Question

Subject : Accounting

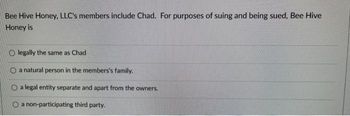

Transcribed Image Text:Bee Hive Honey, LLC's members include Chad. For purposes of suing and being sued, Bee Hive

Honey is

Olegally the same as Chad

a natural person in the members's family.

a legal entity separate and apart from the owners.

O a non-participating third party.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- QUESTION FOUR [35] 4.1 Discuss the people element affecting the operational risk environment. (10) 4.2 Assess the importance of investment and financing considerations during the risk management prioritisation process. (10) 4.3 Explain the correlation between deductibles and risk management. (15arrow_forwardQuestion 24:arrow_forwardQuestion9  Under the modified accrual basis of accounting: a. Revenues are recognized at the time an exchange transaction occurs. b. Expenses are recognized when an obligation occurs for costs incurred in providing services. c. Expenditures are recognized as the cost of an asset expires or is used up in providing governmental services. d. Revenues are recognized when current financial resources become measurable and available to pay current-period obligations.arrow_forward

- The first step in obtaining an Injunction is: Question 7 options: a) Establish there are already damages. b) Obtain a temporary restraining order. c) Start a trial for a permanent injunction.arrow_forwardQuestion Z Nero is an elderly man who lives with his nephew Mervyn. Nero is dependent on Mervyn for support. Mervyn advises Nero to “invest” in Mervyn’s “professional gambling” venture, or Mervyn will no longer support him. Nero liquidates his other investments and signs a contract with Mervyn, to whom Nero gives the funds. Can Nero set aside this contract? Full explain this question and text typing work only We should answer our question within 2 hours takes more time then we will reduce Rating Dont ignore this line.arrow_forwardA suburban office building in Fort Worth, Texas with 36,000 square feet was purchased for $4,500,000 at an 8% cap rate. Debt service for the first year was $305,000 of which $236,000 was interest and $69,000 was principal. Annual depreciation for tax purposes was $148,000. What was the property’s first year taxable income? a. $124,000 b. $212,000 c. - $24,000 d. $55,000arrow_forward

- Incorrect Question 7 After you finish speaking at a business law conference, an eager fan asks you how long is an offer considered open for acceptance by the offeree. Your pithy reply is which of the following? Unless the terms of the offer state otherwise, the offer is open for a reasonable amount of time. Indefinitely, until the offeror revokes or rescinds it. Only 10 days, no exceptions. 30 days unless the parties agree otherwise.arrow_forward17.) Who is deemed to be appointed to accept service of process for an insurer in Fiorida? A. Governor B. Insurance Commissioner C Chief Financial Officer D. Attorney Generalarrow_forward9. Mention any two limitations of franchising? Question 9 options:arrow_forward

- COURSE: DIPLOMA IN ACCOUNTING SUBJECT: BUSINESS & COMPANY LAW I NEED ANSWER FOR ALLarrow_forwardBuckeye Department Stores, Inc., operates a chain of department stores in Ohio. The company's organization chart appears below. Operating data for 20x1 follow. Buckeye Department Stores Cleveland Division Columbus Divişion Downtown Individual Olentangy Store Scioto Store Store Stores BUCKEYE DEPARTMENT STORES, INC. Operating Data for 20x1 (in thousands) Columbus Division Scioto Store $2,500 Olentangy Store $5,000 Downtown Store $12,000 Cleveland Division (all stores) $ 22,000 Sales revenue Variable expenses: Cost of merchandise sold Sales personnel-salaries Sales commissions Utilities Other Fixed expenses: Depreciation-buildings Depreciation-furnishings Computing and billing Warehouse Insurance Property taxes 3,000 500 60 80 70 2,100 310 50 70 35 6,000 760 90 160 13,000 1,700 220 320 270 130 130 90 90 50 30 70 25 20 260 150 480 310 180 460 220 190 40 80 40 75 210 90 35 80 MacBook Pro %23 % 4 & * 5 6. 7 8. Y D F K C V L.arrow_forwardSubject - Acountingarrow_forward

arrow_back_ios

arrow_forward_ios