Hi Preceptor:) you ignored my question but this is specific question as you can see. First question has been solved. Please you may solve related question. Thank you from Turkey :) This is first question: 1) You decide to buy a small office building costing $150.000 and take out a fixed term loan over 5 years at 10%. The loan is to be paid in 5 equal instalments starting at the end of this year. Estimate the annual repayments and prepare a mortgage repayment table showing interest payments, reduction in capital, opening and closing balances. (Solved) Related other question: 2) Solve the first problem above with a change in interest rates from 10% to 5% after the second year. For the first two years interest rate is 10%. a) Construct a mortage repayment table with a change in interest rate from 10% to 5% for the last three years. b) When the interest rate dropped to 5%, is it possible to pay off the loan earlier than 5 years by keeping payments constant?

Hi Preceptor:) you ignored my question but this is specific question as you can see. First question has been solved. Please you may solve related question. Thank you from Turkey :)

This is first question:

1) You decide to buy a small office building costing $150.000 and take out a fixed term loan over 5 years at 10%. The loan is to be paid in 5 equal instalments starting at the end of this year. Estimate the annual repayments and prepare a mortgage repayment table showing interest payments, reduction in capital, opening and closing balances. (Solved)

Related other question:

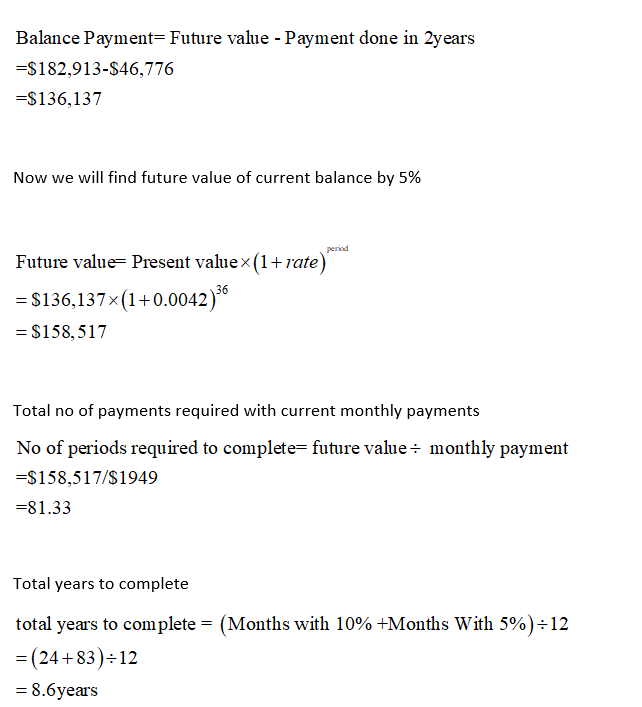

2) Solve the first problem above with a change in interest rates from 10% to 5% after the second year. For the first two years interest rate is 10%. a) Construct a mortage repayment table with a change in interest rate from 10% to 5% for the last three years. b) When the interest rate dropped to 5%, is it possible to pay off the loan earlier than 5 years by keeping payments constant?

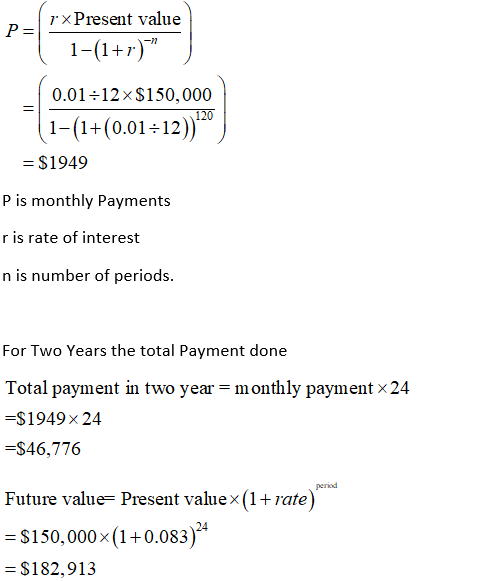

For 10 years period we will calculate the monthly payments.

Step by step

Solved in 3 steps with 3 images