FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

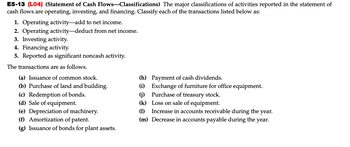

Transcribed Image Text:E5-13 (L04) (Statement of Cash Flows-Classifications) The major classifications of activities reported in the statement of

cash flows are operating, investing, and financing. Classify each of the transactions listed below as:

1. Operating activity-add to net income.

2. Operating activity-deduct from net income.

3. Investing activity.

4. Financing activity.

5. Reported as significant noncash activity.

The transactions are as follows.

(a) Issuance of common stock.

(b) Purchase of land and building.

(c) Redemption of bonds.

(d) Sale of equipment.

(e) Depreciation of machinery.

(f) Amortization of patent.

(g) Issuance of bonds for plant assets.

(h) Payment of cash dividends.

(i) Exchange of furniture for office equipment.

Purchase of treasury stock.

(j)

(k)

Loss on sale of equipment.

(1)

Increase in accounts receivable during the year.

(m) Decrease in accounts payable during the year.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Which of the following is NOT a cash flow from investing activities? a. Cash payments of dividends to shareholders b. Buying or selling of Land, buildings, and plant equipment. c. Buying and selling stocks of other firms d. Buying and selling bonds of other firmsarrow_forward7. Examine each of the following transactions ( 1 ) through ( 5 ). Determine where each should be reported on a statement of cash flows. The possible locations are identified by items A through E. (1) Common stock of another company was accepted in exchange for a copyright. (2) Received cash dividends from available for sale equity securities. (3) Received principal payment on loan previously made to subsidiary company. (4) Used excess cash to purchase treasury stock. (5) Received cash settlement on a lawsuit. (A) Operating Activities (B ) Investing Activities (C) Financing Activities (D) Schedule of Noncash Financing and/or Investing Activities (E) Not Reported on the Statement of Cash Flows O A. 1 = C; 2 = B; 3 = A; 4 = B; 5 = A. B. 1 = D; 2 = A; 3 = B; 4 = C; 5 = A. OC. 1 = B; 2 = A; 3 = C; 4 = B; 5 = E. OD. 1 = C; 2 = C; 3 = B; 4 = C; 5 = E. OE. 1 = D; 2 = A; 3 = A; 4 = B; 5 = E.arrow_forwardFor each of the following accounts, place the letter of the financial statement on which it would be found in the space provided.1) Treasury Stock2) Amoritization Expense3) Trucks4) Gain on Sale of Equipment5)Unearned Revenues6) Accounts Receivablearrow_forward

- Which of the following contains only accounts found on the balance sheet? Cash, notes payable, gross profit, common stock O Interest payable, inventory, accumulated depreciation, sales Gain on land sale, equipment, prepaid rent, accounts payable Cost of goods sold, utilities payable, common stock, prepaid rent Accumulated depreciation, retained earnings, wages payable, accounts receivablearrow_forwardVishnuarrow_forwardThe balance in the Retained Earnings account represents: Select one: a. Accumulated revenues from all prior years of operations b. Accumulated earnings that have not been distributed to stockholders c. The amount of cash available for dividends d. Cash in the bankarrow_forward

- Classify the following cash flows as either operating, investing, or financing activities, assuming the indirect method. Cash Flow 1. Cash paid to purchase investments. 2. Paid cash dividends. 3. Paid long-term debt with cash. 4. Paid cash for rent. 5. Issued common stock for cash. 6. Paid cash for wages and salaries. 7. Received cash interest on a note. 25 8. Paid cash for property taxes on building. 9. Paid accounts payable with cash. 10. Received cash from sale of land. Activity Investing Financing Financing Operatingarrow_forwardWhich of the following is reported under the Financing Activities in the Statement of Cash Flow? O Collection of account receivable O Cash payment to suppliers Issuance of bonds payable O Sale of buildingarrow_forwardIndicate if the following transactions increase or decrease cash and classify the transactions as Operating, Investing or Financing Activities Enter I For increase and D for decrease. Enter O for Operating, I for Investing, and F for Financing. 1. Pay taxes D O 2. Collect cash from customers I O 3. Issue common stock F 4. Take out a loan from a bank 5. Purchase stock in another company I 6. Sell government debt security 7. Buy a patent 8. Retire a bonds payable 9. Pay dividends 10. Pay insurance 11. Pay interest on a loan 12. Pay principal on a loan 13. Pay salaries 14. Repurchase treasury stock 15. Sell a copyright to another firm 16. Pay suppliers for inventory 17. Dividend payments received from stock investment. 18. Interest payments received from investment in government debt securities.arrow_forward

- Classify the following cash flows as either operating, investing, or financing activities, assuming the indirect method. Cash Flow 1. Purchased inventories with cash. 2. Received cash interest on a note. 3. Paid cash for property taxes on building. 4. Paid cash for utilities. 5. Paid cash for rent. 6. Received cash from sale of land. 7. Paid accounts payable with cash. 8. Sold stock investments for cash. 9. Issued preferred stock for cash. 10. Issued common stock for cash. Activityarrow_forwardWhich of these transactions would be part of the investing section of the statement of cash flows using the direct method? A. Cash received from customers B. Dividend payments to shareholders, paid in cash C. Cash paid for purchase of equipment Sales of product, for cash D. Land purchased on a notearrow_forwardIn a statement of cash flows, indicate which of the following does NOT correspond to investment activities: Select one: a. Purchase of property, plant and equipment assets. b. Loan granted to company officials. c. Compensation received from the insurer for warehouse destroyed by fire. d. Sale of investments to negotiate (tradingarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education