FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

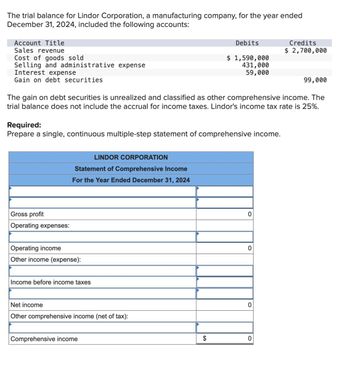

Transcribed Image Text:The trial balance for Lindor Corporation, a manufacturing company, for the year ended

December 31, 2024, included the following accounts:

Account Title

Sales revenue

Cost of goods sold

Selling and administrative expense

Interest expense

Gain on debt securities

Gross profit

Operating expenses:

Required:

Prepare a single, continuous multiple-step statement of comprehensive income.

LINDOR CORPORATION

Statement of Comprehensive Income

For the Year Ended December 31, 2024

The gain on debt securities is unrealized and classified as other comprehensive income. The

trial balance does not include the accrual for income taxes. Lindor's income tax rate is 25%.

Operating income

Other income (expense):

Income before income taxes

Net income

Other comprehensive income (net of tax):

Debits

Comprehensive income

$ 1,590,000

431,000

59,000

$

0

0

0

Credits

$ 2,700,000

0

99,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Below are the titles of a number of debit and credit accounts as they might appear on the statement of financial position of Hayduke ASA as of October 31, 2022. Select the Current Asset, Current Liability, Borderline, and Not a Current Item from among these debit and credit accounts. Debit Interest Accrued on Government Securities Notes Receivable Petty Cash Fund Government Securities Treasury Shares Current Asset Current Liability Borderline Not a Current Item Credit Share Capital-Preference 6% First Mortgage Bonds, due in 2029 Preference Dividend, payable Nov. 1,2022 Allowance for Doubtful Accounts Customers' Advances (on contracts to be completed next year)arrow_forwardProvide Correctarrow_forwardThe trial balance of Sam’s Deli Inc. at October 31, 2020, does not balance: The accounting records contain the following errors: -Recorded a $1,000 cash revenue transaction by debiting Accounts Receivable. The credit entry was correct. -Posted a $1,000 credit to Accounts Payable as $100. -Did not record utilities expense or the related account payable in the amount of $200. -Understated Share Capital by $1,100. -Omitted insurance expense of $1,000 from the trial balance. Q1: Prepare the correct trial balance at October 31, 2020, complete with a heading. Journal entries are not required but will be helpful in correcting the trial balance. Q2: Organize the elements of the trial balance in a way that would assist a bank manager who has to decide whether to loan money to Sam’s Deli.arrow_forward

- Use the information below for Harding Company to answer the question that follow. Harding Company Accounts payable $36,767 Accounts receivable 74,993 Accrued liabilities 6,681 Cash 17,378 Intangible assets 41,965 Inventory 83,039 Long-term investments 90,147 Long-term liabilities 70,154 Marketable securities 39,256 Notes payable (short-term) 24,477 Property, plant, and equipment 689,894 Prepaid expenses 1,932 Based on the data for Harding Company, what is the amount of working capital?arrow_forwardConcord, Inc. had net sales in 2025 of $1,428,800. At December 31, 2025, before adjusting entries, the balances in selected accounts were Accounts Receivable $392,000 debit, and Allowance for Doubtful Accounts $4,240 credit. If Concord estimates that 9% of its receivables will prove to be uncollectible. Prepare the December 31, 2025, journal entry to record bad debt expense. (If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Credit account titles are automatically indented when the amount is entered. Do not indent manually. List debit entry before credit entry.)arrow_forwardThe financial statements of Calico Corporation, for the May 31 year-end, included the following information relating to their allowance for doubtful accounts: Balance in allowance at the beginning of the year $278 million, accounts written off during the year of $116 million, balance in allowance at the end of the year $271 million. What did Calico Corporation report as bad debt expense for the year? Select one: a. $155 million b. $109 million c. None of the above d. $162 million e. $123 millionarrow_forward

- The following information has been extracted from the annual reports of Lilydale Ltd and Monbulk Ltd. Lilydale Ltd Monbulk Ltd $2 950 300 17 100 Sales (net credit) revenue for year Allowance for Doubtful Debts, 1/7/18 Allowance for Doubtful Debts, 30/6/19 Accounts receivable (gross) 1/7/18 Accounts receivable (gross) 30/6/19 $2 204 300 27 100 19780 28 100 722 650 368 000 485 800 384 200 (a) Calculate the receivables turnover ratio and average collection period for both companies. Comment on the difference in their collection experiences. (b) Compare the success or otherwise of their cash collection policies, given that the average receivables turnover for the industry in which the companies operated is 7. Credit terms for both companies are 2/10, n/30.arrow_forwardSagararrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education