FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

Please do not give solution in image format thanku

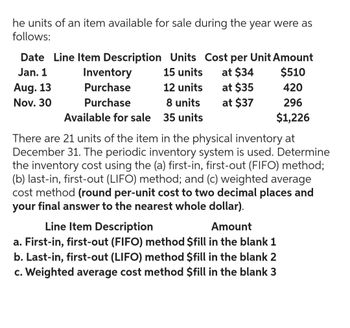

Transcribed Image Text:he units of an item available for sale during the year were as

follows:

Date Line Item Description Units Cost per Unit Amount

Jan. 1

15 units

at $34

$510

12 units

at $35

420

8 units

at $37

Available for sale 35 units

Aug. 13

Nov. 30

Inventory

Purchase

Purchase

296

$1,226

There are 21 units of the item in the physical inventory at

December 31. The periodic inventory system is used. Determine

the inventory cost using the (a) first-in, first-out (FIFO) method;

(b) last-in, first-out (LIFO) method; and (c) weighted average

cost method (round per-unit cost to two decimal places and

your final answer to the nearest whole dollar).

Line Item Description

Amount

a. First-in, first-out (FIFO) method $fill in the blank 1

b. Last-in, first-out (LIFO) method $fill in the blank 2

c. Weighted average cost method $fill in the blank 3

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step 1: Introduce to FIFO, LIFO and Weighted Average Method

VIEW Step 2: Working for number of sales unit

VIEW Step 3: Working for ending inventory using FIFO Method

VIEW Step 4: Working for ending inventory using LIFO Method

VIEW Step 5: Working for ending inventory using Weighted Average

VIEW Solution

VIEW Step by stepSolved in 6 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please help me,arrow_forwardRobert LaClerq is paid a regular wage of $9.50 an hour, overtime at the rate of 1 times the regular rate for all hours worked over 8 in any weekday, and overtime at the rate of 2 times the regular rate for hours worked on Saturdays, Sundays, and holidays. During the week ended February 14, LaClerq worked the following days and hours. Calculate the regular hours worked and the overtime hours worked. Then answer the questions that follow. Day Total Hours Worked RegularHours OvertimeHours Monday 7 Tuesday 10 Wednesday 8 Thursday 10 Friday 11 Saturday 2 48 1. How many regular hours did Mr. LaClerq work? Regular Hours 2. How many overtime hours did Mr. LaClerq work? Overtime Hours 3. What was Mr. LaClerq's regular earnings for the week? (Round your answer to 2 decimal places. Omit the…arrow_forwardWrite me a human paragraph without using Al about what a memorandoms of understanding is and how it is usedarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education