FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

pls. show me the solutions for 3,4,5,6 thankiesss

Transcribed Image Text:amount to P59,708. Interest payments are due every December 31

On January 1, 20x1, the BTr issues a 5-year, 6%, P2,000,000 bonds

interest rate adjusted for both the bond discount and bond issue

for P1,900,000. Transaction costs on the issuance (bond issue costs)

A provision requires disclosure in the notes.

с. 10.3М

d. 9,633,314

hition?

10M-300x

but the principal is due only at maturity date. The effective

the carrying amo

a. 10M

b. 9.7М

Use the following information for the next three questions:

Costs)

December

due

amount to P59,708. Interest payments are

but the principal is due only at maturity date. The effect

interest rate adjusted for both the bond discount and bond ie

every

31

costs is 8%.

4. How much is the carrying amount of the bonds on initial

recognition?

a. 2,000,000

b. 1,900,000

c. 1,959,709.

d. 1,840,292

How much is the interest expense for 20x1?

c. 156,777

d. 147,223

a. 160,000

b. 152,000

6 How much is the carrying amount of the bonds on December

31, 20x1?

a. 1,867,515

b. 1,813,069

c. 1,932,000

d. 1,99,649

с.

7. Which of the following distinguishes a provision from of

types of liabilities?

a. A provision requires disclosure in the notes

b. A provision is supported by an

Transcribed Image Text:ntity

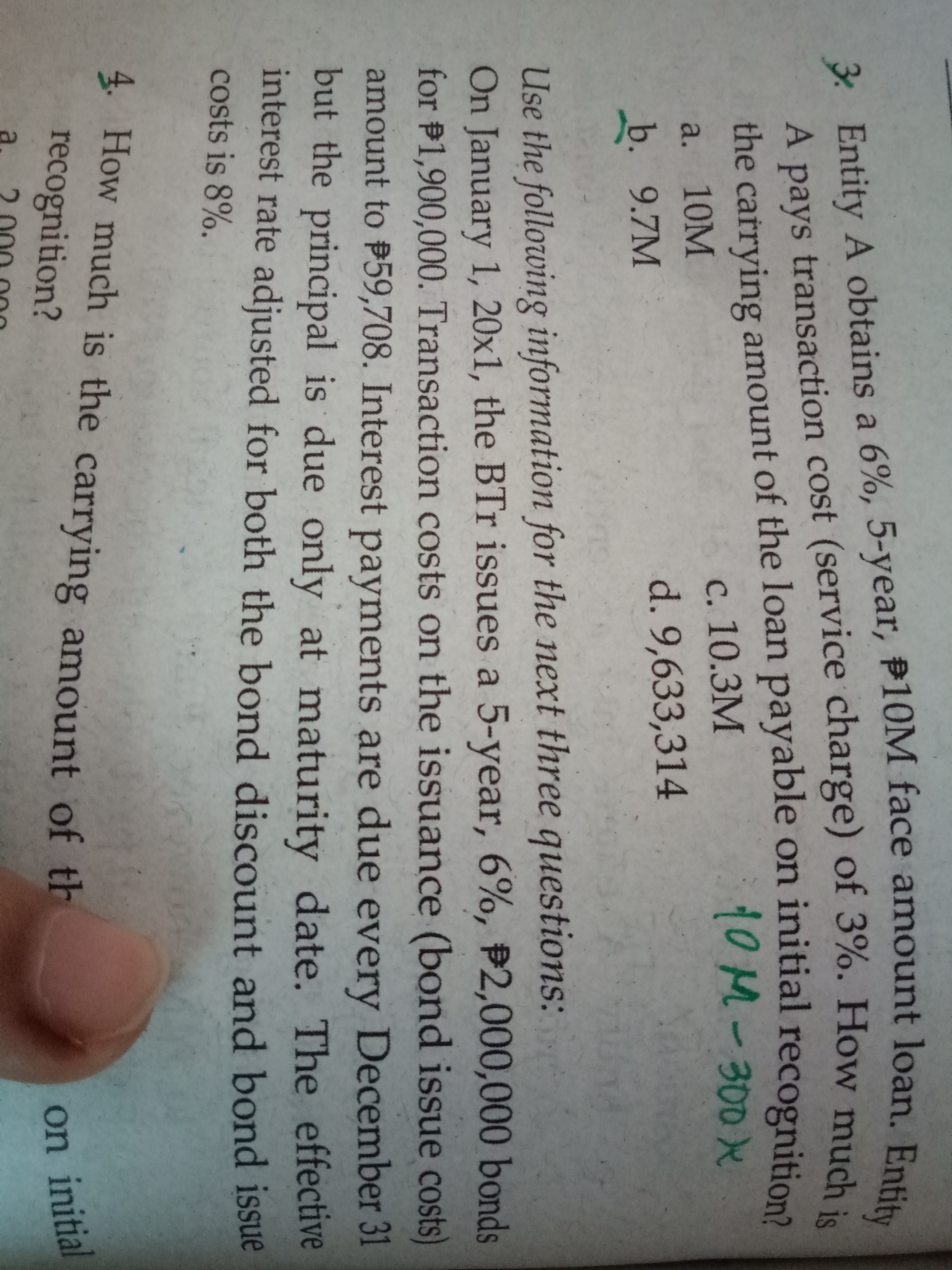

3 Entity A obtains a 6%, 5-year, P10M face amount loạn B.

A pays transaction cost (service charge) of 3%. How much

the carrying amount of the loan payable on initial recognition

10M-300x

с. 10.3М

a. 10M

d. 9,633,314

b. 9.7M

Use the following information for the next three questions:

On January 1, 20x1, the BTr issues a 5-year, 6%, P2,000,000 bonds

for P1,900,000. Transaction costs on the issuance (bond issue costs)

amount to P59,708. Interest payments are due every December 31

but the principal is due only at maturity date. The effective

interest rate adjusted for both the bond discount and bond issue

costs is 8%.

4. How much is the carrying amount of th

recognition?

on initial

a.

3 A a 6%, face Entity

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education