FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

please provide answer in proper format with all working like explanation calculation formula with steps answer in text no image no handwritten

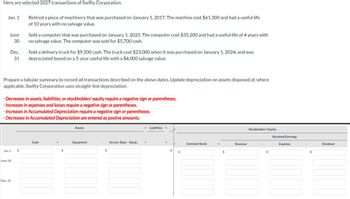

Transcribed Image Text:Here are selected 2027 transactions of Swifty Corporation.

Jan. 1

June

30

Dec.

31

Jan. 1

Prepare a tabular summary to record all transactions described on the above dates. Update depreciation on assets disposed of, where

applicable. Swifty Corporation uses straight-line depreciation.

June 30

Retired a piece of machinery that was purchased on January 1, 2017. The machine cost $61,300 and had a useful life

of 10 years with no salvage value.

Decreases in assets, liabilities, or stockholders' equity require a negative sign or parentheses.

• Increases in expenses and losses require a negative sign or parentheses.

• Increases in Accumulated Depreciation require a negative sign or parentheses.

Decreases in Accumulated Depreciation are entered as postive amounts.

Dec. 31

Sold a computer that was purchased on January 1, 2025. The computer cost $35,200 and had a useful life of 4 years with

no salvage value. The computer was sold for $5,700 cash.

$

Sold a delivery truck for $9,500 cash. The truck cost $23,000 when it was purchased on January 1, 2024, and was

depreciated based on a 5-year useful life with a $4,000 salvage value.

Cash

+

$

Assets

Equipment

$

Accum. Depr. - Equip.

= Liabilities +

Common Stock

+

$

Revenue

Stockholders' Equity

-

Retained Earnings

Expense

$

Dividend

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Fill out the missing columns and show the calculation and formulasarrow_forwardPlease provide only typed answer solution no handwritten solution needed allowed... Please do it neat and clean correctly.arrow_forwardWill you please provide the formulas (explanation) to understand the results or numbers that were added in the solution?arrow_forward

- help please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forwardCan i have the steps in formula form pleasearrow_forwardPlease see attached picturearrow_forward

- How can you display or print a batch or group of reports quickly? A. Create a memorized group of reports. B. Click Batch Reports from the Home Page C. Click Reports > Process multiple reports D. You cannot do this in Quickbooksarrow_forwardcan you do it again, please, no tables, only formulas, pleasearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education