FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

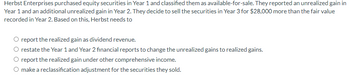

Transcribed Image Text:Herbst Enterprises purchased equity securities in Year 1 and classified them as available-for-sale. They reported an unrealized gain in

Year 1 and an additional unrealized gain in Year 2. They decide to sell the securities in Year 3 for $28,000 more than the fair value

recorded in Year 2. Based on this, Herbst needs to

report the realized gain as dividend revenue.

O restate the Year 1 and Year 2 financial reports to change the unrealized gains to realized gains.

report the realized gain under other comprehensive income.

O make a reclassification adjustment for the securities they sold.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 1 steps

Knowledge Booster

Similar questions

- Concord Corporation purchased 360 shares of Sherman Inc. common stock for $11,900 (Concord does not have significant influence). During the year, Sherman paid a cash dividend of $3.25 per share. At year-end, Sherman stock was selling for $37.50 per share. Prepare Concord' journal entries to record (a) the purchase of the investment, (b) the dividends received, and (c) the fair value adjustment. (Assume a zero balance in the Fair Value Adjustment account.) (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) No. Account Titles and Explanation Debit Credit (a) (b) (c)arrow_forwardCheyenne Ltd. is a Canadian publicly-traded business with a December 31 fiscal year end. In order to get a better return on some of its excess cash, Cheyenne purchased 130 common shares of AFS Corporation on July 1, 2023 at a price of $3 per share. Due to the nature of the investment, Cheyenne's management is accounting for the equity investment using the fair-value through other comprehensive income (FV-OCI) without recycling to net income. On August 1, 2023, AFS declared dividends of $2/share, and paid those dividends on August 20, 2023. On December 31, 2023, shares in AFS were trading at $5 per share. On September 15, 2024, Cheyenne sold the shares in AFS for $6 per share. Prepare the journal entries required to record the above transactions on the books of Cheyenne Ltd. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. List all debit…arrow_forwardBrooks Company purchases debt investments as trading securities at a cost of $71,000 on December 27. This is its first and only purchase of such securities. At December 31, these securities had a fair value of $90,000. Brooks sells a portion of its trading securities (costing $35,500) for $40,250 cash. Analyze each transaction above by showing its effects on the accounting equation-specifically, identify the accounts and amounts (including + or -) for each transaction.arrow_forward

- Under the accumulated other comprehensive income in stockholders’ equity section of its December 31, year 2 balance sheet, what amount should Stone report? *arrow_forwardConcord Corporation purchased for $285,000 a 25% interest in Murphy, Inc. This investment enables Concord to exert significant influence over Murphy. During the year, Murphy earned net income of $185,000 and paid dividends of $54,000.Prepare Concord’s journal entries related to this investment. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Account Titles and Explanation Debit Credit enter an account title to record the purchase enter a debit amount enter a credit amount enter an account title to record the purchase enter a debit amount enter a credit amount (To record the purchase.) enter an account title to record the net income enter a debit amount enter a credit amount enter an account title to record the net income enter a debit amount enter a credit amount (To record the net income.)…arrow_forwardBrave Industries owned investment securities with a book value of $20 million on August 12. At that time, Brave's board of directors declared a property dividend consisting of these securities. The fair value of the securities was as follows: Declaration --- August 12 Date of record --- September 1 Distribution date --- September 20 By how much is total stockholder' equity reduced by the property dividend? $31 million $30 million $27 million $20 million $28 million 30 million 31 millionarrow_forward

- Cheyenne Corporation purchased for $327,000 a 25% interest in Murphy, Inc. This investment enables Cheyenne to exert significant influence over Murphy. During the year, Murphy earned net income of $185,000 and paid dividends of $62,000. Prepare Cheyenne's journal entries related to this investment. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Account Titles and Explanation Debit Credit (To record the purchase.) (To record the net income.) (To record the dividend.) Larrow_forwardRunner Corporation, which reports under IFRS, has the following investments at December 31, 2024: 2. 3. 4. Trading investments: common shares of National Bank, cost $36,500, fair value $43,400. Investment in an associate (40% ownership): common shares of Sword Corp., cost $218,200, fair value cannot be determined because the shares do not trade publicly. Runner purchased the investment on January 1, 2024. For the year ended December 31, 2024, Sword Corp. reported net income of $46,600 and declared and paid dividends of $15,800. Equity investment: common shares of Epee Inc. (19% ownership) purchased on July 1, 2024, cost $423,300, fair value at December 31, 2024, $545,200. Management intends to purchase more shares of Epee in two years. Epee earned $39,900 for the year ended December 31, 2024, and declared and paid dividends of $1,800, which Runner received at the end of each quarter in 2024. Bond investment to be held to maturity: bonds of Ghoti Ltd., purchased at a cost equal to its…arrow_forwardSunland Corporation purchased 370 shares of Sherman Inc. common stock for $ 13,100 ( Sunland does not have significant influence). During the year, Sherman paid a cash dividend of $ 3.00 per share. At year-end, Sherman stock was selling for $ 37.50 per share.Prepare Sunland's journal entries to record (a) the purchase of the investment, (b) the dividends received, and (c) the fair value adjustment. (Assume a zero balance in the Fair Value Adjustment account.) (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) No. Account Titles and Explanation Debit Credit (a) enter an account title to record the purchase of the investment enter a debit amount enter a credit amount enter an account title to record the purchase of the investment enter a debit amount enter a credit amount (b) enter an account title to record…arrow_forward

- Sandhill Corporation purchased for $288,000 a 25% interest in Murphy, Inc. This investment enables Sandhill to exert significant influence over Murphy. During the year, Murphy earned net income of $173,000 and paid dividends of $54,000. Prepare Sandhill's journal entries related to this investment. (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.)arrow_forwardIndigo Corporation owns shares of Raccoon Company that are classified as part of Indigo's trading portfolio and accounted for using the fair value through net income model. At December 31, 2021, the securities were carried in Indigo's accounting records at their cost of $418,000, which equaled their fair value. On November 1, 2022, when the securities fair value was $442,000, Indigo declared property dividend that will result in Raccoon’s securities being distributed on December 15, 2022 to the shareholders of record on December 1, 2022.Prepare the journal entries for all three dates. Date Account Titles and Explanation Debit Credit Nov. 1, 2022Dec. 1, 2022Dec. 15, 2022 (To record fair value adjustment) (To record declaration of property dividend) Nov. 1, 2022Dec. 1, 2022Dec. 15, 2022 Nov. 1, 2022Dec. 1, 2022Dec. 15, 2022arrow_forwardConcord Corporation purchased for $288,000 a 25% interest in Murphy, Inc. This investment enables Concord to exert significant influence over Murphy. During the year, Murphy earned net income of $173,000 and paid dividends of $54,000. Prepare Concord's journal entries related to this investment. (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Account Titles and Explanation Debit Credit (To record the purchase.) (To record the net income.) (To record the dividend.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education