FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

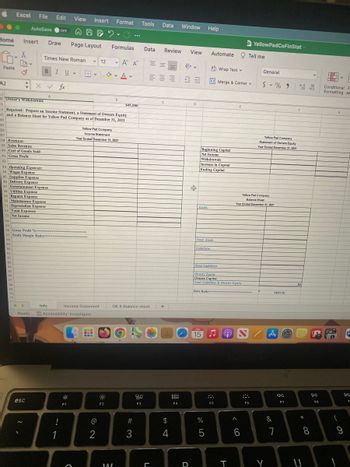

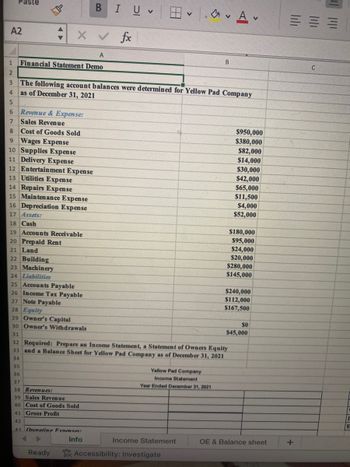

The following account balances were determined for yellow pad company as of December 31, 2021. Prepare an income statement, statement of owners, equity, and a balance sheet for yellow pad company as of December 31, 2021.

Transcribed Image Text:Home Insert Draw Page Layout

0.

Paste

A2

Excel File Edit View Insert Format Tools Data

●

AutoSave OFF

THEY C

36

37

38 Revenues:

39 Sales Revenue

40 Cost of Goods Sold

41 Gross Profit

42

54

X

48 Utilities Expense

49 Repairs Expense

43 Operating Expenses:

44 Wages Expense

45 Supplies Expense

46 Delivery Expense

47 Entertainment Expense

60

61

62

63

#

50 Maintenance Expense

51 Depreciation Expense

52 Total Expenses

53 Net Income

64

55

56 Gross Profit %-

65

10 Owner's Withdrawals

81

32 Required: Prepare an Income Statement, a Statement of Owners Equity

33 and a Balance Sheet for Yellow Pad Company as of December 31, 2021

34

35

66

67

57 Profit Margin Ration

58

59

68

69

70

71

x ✓ fx

Times New Roman ✓12

B IU

HH ✓ V

44

Ready

esc

A

Info

!

1

V

Accessibility: Investigate

F1

Income Statement

O

==

B

Yellow Pad Company

Income Statement

Year Ended December 31, 2021

@

2

1. A

V

5

V

F2

Formulas Data Review View Automate Tell me

B

WAZ

A A

...

$45,000

OE & Balance sheet

#3

20

F3

==

E

三三五

L

C

+

Window Help

$

4

900

000

F4

D

D

+

Beginning Capital

Net Income

Withdrawals

Increase in Capital

Ending Capital

Assets:

Total Assets

Liabilities

Debt Ratio

JUN

15

Wrap Text v

Merge & Center v

Merge

Total Liabilities

Owners Equity

Owners Capital

Total Liabilities & Owners Equity

%

5

F5

e

T

^

YellowPadCoFinStat

6

Yellow Pad Company

Balance Sheet

Year Ended December 31, 2021

F6

General

$%900

Yellow Pad Company

Statement of Owners Equity

Year Ended December 31, 2021

Y

#DIV/0!

A

&

7

Ja

F7

.00 0

$0

*

8

v

U

DII

FB

Conditional F

Formatting as

F

6

G

(

-

9

w

F

Transcribed Image Text:Paste

A2

P

-xv fx

Revenue & Expense:

Sales Revenue

Cost of Goods Sold

A

1 Financial Statement Demo

2

3 The following account balances were determined for Yellow Pad Company

as of December 31, 2021

4

5

6

7

8

9 Wages Expense

10 Supplies Expense

11 Delivery Expense

12 Entertainment Expense

13 Utilities Expense

14 Repairs Expense

15 Maintenance Expense

16 Depreciation Expense

17 Assets:

BIUV

18 Cash

19 Accounts Receivable

20 Prepaid Rent

21 Land

22 Building

23 Machinery

24 Liabilities

Ready

1. Av

Yellow Pad Company

Income Statement

Year Ended December 31, 2021

Income Statement

25 Accounts Payable

26 Income Tax Payable

27 Note Payable

28 Equity

29 Owner's Capital

30 Owner's Withdrawals

31

32 Required: Prepare an Income Statement, a Statement of Owners Equity

and a Balance Sheet for Yellow Pad Company as of December 31, 2021

33

34

35

36

37

38 Revenues:

39 Sales Revenue

40 Cost of Goods Sold

41 Gross Profit

42

43 Onerating Exnenses:

A

Info

Accessibility: Investigate

B

$950,000

$380,000

$82,000

$14,000

$30,000

$42,000

$65,000

$11,500

$4,000

$52,000

$180,000

$95,000

$24,000

$20,000

$280,000

$145,000

$240,000

$112,000

$167,500

$0

$45,000

OE & Balance sheet

三三三

+

C

I

E

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The financial statements of Dandy Distributors Ltd. are shown on the "Fcl. Stmts." page. 1 Based on Dandy's financial statements, calculate ratios for the year ended December 31, 2020. Assume all sales are on credit. Show your work. 2 From these ratios, analyze the financial performance of Dandy.arrow_forwardThe following Information is available from the accounting records of Manahan Co. for the year ended December 31, 2019: Net cash provided by financing activities Dividends paid Loss from discontinued operations, net of tax savings of $39,700 Income tax expense Other selling expenses Net sales Advertising expense Accounts receivable Cost of goods sold General and administrative expenses Net sales Cost of goods sold Gross profit Expenses: Required: a. Calculate the operating Income for Manahan Co. for the year ended December 31, 2019. Advertising expense General and administrative expenses Operating income MANAHAN CO. Operating Income Statement For the year ended December 31, 2019 b. Calculate the company's net Income for 2019. Net income $ $119,000 18, 200 119,100 $ 27,288 11,500 646,600 47,000 59,300 368,562 141,800 0 0 0arrow_forwardWhat is a list of the accounts the company uses that includes the account numbers called with the accounts listed in order of the expanded accounting equation? Group of answer choices balance sheet chart of accounts income statement accountarrow_forward

- Sweet home Inc., includes the following selected accounts in its general ledger at December 31, screenshot attacahed thanks fas fakopearrow_forwardPlease analyze, assess, and synthesize the Annual Report or Form 10-K or Form 20 - F (whatever they call it in that jurisdiction) of the company you choose. You can usually find it on the Company's website in Investor R. Introduction 2. Industry situation and company plans A. Management Letter B. B. Review Company's Products and Services 3. Financial Statements A. Income Statement B. Cash Flow Statement C. Balance Sheet D. Accounting Policies 4. Financial Analysis & Ratio A. Financial Analysis B. Ratio C. Market Indicator Financial Ratios 5. References 6. Complete Calcuation of Part 4 in excelLimiarrow_forwardPrepare an income statement for Simpson Ltd for the month ended 31 July 2021arrow_forward

- Following are selected balance sheet accounts of Sheffield Bros. Corp. at December 31, 2020 and 2019, and the increases or decreases in each account from 2019 to 2020. Also presented is selected income statement information for the year ended December 31, 2020, and additional information. Selected balance sheet accounts Assets Accounts receivable Property, plant, and equipment Accumulated depreciation-plant assets Liabilities and stockholders' equity. Bonds payable Dividends payable Common stock, $1 par Additional paid-in capital Retained earnings Depreciation Gain on sale of equipment Net income Additional information: 1. 2. 3. (a) (b) (c) (d) 2020 $34,000 Proceeds from the sale of equipment. Cash dividends paid. 278,500 (176,300 ) (168,400) 2020 Redemption of bonds payable. $49,000 8,000 22,100 9,100 104,600 Selected income statement information for the year ended December 31, 2020: Sales revenue $154,400 38,100 2019 14,700 $24,100 30,900 249,400 2019 $45,900 5,100 18,900 3,000…arrow_forwardAssume that Lululemon Athletica Inc. reported the following summarized data at December 31, 2020. Accounts appear in no particular order. Revenues: $275, Other Liabilities: $38, Other assets: $101, Cash and other Current assets: 53, Accounts Payable: $5, Expenses: $244, Shareholder's equity: $80. Prepare the Trail Balance of Lululemon at December 31,2020. List the accounts in proper order, as shown on "in class" practice. How much was Lululemon's net income or net loss?arrow_forwardFollowing are selected accounts for Best Buy, Inc., for the fiscal year ended February 2, 2019. (a) Indicate whether each account appears on the balance sheet (B) or income statement (I). Best Buy, Inc. ($ millions)Amount Classification Sales $42,879 Answer B I Accumulated depreciation 6,690 Answer B I Depreciation expense 770 Answer B I Retained earnings 2,985 Answer B I Net income 1,464 Answer B I Property, plant & equipment, net 2,510 Answer B I Selling, general and admin expense 8,015 Answer B I Accounts receivable 1,015 AnswerB I Total liabilities 9,595 Answer B I Stockholders' equity 3,306 Answer B I (b) Using the data, compute total assets and total expenses. Total Assets Answer Total Expenses Answer answer complete and correct and in detail with all workarrow_forward

- Byrd Company had the following transactions during 2019 and 2020: 1. Prepare the journal entries for Byrd for both 2019 and 2020. Assume that the net price method is used to account for the credit terms. 2. Show how the preceding items would be reported in the current liabilities section of Byrd’s December 31, 2019, balance sheet. 3. Next Level Assuming Byrd’s current assets were $1,200,000 and its current ratio was 2.4 at the end of 2018, compute the current ratio at the end of 2019 (based solely on the effects of the preceding transactions).arrow_forwardLansing Company’s 2018 income statement and selected balance sheet data (for current assets and current liabilities) at December 31, 2017 and 2018, follow. LANSING COMPANYIncome StatementFor Year Ended December 31, 2018 Sales revenue $ 100,200 Expenses Cost of goods sold 43,000 Depreciation expense 12,500 Salaries expense 19,000 Rent expense 9,100 Insurance expense 3,900 Interest expense 3,700 Utilities expense 2,900 Net income $ 6,100 LANSING COMPANYSelected Balance Sheet Accounts At December 31 2018 2017 Accounts receivable $ 5,700 $ 6,000 Inventory 2,080 1,590 Accounts payable 4,500 4,800 Salaries payable 900 710 Utilities payable 240 170 Prepaid insurance 270 300 Prepaid rent 240 190 Required:Prepare the cash flows from operating activities section only of the company’s 2018 statement of cash flows using the direct method. (Amounts to be…arrow_forward1.32. Creating Balance Sheets and Income Statements. Using the information in the below table, prepare a classified balance sheet for Erie Company as of December 31, 2019 and December 31, 2020, along with multi-step income statements for the years then endedarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education