FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Prepare Bank Reconciliation statement .

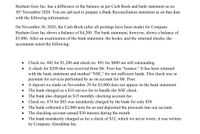

Transcribed Image Text:Hesham Geer Inc. has a difference in the balance as per Cash Book and bank statement as on

30th November 2020. You are advised to prepare a Bank Reconciliation statement as on that date

with the following information:

On November 30, 2020, the Cash Book (after all postings have been made) for Company

Hesham Geer Inc shows a balance of $4,200. The bank statement, however, shows a balance of

$5,000. After an examination of the bank statement, the books, and the returned checks, the

accountant noted the following:

Check no. 482 for $1,200 and check no. 491 for $800 are still outstanding.

A check for $200 that was received from Mr. Poor has "bounce." It has been returned

with the bank statement and marked “NSF," for not sufficient funds. This check was in

payment for services performed by us on account for Mr. Poor.

A deposit we made on November 29 for $3,000 does not appear on the bank statement.

The bank charged us a $10 service fee to handle the NSF check.

The bank also charged us $15 monthly checking account fee.

Check no. 474 for $85 was mistakenly charged by the bank for only $58.

The bank collected a $2,000 note for us and deposited the proceeds into our account.

The checking account earned $30 interest during the month.

The bank mistakenly charged us for a check of $32, which we never wrote; it was written

by Company Almokhtar Inc.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Describe how a bank might use standards.arrow_forward4. Which of the following audit procedures is most appropriate to address the occurrence assertion for sales? a. Confirm receivables balances. b. Perform analytical procedures. c. Review collectability. d. Confirm cash deposits in banks.arrow_forwardWhat audit procedures would you use to determine that the cash balances actually exist at the balance sheet date? Is a bank statement provided by the client sufficient audit evidence?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education