Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

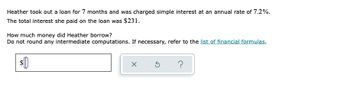

Transcribed Image Text:Heather took out a loan for 7 months and was charged simple interest at an annual rate of 7.2%.

The total interest she paid on the loan was $231.

How much money did Heather borrow?

Do not round any intermediate computations. If necessary, refer to the list of financial formulas.

X

5 ?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Give me correct answer and explanation. Don't upload any image please.jarrow_forwardWhat is Temporary financing?arrow_forwardLeona purchased a home and obtained a 25 year loan of 437,750$ at an annual interest rate of 6.5%. Find the amount of interest paid on the loan over the 25 years. Round answer to nearest cent.arrow_forward

- Linda borrowed money from a bank to buy a fishing boat. She took out a personal, amortized loan for $13,500, at an interest rate of 4.35%, with monthly payments for a term of 4 years. For each part, do not round any intermediate computations and round your final answers to the nearest cent. If necessary, refer to the list of financial formulas. (a) Find Linda's monthly payment. S (b) If Linda pays the monthly payment each month for the full term, find her total amount to repay the loan. s (c) If Linda pays the monthly payment each month for the full term, find the total amount of interest she will pay. $0 X ?arrow_forwardArianna borrowed $6700. Over the course of 4 years, Arianna ended up paying $1340 in interest. What was the simple interest rate of the loan? Record your answer as a percentage. Do not inlcude the % symbol in your answer. 11%arrow_forwardPlease don't provide handwritten solution ....arrow_forward

- Dave took out a $5800 loan at 11% and eventually repaid $7714 (principal and interest). What was the time period of the loan? The time period of the loan was year(s). (Type an integer or a decimal.)arrow_forwardCathy borrowed a student loan for $700 and agreed to pay off the loan $740 one month later. what is the annual interest rate? assume it's computed using simple intrestarrow_forward2. Smith family borrowed a large sum of money to purchase their family car. The interest rate on their loan was 5%. The lender agreed to the following repayment schedule, $5300 at the end of the first year and $5300 at the end of the second year. How much did Smith family borrow?arrow_forward

- Vincent received a loan of $28,000 at 4.25% compounded monthly. She had to make payments at the end of every month for a period of 5 years to settle the loan. a. Calculate the size of payments. Round to the nearest cent b. Complete the partial amortization schedule, rounding the answers to the nearest cent. Payment Number Payment K 0 1 2 0 0.00 0 0 Total :: :: $0.00 $0.00 $0.00 $0.00 $0.00 Interest Portion Principal Portion $0.00 $0.00 :: :: $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 Principal Balance $28,000.00 $0.00 $0.00 :: $0.00 $0.00 0.00arrow_forwardEnzo borrowed $4800 from the bank for 18 months. The bank discounted the loan at 4.7%. How much was the interest? (State your result to the nearest penny). How much did Enzo receive from the bank? ( State your result to the nearest penny) What was the actual rate of interest? (State your result to the nearest hundredth of a percent.) Need only handwritten solution only (not typed one).arrow_forwardam. 111.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education