FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

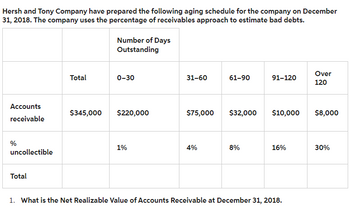

Transcribed Image Text:Hersh and Tony Company have prepared the following aging schedule for the company on December

31, 2018. The company uses the percentage of receivables approach to estimate bad debts.

Accounts

receivable

%

uncollectible

Total

Total

Number of Days

Outstanding

0-30

$345,000 $220,000

1%

31-60

61-90

$75,000 $32,000

4%

8%

91-120

$10,000

16%

1. What is the Net Realizable Value of Accounts Receivable at December 31, 2018.

Over

120

$8,000

30%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Junko Enterprises uses the percentage of receivables method for estimating bad debts. At 1/1/23, Junko Enterprises had a credit balance in Allowance for Bad Debts of $900,000. Prepare journal entries for the following events: a) On Oct. 2, 2023, Junko realized that a specific account receivable of $920,000 had gone bad and had to be written off. b) An account receivable of $50,000 was collected on Oct. 25, 2023. This account had previously been written off as a bad debt in 2022. c) Junko has determined that Allowance for Bad Debts would be $970,000 at the end of 2023.arrow_forwardSimple Things Company uses the aging method to estimate Accounts Receivable. The company's management estimates that uncollectible accounts will be $27,000. The Allowance for Bad Debts has a debit balance of $11,000 before the adjusting entry for bad debt expense. What will be the amount of bad debts expense reported on the income statement?arrow_forwardThe following information is available for Reagan Company: Allowance for doubtful accounts at December 31, 2020 (beginning balance) $ 8,000 Accounts receivable deemed worthless and written off during 2021 9,000 As a result of a review and aging of accounts receivable it has been determined that an allowance for doubtful accounts of $5,500 is needed at December 31, 2021. What amount should Reagan record as "bad debt expense" for the year ended December 31, 2021? $4.500 $5.500 $6.500 13.500arrow_forward

- he following information is related to December 31, 2021 balances. • Accounts receivable $3340000 • Allowance for doubtful accounts (credit) (275000) • Cash realizable value $3065000 During 2022 sales on account were $877000 and collections on account were $506000. The company wrote off $48500 in uncollectible accounts. An analysis of outstanding receivable accounts at year end indicated that bad debts should be estimated at $371000. Bad debt expense for 2022 is $371000. $96000. $144500. $47500.arrow_forward5arrow_forward12/31/2020: During 2020, $10,000 in accounts receivable were written off. At the end of the second year of operations, Yolandi Company had $1,000,000 in sales and accounts receivable of $400,000. Yolandi’s management has estimated that 1.5% of sales will be uncollectible. For the end of 2020, after the adjusting entry for bad debts was journalized, what is the balance in the following accounts: Bad debt expense Allowance for doubtful accounts For the end of 2020, what is the company’s net realizable value?arrow_forward

- At January 1, 2024, ABC Company reported an allowance for bad debts with a $7,190 credit balance. During 2024, ABC wrote-off as uncollectible accounts receivable totaling $12,530. At December 31, 2024, ABC Company had accounts receivable totaling $325,000 and prepared the following aging schedule: Accounts Receivable not past due 1-39 days past due 40-79 days past due 80-119 days past due over 119 days past due total $167,000 $ 52,000 $ 69,000 $ 26,000 $ 11,000 $325,000 % Uncollectible 2% 8% 14% 22% 45% Calculate the amount of bad debt expense recorded by ABC Company for 2024.arrow_forwardThe following are a series of unrelated situations. 1. Halen Company’s unadjusted trial balance at December 31, 2020, included the following accounts. Debit Credit Accounts receivable $53,000 Allowance for doubtful accounts 4,000 Net sales $1,200,000 Halen Company estimates its bad debt expense to be 7% of gross accounts receivable. Determine its bad debt expense for 2020. 2. An analysis and aging of Stuart Corp. accounts receivable at December 31, 2020, disclosed the following. Amounts estimated to be uncollectible $ 180,000 Accounts receivable 1,750,000 Allowance for doubtful accounts (per books) 125,000 What is the net amount expected to be collected of Stuart’s receivables at December 31, 2020? 3. Shore Co. provides for doubtful accounts based on 4% of gross accounts receivable, The following data are available for 2020. Credit sales during 2020 $4,400,000 Bad debt expense 57,000 Allowance for doubtful…arrow_forwardOn December 31, 2024, a company had balances in Accounts Receivable and Allowance for Uncollectible Accounts of $47,500 and $2,000, respectively. During 2025, the company wrote off $700 in accounts receivable and determined that there should be an allowance for uncollectible accounts of $4,800 at December 31, 2025, Bad debt expense for 2025 would be: Multiple Choice $3,500 $700 $7,500 $3.000 G Ⓒ 100 Ⓒ HI Larrow_forward

- a. Calculate the total estimated bad debts based on the above information.arrow_forwardBlossom Company uses the percentage-of-receivables basis to record bad debt expense. Accounts receivable (ending balance) $500,000 (debit) Allowance for doubtful accounts (unadjusted) 4,000 (debit) The company estimates that 2% of accounts receivable will become uncollectible.(a)Prepare the adjusting journal entry to record bad debt expense for the year. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Account Titles and Explanation Debit Creditarrow_forwardAt January 1, 2024, Betty DeRose, Inc. had an allowance for doubtful accounts with a $4,390 credit balance. During 2024, Betty recorded $9,560 of write-offs and recorded $2,750 of recoveries of accounts receivable that had been written off in prior years. At December 31, 2024, Betty prepared the following aging schedule: Accounts Receivable not past due $150,000 $ 64,000 1-30 days past due 31-60 days past due $ 39,000 61-90 days past due $ 47,000 over 90 days past due $ 11,000 Calculate Betty's bad debt expense for 2024. % Uncollectible 2% 6% 9% 16% 34%arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education