based on direct labor hours. At the beginning of the year, the company provided the following estimates: Department Molding Painting Direct labor-hours 36,500 56,600 Machine-hours 82,000 37,000 Fixed manufacturing overhead cost $ 213,200 $ 515,060 Variable manufacturing overhead per machine-hour $ 2.80 0 Variable manufacturing overhead per direct labor hour 0 $ 4.80 Job 205 was started on August 1 and completed on August 10. The company's cost records show the following information concerning the job: Department Molding Painting Direct labor-hours 84 128 Machine-hours 360 67 Direct materials $ 948 $ 1,160…arrow_forward

- Frame Corporation has two production departments, Casting and Customizing. The company uses a job-order costing system and computes a predetermined overhead rate in each production department. The Casting Department's predetermined overhead rate is based on machine- hours and the Customizing Department's predetermined overhead rate is based on direct labor-hours. At the beginning of the current year, the company had made the following estimates: Machine-hours Direct labor-hours Total fixed manufacturing overhead cost Variable manufacturing overhead per machine-hour Variable manufacturing overhead per direct labor-hour O $24,000 O $110,400 $86,400 Casting Customizing 19,000 1,000 $ 138,700 $ 1.60 The estimated total manufacturing overhead for the Customizing Department is closest to: $60,379 11,000 8,000 $ 86,400 S 3.00arrow_forwardMoody Corporation uses a job-order costing system with a plantwide predetermined overhead rate based on machine-hours. At the beginning of the year, the company made the following estimates: Machine-hours required to support estimated production Fixed manufacturing overhead cost Variable manufacturing overhead cost per machine-hour Required: 1. Compute the plantwide predetermined overhead rate. 2. During the year, Job 400 was started and completed. The following information was available with respect to this job: Direct materials Direct labor cost Machine-hours used $ 400 $ 270 34 Compute the total manufacturing cost assigned to Job 400. 3. If Job 400 includes 50 units, what is the unit product cost for this job? 4. If Moody uses a markup percentage of 130% of its total manufacturing cost, then what selling price per unit would it have established for Job 400? Complete this question by entering your answers in the tabs below. 156,000 $ 651,000 4.70 S Required 1 Required 2 If Job 400…arrow_forwardWhite Company has two departments, Cutting and Finishing. The company uses a job-order costing system and computes a predetermined overhead rate in each department. The Cutting Department bases its rate on machine-hours, and the Finishing Department bases its rate on direct labor-hours. At the beginning of the year, the company made the following estimates: Department Cutting Finishing Direct labor-hours 7,800 76,000 Machine-hours 52,700 3,200 Total fixed manufacturing overhead cost $ 390,000 $ 425,000 Variable manufacturing overhead per machine-hour $ 3.00 0 Variable manufacturing overhead per direct labor-hour 0 $3.75 Required (see below for hints, if needed): 1. Compute the predetermined overhead rate for each department. 2. The job cost sheet for Job 203, which was started and completed during the year, showed the following: Department Cutting Finishing Direct labor-hours 3 16 Machine-hours 89 6 Direct materials $ 730 $ 380 Direct labor…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education