FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Q.Prepare the revenues budget for the year 2018.

Transcribed Image Text:Hazlett, Inc., operates at capacity and

makes plastic combs and hairbrushes. Although the combs and brushes are a matching set, they are sold

individually and so the sales mix is not 1:1. Hazlett's management is planning its annual budget for fiscal

year 2018. Here is information for 2018:

Input Prices

Direct materials

$0.30 per ounce

$0.75 per bunch

$ 18 per direct manufacturing labor-hour

Plastic

Bristles

Direct manufacturing labor

Input Quantities per Unit of Output

Combs

Brushes

Direct materials

Plastic

5 ounces

8 ounces

16 bunches

Bristles

Direct manufacturing labor

Machine-hours (MH)

0.05 hours

0.2 hours

0.025 MH

0.1 MH

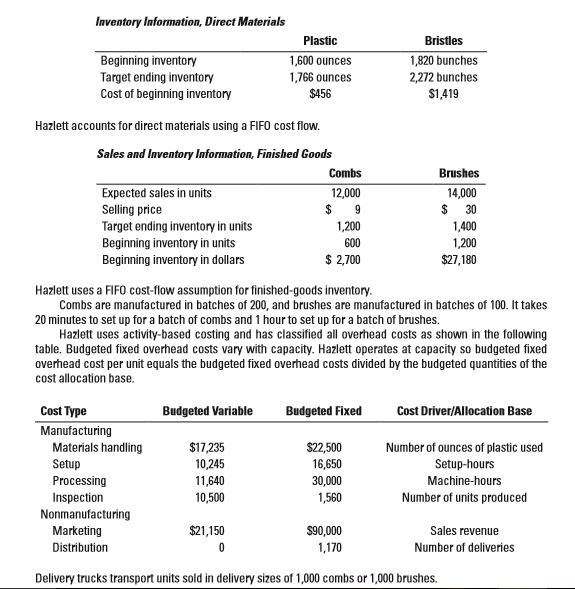

Transcribed Image Text:Inventory Information, Direct Materials

Plastic

Bristles

Beginning inventory

Target ending inventory

Cost of beginning inventory

1,820 bunches

1,600 ounces

1,766 ounces

$456

2,272 bunches

$1,419

Hazlett accounts for direct materials using a FIFO cost flow.

Sales and Inventory Information, Finished Goods

Combs

Brushes

Expected sales in units

12,000

14,000

24

Selling price

30

Target ending inventory in units

Beginning inventory in units

Beginning inventory in dollars

1,200

1,400

600

1,200

$ 2,700

$27,180

Hazlett uses a FIFO cost-flow assumption for finished-goods inventory.

Combs are manufactured in batches of 200, and brushes are manufactured in batches of 100. It takes

20 minutes to set up for a batch of combs and 1 hour to set up for a batch of brushes.

Hazlett uses activity-based costing and has classified all overhead costs as shown in the following

table. Budgeted fixed overhead costs vary with capacity. Hazlett operates at capacity so budgeted fixed

overhead cost per unit equals the budgeted fixed overhead costs divided by the budgeted quantities of the

cost allocation base.

Budgeted Variable

Cost Type

Manufacturing

Budgeted Fixed

Cost Driver/Allocation Base

Materials handling

Setup

$17,235

$22,500

16,650

Number of ounces of plastic used

10,245

Setup-hours

30,000

Processing

11,640

Machine-hours

10,500

Inspection

Nonmanufacturing

1,560

Number of units produced

Marketing

$21,150

$90,000

Sales revenue

1,170

Distribution

Number of deliveries

Delivery trucks transport units sold in delivery sizes of 1,000 combs or 1,000 brushes.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Budget comparison schedules or statements are needed for which funds? Should the budgetary comparison schedules' real revenues and expenditures be presented in accordance with GAAP? Why are you or are you not?arrow_forwardHow do amendments to government policies effect the fourth-quarter budget of an organization?arrow_forwardA capital budget shows a proposed list of investments.arrow_forward

- Identify some essential component of the annual budget process for a state or local government. How long might the process take?arrow_forwardWhich of the following items do you need to have available to develop a budget? a) Prior period operating results b) Assumptions of next period operations c) Goals d) All of the above 0.000.arrow_forwardThe budgeted income statement is part of which element of the master budget? The financial budget The operating budget The capital expenditures budget None of the abovearrow_forward

- LB Enterprises (LB) is preparing its budget for the first quarter of 2019. LB's balance sheet as of December 31, 2018 is as follows: Assets Liabilities Cash $5,000 Accounts Payable $9500 Accounts Recievable 28,000 Inventories Direct Materials 8,100 Finished Goods (500 Units) 16,870 Stockholders Equity Equipment - gross 45,000 Accumulated depreciation 15.000 Common Stock $15,000 Net Equipment 30,000 Retained Earnings 63,470 Total Assets $87,970 Total Liabilities and $87,960 Equity LB sells one product for $45/unit. The Company forecasts that it will sell 2,000; 1,500; 1,600; and 1,700 units in January, February, March and April, respectively. • Sales to customers are all on credit. 40% of the cash for these sales is collected in the month of the sale and the remaining 60% is collected in the following month. LB wants finished goods inventory equal to 25% of the next month's sales on hand at the end of each month. LB wants direct materials equal to 75% of the current month's production…arrow_forwardWhat revenue sources allow this budget to be balanced in each year? What revenue source will have the greatest impact on the budget? What assumptions have been made with respect to revenue sources? What two expenditures will have the greatest impact upon the budget?arrow_forwardWhat is the capital expenditures budget?arrow_forward

- Today is November 1, 2021. A continuous budget for the period from November 1, 2021 through October 31, 2022 is more reflective of current operating conditions than an operating budget for calendar year 2021 that was compiled in November 2020. True or false?arrow_forwardBudget development for the coming year usually?arrow_forward1. Briefly describe the two types of financial statements that government are required to issue under GASB 34 2. Why do governments make a journal entry to record the budget?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education