FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

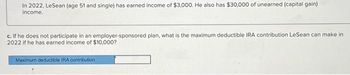

Transcribed Image Text:In 2022, LeSean (age 51 and single) has earned income of $3,000. He also has $30,000 of unearned (capital gain)

income.

c. If he does not participate in an employer-sponsored plan, what is the maximum deductible IRA contribution LeSean can make in

2022 if he has earned income of $10,000?

Maximum deductible IRA contribution

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Which of the following is NOT true about an RESP? Select one: a. Withdrawals are taxed in the hands of the beneficiary b. There is a lifetime contribution limit per beneficiary c. The federal government subsidizes the parents' deposits with a grant d. Deposits are not deductible, beneficiary's withdrawals are not taxablearrow_forwardA single taxpayer, under age 65, who is a dependent of another taxpayer, has to file a tax return if their unearned income exceeds more than which amount?arrow_forwardJasmine 29 is filing as a single tax payer in 2020 she recieve income from the following sources 39000 wages Alimony payment totaling 14328 her divorce was finalize in October 2019 Unemployment compensation of 6200 Jasmine also made a timely 2000 contribution to a traditional ira for 2020 She has no other income and will file a standard deduction What is Jasmine adjustable gross ? incomearrow_forward

- During the tax year Thomas and you long to receive 24,000 and Social Security benefits them out of there adjusted gross income for the year was 2000 and they receive no tax exempt interest incomeCalculate the amount of the Social Security benefitsarrow_forwardCalculate the tax payable if an individual taxpayer has the following amounts of taxable income. Include Medicare Levy and Medicare Levy surcharge, where applicable. $17,000 – Non-resident (not a working holiday maker). $95,000 – Non-resident, (not a working holiday maker. $100,000 – Resident, with no private health insurance. $245,000 - Resident; with private health insurance.arrow_forwardWhich of the toliowing types of interest is not taxable in the year it is posted to the taxpayer's account? Select one O a Interest on a savings account OD interest on an investment account Oc Imterest on an IRA O d. interest on ife insurance proceeds remaining with the insurance companyarrow_forward

- kai.9 Keith has a 2022 tax liability of $2,680 before taking into account his American Opportunity credit. He paid $2,820 in qualifying expenses, was a full-time student seeking a BA, was not claimed as a dependent on his parents' return, and his American Opportunity credit was not subject to phase out. What is the amount of his American Opportunity credit?arrow_forward3. Fess receives wages totaling $75,700 and has net earnings from self-employment amounting to $61,300. In determining her taxable self-employment income for the OASDI tax, how much of her net self-employment earnings must Fess count?arrow_forwardWhich of the following is a deductible expense for an individual taxpayer? A) Rent payments for personal use B) Mortgage interest on a vacation home C) Childcare expenses while working D) Personal clothing purchasesarrow_forward

- B4.arrow_forwardTaxpayers who make after-tax contributions to qualified employer plan can recover their investment when they begin to take periodic payments. How is the after-tax contribution recovered?arrow_forwardwhich of the following are tax benefits of a traditional qualified employer defined contribution plan? a. employer matching contributions are not included in the current year's gross income b. Qualified distributions are not subject to income tax c. Contributions are not included in the current year's gross income d. Investments earnings are not subject to tax until they are distributedarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education