FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

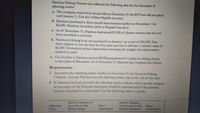

Transcribed Image Text:Harrison Fishing Charters has collected the following data for the December 31

adjusting entries:

a. The company received its electric bill on December 31 for $375 but will not pay it

until January 5. (Use the Utilities Payable account.)

b. Harrison purchased a three-month boat insurance policy on November 1 for

$3,600. Harrison recorded a debit to Prepaid Insurance.

c. As of December 31, Harrison had earned $1,000 of charter revenue that has not

been recorded or received.

d. Harrison's fishing boat was purchased on January 1 at a cost of $56,500. Har-

rison expects to use the boat for five years and that it will have a residual value of

$6,500. Determine annual depreciation assuming the straight-line depreciation

method is used.

e. On October 1, Harrison received $5,000 prepayment for a deep-sea fishing charter

to take place in December. As of December 31, Harrison has completed the charter.

Requirements

1. Journalize the adjusting entries needed on December 31 for Harrison Fishing

Charters. Assume Harrison records adjusting entries only at the end of the year.

2. If Harrison had not recorded the adjusting entries, indicate which specific category

of accounts on the financial statements would be misstated and if the misstate-

ment is overstated or understated. Use the following table as a guide:

Adjusting

Entry

Specific Category of

Accounts on the

Balance Sheet

Specific Category

of Accounts on the

Income Statement

Over /

Over/

Understated

Understated

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 7 steps with 7 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On December 31, Year 1, the Loudoun Corporation estimated that 3% of its credit sales of $112,500 would be uncollectible. Loudoun uses the allowance method. On February 15, Year 2, one of Loudoun's customers failed to pay his $1,050 account and the account was written off. On April 4, Year 2, this customer paid Loudoun the $1,050. Which of the following correctly states the effect of the adjustment dated December 31, Year 1, on the financial statements of the Loudoun Corporation? A. B. C. D. Assets (3,375) (3,375) 3,375 ΝΑ Multiple Choice Option D Option C Option A Option B Balance Sheet = Liabilities + 3,375 ΝΑ ΝΑ ΝΑ Stockholders' Equity ΝΑ (3,375) 3,375 ΝΑ Revenue ΝΑ ΝΑ ΝΑ ΝΑ Income Statement Expense ΝΑ 3,375 (3,375) ΝΑ = Net Income ΝΑ (3,375) 3,375 ΝΑ Statement of Cash Flows ΝΑ ΝΑ 3,375 0A ΝΑarrow_forwardSuppose a customer rents a vehicle for three months from Franklin Rental on November 1, paying $3,750 ($1,250/month). Required: 1.&2. Record the necessary entries in the Journal Entry Worksheet below. 3. Calculate the year-end adjusted balances of Deferred Revenue and Service Revenue (assuming the balance of Deferred Revenue at the beginning of the year is $0).arrow_forwardOn December 31, Year 1, the Loudoun Corporation estimated that 3% of its credit sales of $112.500 would be uncollectible. Loudoun uses the allowance method. On February 15, Year 2, one of Loudoun's customers failed to pay his $1,050 account and the account was written off. On April 4, Year 2, this customer paid Loudoun the $1,050. Which of the following correctly states the effect of Loudoun's recording the restablishment of the receivable on April 4, Year 2? Cash 蛋蛋蛋白 NA a. b. NA C. NA d. NA Assets Multiple Choice + Net Realizable Value - 1,050 (1,050) (1,050) (1,050) 1,050 (1,050) Option A Option Balance Sheet Option C Liabilities + Accounts Payable + NA + NA (1,050) 1,050 + Stockholders' Equity Retained earnings NA (1,050) NA NA Common Stock NA NA NA (1,050) Revenue NA (1,050) NA NA Income Statement Expenses NA NA NA 1,050. = Net Income NA (1,050) NA (1,050) Statement of Cash Flows NA NA NA NAarrow_forward

- Wilson Company paid $6,300 for a 4-month insurance premium in advance on November 1, with coverage beginning on that date. The balance in the prepaid insurance account before adjustment at the end of the year is $6,300, and no adjustments had been made previously. The adjusting entry required on December 31 is: Multiple Choice O O O Debit Prepaid Insurance, $1,575; credit Insurance Expense, $1,575. Debit Cash, $6,300; Credit Prepaid Insurance, $6,300. Debit Prepaid Insurance, $3,150; credit Insurance Expense, $3,150. O Debit Insurance Expense, $1,575; credit Prepaid Insurance, $1,575. Debit Insurance Expense, $3,150; credit Prepaid Insurance, $3,150.arrow_forwardCarson's Bakery operates its business on a calendar year-end and uses 3% of Accounts Receivable to estimate bad debt expense. The company presents the following information at December 31, 2020 before any adjusting entries have been made. Account DR CR Accounts receivable 978,000 Allowance for doubtful accounts 23,750 667,500 Net credit sales What will the company record for bad debt expense? Debit choose your answer... type your answer... Credit choose your answer... type your answer...arrow_forwardAt the end of the year, Dahir Incorporated’s balance of Allowance for Uncollectible Accounts is $1,500 (credit) before adjustment. The company estimates future uncollectible accounts to be $7,500. What adjusting entry would Dahir record for Allowance for Uncollectible Accounts? (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.)arrow_forward

- On March 1, the Applewood Corporation wanted to purchase a $475,000 piece of equipment, but Applewood was only able to furnish $161,500 of its own cash to purchase the equipment. Applewood borrowed the remainder of the $475,000 from the People’s National Bank on a 2-year, 5.5% note. Required: If the company keeps its records on a calendar year, what adjusting entry should Applewood make on December 31? If an amount box does not require an entry, leave it blank. When required, round your answers to the nearest dollar. Dec. 31 fill in the blank 2 fill in the blank 3 fill in the blank 5 fill in the blank 6 (Record accrued interest expense)arrow_forwardThe information necessary for preparing the December 31, 2021 year-end adjusting entries for Vito’s Pizza Parlor appears below. Vito’s fiscal year-end is December 31. On July 1, 2021, purchased $11,500 of IBM Corporation bonds at face value. The bonds pay interest twice a year on January 1 and July 1. The annual interest rate is 12%. Vito’s depreciable equipment has a cost of $31,500, a five-year life, and no salvage value. The equipment was purchased in 2019. The straight-line depreciation method is used. On November 1, 2021, the bar area was leased to Jack Donaldson for one year. Vito’s received $6,900 representing the first six months’ rent and credited deferred rent revenue. On April 1, 2021, the company paid $2,760 for a two-year fire and liability insurance policy and debited insurance expense. On October 1, 2021, the company borrowed $23,000 from a local bank and signed a note. Principal and interest at 12% will be paid on September 30, 2022. At year-end, there is a $1,950…arrow_forwardThe information necessary for preparing the 2021 year-end adjusting entries for Gamecock Advertising Agency appears below. Gamecock’s fiscal year-end is December 31. 1. On July 1, 2021, Gamecock receives $6,000 from a customer for advertising services to be given evenly over the next 10 months. Gamecock credits Deferred Revenue. 2. At the beginning of the year, Gamecock’s depreciable equipment has a cost of $28,000, a four-year life, and no salvage value. The equipment is depreciated evenly (straight-line depreciation method) over the four years. 3. On May 1, 2021, the company pays $4,800 for a two-year fire and liability insurance policy and debits Prepaid Insurance. 4. On September 1, 2021, the company borrows $20,000 from a local bank and signs a note. Principal and interest at 12% will be paid on August 31, 2022. 5. At year-end there is a $2,700 debit balance in the Supplies (asset) account. Only $1,000 of supplies remains on hand.Required: Record the necessary adjusting entries on…arrow_forward

- At year-end (December 31), Chan Company estimates its bad debts as 1% of its annual credit sales of $487,500. Chan records its Bad Debts Expense for that estimate. On the following February 1, Chan decides that the $580 account of P. Park is uncollectible and writes it off as a bad debt. On June 5, Park unexpectedly pays the amount previously written off. Prepare Chan's journal entries for the transactions. View transaction list Journal entry worksheet 1 2 3 4 Record the estimated bad debts expense. Note: Enter debits before credits. Debit Date General Journal Credit Dec 31arrow_forwardDuring the month of June, Novak Boutique recorded cash sales of $259, 350 and credit sales of $126, 420, both of which include the 5% sales tax that must be remitted to the state by July 15. Prepare the adjusting entry that should be recorded to fairly present the June 30 financial statements. (If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually. List all debit entries before credit entries.) Date Account Titles and Explanation Debit Credit June 30 enter an account title for the adjusting entry on June 30 Sales Revenue Correct answer enter a debit amount 250653 Incorrect answer enter a credit amount Incorrect answer enter an account title for the adjusting entry on June 30 Sales Taxes Payable Correct answer enter a debit amount Incorrect answer enter a credit amount 250653 Incorrect answerarrow_forwardA company has a property insurance policy with an annual premium of $1,310. In recent months, the company has filed four different claims against the policy: a fire, two burglaries, and a vandalism incident. The insurance company has elected to cancel the policy, which has been in effect for 310 days. What is the regular refund due (in $) to the company? (Round your answer to the nearest cent.) $ Submit Answorlarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education