Milestone 1-

I wanted to see if anyone could verify my numbers as correct, or point me in the right direction if I have made an error.

You plan to open a small business for manufacturing pet collars, leashes, and harnesses. You have found a workshop space you can use for sewing your products. After some research and planning, you have estimates for the various operating costs for your business.

The total square footage for the sewing rooms is 1,500 square feet broken into three areas (500 square feet each). You have taken out a loan for start-up costs, and the monthly payment is $550; it goes into effect immediately and should be accounted for in your costs. You will also collect a modest salary for the first year of $500 per month; remember to divide evenly among the services.

Salary and Hiring Data

· One collar maker, who will be paid $16.00 per hour and work 40 hours per week

· One leash maker, who will be paid $16.00 per hour and work 40 hours per week

· One harness maker, who will be paid $17.00 per hour and work 40 hours per week

· One receptionist, who will be paid $15.00 per hour and work 30 hours per week

Other Costs

· Rent: $750 per month; allocate based on square footage

· High-tensile strength nylon webbing—$12 per yard of webbing

o 3 collars per yard of webbing

o 2 leashes per yard of webbing

o 2 harnesses per yard of webbing

· Polyester/nylon ribbons—$9 per yard of ribbon

o 3 collars per yard of ribbon

o 2 leashes per yard of ribbon

o 2 harnesses per yard of ribbon

· Buckles made of cast hardware—$0.50 per buckle

o 4 buckles used per collar

o 3 buckles used per leash

o 8 buckles used per harness

· 3 industrial sewing machines at $3,300 each for a total of $9,900;

· Utilities and insurance: $600 per month; allocate based on square footage

· Scissors, thread, cording: $1,200

· Price tags: $250 for 2,500 ($0.10 each)

· Office supplies: $2,400 or $200 per month

· Other business equipment: $2,000

· Loan payment of $550 per month

· Salary drawn of $500 per month

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

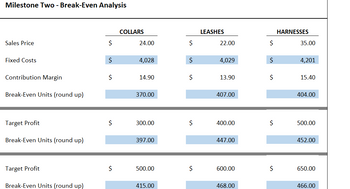

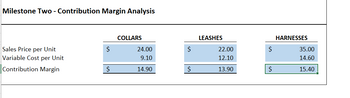

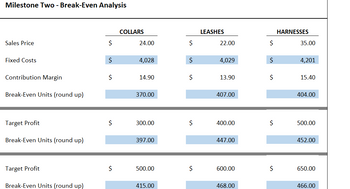

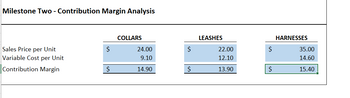

Here's the second part of the milestone if you could verify these numbers to being accurate?

Here's the second part of the milestone if you could verify these numbers to being accurate?

- Karen has been working with a small travel agency for the past few years to learn the business and to better understand what costs are necessary to run it. Now, having been in the business world for a few years, she's ready to start her own travel agency, specializing in "off the grid" locations. She knows there will be both overhead costs and labor costs, since she intends to hire one assistant. The following chart outlines her estimates thus far. Annual net operating cash flows³ Initial asset investment Asset life in years $3,800 $9,800 8 Salvage value of asset at end of useful life $1,000 Tax rate 25% a After assistant and overhead costs, but does not include a salary for Karen. As a new business owner, Karen only expects to earn a 5% rate of return. She conducted an initial NPV anlaysis for an 8-year interval, recognizing that she'll make some significant adjustments after that point. Her initial analysis revealed a positive NPV. Click here to view the factor table (a) Rerun the…arrow_forwardPlease answer Earrow_forwardSOLVE THE FOLLOWING PROBLEMS: 1. A civil engineer has 2 alternative designs for a house. Both designs involve the acquisition of a work force that will be provided by the owner and other capital equipment to be used for this construction only. a. Design 1 calls for a workforce consisting of 5 men each costing P500/day. This design will be finished in 4 months. b. Design 2 calls for a workforce consisting of 10 men each costing P350/day and is expected to be finished in 3 months. In addition, there will be a project engineer who will supervise the work and will be paid P1200/day. His supervision will be required during the entire construction period. Disregarding material cost, how much is the total salary expenses for Design 1 and for Design 2. Assume that there are 24 working days in a month.arrow_forward

- st K Yard Growers Corp manufactures garden tools in a factory in Taneytown, Maryland. Recently, the company designed a collection of tools for professional use rather than consumer use. Management needs to make a good decision about whether to produce this line in their existing space in Maryland, where space is available or to accept an offer from a manufacturer in Taiwan. Data conceming the decision are (Click the icon to view the data.) Read the requirements Requirement 1. Should Yard Growers Corp manufacture the 680,000 garden tools in the Maryland facility or purchase them from the supplier in Taiwan? Explain The cost of manufacturing 680,000 garden tools in the Maryland facility is 680,000 garden tools from the Taiwan supplier is and the cost of purchasing Yard Growers Corp purchase the garden tools from the Talwan supplier because it is than the relevant costs to manufacture the garden tools in Maryland SKIP REQUIREMENT 2 Requirement 3. What are some of the qualitative factors…arrow_forwardIs the answer I have for b correct? The software keeps telling me I'm wrongarrow_forwardAmong these 3 jobs offer which one has more benefits and negative impacts for each position including the financial analysis. Make calculations in addition with explanations.arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education