Survey of Accounting (Accounting I)

8th Edition

ISBN: 9781305961883

Author: Carl Warren

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

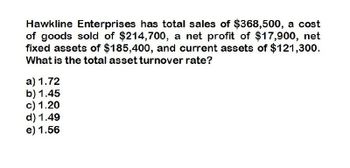

What is the total asset turnover rate for these financial accounting question?

Transcribed Image Text:Hawkline Enterprises has total sales of $368,500, a cost

of goods sold of $214,700, a net profit of $17,900, net

fixed assets of $185,400, and current assets of $121,300.

What is the total asset turnover rate?

a) 1.72

b) 1.45

c) 1.20

d) 1.49

e) 1.56

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- 6arrow_forwardUsing the following data for Marigold, Inc., compute its asset turnover and the return on assets ratio. Net Income 2026 $165,040 Total Assets 12/31/26 2,243,000 Total Assets 12/31/25 1,883,000 Net Sales 2026 2,166,150 Asset turnover (Round to 2 decimal places, e.g. 15.35.) 1.05 times Return on assets (Round to 1 decimal place, e.g. 15.3%.) 8 %arrow_forwardFlask Company reports net sales of $4,343 million; cost of goods sold of $2,808 million; net income of $283 million; and average total assets of $2,150. Compute its total asset turnover. Multiple Choice 0.13. 0.77. 1.31. 2.02. 1.55.arrow_forward

- Dundee Company reported the following for the current year: Net sales Cost of goods sold Beginning balance of total assets. Ending balance of total assets Compute total asset turnover. Numerator. 1 1 $ 100,800 72,000 127,000 97,880 Total Asset Turnover Denominator: = = = Total Asset Turnover Total asset turnover timesarrow_forwardCompute the Total assets turnoverarrow_forwardUse the following dataarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning