FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

im.3

answer must be in proper format or i will give down vote

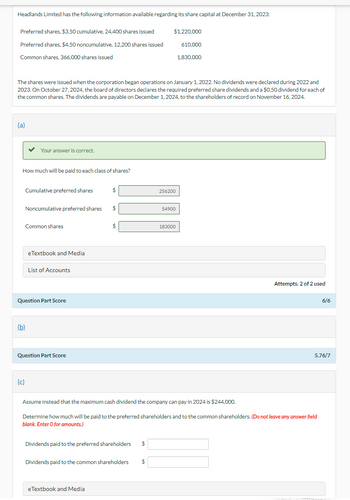

Transcribed Image Text:Headlands Limited has the following information available regarding its share capital at December 31, 2023:

Preferred shares, $3.50 cumulative, 24,400 shares issued

$1,220,000

Preferred shares, $4.50 noncumulative, 12,200 shares issued

Common shares, 366,000 shares issued

610,000

1,830,000

The shares were issued when the corporation began operations on January 1, 2022. No dividends were declared during 2022 and

2023. On October 27, 2024, the board of directors declares the required preferred share dividends and a $0.50 dividend for each of

the common shares. The dividends are payable on December 1, 2024, to the shareholders of record on November 16, 2024.

(a)

Your answer is correct.

How much will be paid to each class of shares?

Cumulative preferred shares

$

256200

Noncumulative preferred shares

$

54900

Common shares

183000

eTextbook and Media

List of Accounts

Question Part Score

(b)

Question Part Score

Attempts: 2 of 2 used

6/6

5.76/7

(c)

Assume instead that the maximum cash dividend the company can pay in 2024 is $244,000.

Determine how much will be paid to the preferred shareholders and to the common shareholders. (Do not leave any answer field

blank. Enter O for amounts.)

Dividends paid to the preferred shareholders $

Dividends paid to the common shareholders $

eTextbook and Media

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- Hello question is attached, thanks.arrow_forwardI need both answers pls explanation I need answer typing clear urjent no chatgpt used i will give upvotesarrow_forwardWhat is forecasting risk and how can it affect decision making? atting re for you! th your chat Edit View Insert Format Tools Table 12pt Paragraph Paragraph р B IUA BIUA 2 2 T² : T² V i I 0 words ✓arrow_forward

- gu an inlo channel. 6. Effective communication means the transference and understanding of meaning, but you cannot know if someone has received your message and comprehended it in the way you intended unless you seek O informal communication. O one-way communication. Ononverbal communication. O feedback. o search 84°F Mostly sunny 近arrow_forwardcan you solve by ansewring the question'a in a fromual.arrow_forwardPlease answer G part with explanationarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education