FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

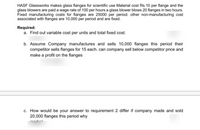

Transcribed Image Text:HASF Glassworks makes glass flanges for scientific use Material cost Rs.10 per flange and the

glass blowers are paid a wage rate of 100 per hours a glass blower blows 20 flanges in two hours.

Fixed manufacturing costs for flanges are 25000 per period. other non-manufacturing cost

associated with flanges are 10,000 per period and are fixed.

Required:

a. Find out variable cost per units and total fixed cost.

b. Assume Company manufactures and sells 10,000 flanges this period their

competitor sells flanges for 15 each. can company sell below competitor price and

make a profit on the flanges

c. How would be your answer to requirement 2 differ if company made and sold

20,000 flanges this period why

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Use the information provided to calculate standard costs: To make one switch it takes 19 feet of plastic-coated copper wire and 0.8 pounds of plastic material. The plastic material can usually be purchased for $20 per pound, and the wire costs $2.12 per foot. The labor necessary to assemble a switch consists of two types. The first type of labor is assembly, which takes 3.1 hours. These workers are paid $27 per hour. The second type of labor is finishing, which takes 2.4 hours. These workers are paid $28 per hour. Overhead is applied using labor hours. The variable overhead rate is $14.25 per labor hour. The fixed overhead rate is $15.26 per hour. What is the total standard cost for manufacturing overhead? Round to the nearest penny, two decimal places.arrow_forwardRitchie Manufacturing Company makes a product that it sells for $180 per unit. The company incurs variable manufacturing costs of $100 per unit. Variable selling expenses are $17 per unit, annual fixed manufacturing costs are $460,000, and fixed selling and administrative costs are $195,200 per year. Required Determine the break-even point in units and dollars using each of the following approaches: a. Use the equation method. b. Use the contribution margin per unit approach. c. Use the contribution margin ratio approach. d. Prepare a contribution margin income statement for the break-even sales volume. Complete this question by entering your answers in the tabs below. Req A to C Req D Determine the break-even point in units and dollars using the equation method, the contribution margin per unit approach and the contribution margin ratio approach. a. Break-even point in units a. Break-even point in dollars b. Contribution margin per unit b. Break-even point in units b. Break-even point…arrow_forwardDengerarrow_forward

- Werner Company produces and sells disposable foil baking pans to retailers for $2.65 per pan. The variable cost per pan is as follows: Direct materials Direct labor Variable factory overhead Variable selling expense Fixed manufacturing cost totals $143,704 per year. Administrative cost (all fixed) totals $19,596. Required: $0.27 0.51 0.69 0.18 Compute the number of pans that must be sold for Werner to break even. pans Conceptual Connection: What is the unit variable cost? What is the unit variable manufacturing cost? Round your answers to the nearest cent. Unit variable cost Unit variable manufacturing cost Which is used in cost-volume-profit analysis? Unit variable cost ✓ How many pans must be sold for Werner to earn operating income of $7,000? pans How much sales revenue must Werner have to earn operating income of $7,000?arrow_forwardRitchie Manufacturing Company makes a product that it sells for $150 per unit. The company incurs variable manufacturing costs of $60 per unit. Variable selling expenses are $18 per unit, annual fixed manufacturing costs are $ 480,000, and fixed selling and administrative costs are $240, 000 per year. Required: Determine the break-even point in units and dollars using each of the following approaches: a. Use the equation method. b. Use the contribution margin per unit approach. c. Use the contribution margin ratio approach. d. Confirm your results by preparing a contribution margin income statement in excel for the break - even sales volume.arrow_forwardYou make widgets, which is a subassembly for you main product of whatsup. An outside vendor has provided you with a quote to supply the widget part for $ 72.00 per unit Your cost records show the following: Your projected production for the widget is 12,500 units Item of Cost Per Unit Cost Direct Material $18.75 Direct Labor $38.00 Variable manufacturing overhead $9.25 Lease on manufacturing facility $36,000.00 per year Depreciation of equipment $2.50 Allocated Corporate Expenses $1.25 If this offer is accepted, you can sublease the manufacturing facility for $15,000 per year All direct and variable costs can be avoided. The equipment has no salvage value How much would net operating income be changed if the outside supplier offer was accepted? Show all calculations for full creditarrow_forward

- Olsen Company produces two products. Product A has a contribution margin of $30 and requires 10 machine hours. Product B has a contribution margin of $24 and requires 4 machine hours. Determine the more profitable product assuming the machine hours are the constraint. Unit contribution margin per bottleneck hour:Product A $_____Product B $_____ Product ____ is most profitable.arrow_forwardIvanhoe's Water World is distributing replacement water coolers in the Montreal area for $160 per cooler. Ivanhoe's fixed costs are equal to $65,875 per month, and the Ivanhoe's accounting staff has calculated the monthly break-even in units to be 775. (a) Your answer is incorrect. Given this information, compute the variable cost per unit and the contribution margin per unit. Variable cost $ Contribution margin $ +A per unit per unit SUPPORTarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education