FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:Harrington Company was sued by an employee in late 2020. General counsel concluded that there was an 80 percent probability

that the company would lose the lawsuit. The range of possible loss is estimated to be $20,000 to $70,000, with no amount in the

range more likely than any other. The lawsuit was settled in 2021, with Harrington making a payment of $60,000.

Assume that Harrington Company is a U.S.-based company that is issuing securities to foreign investors who require financial

statements prepared in accordance with IFRS. Thus, adjustments to convert from U.S. GAAP to IFRS must be made. Ignore income

taxes.

Required:

a. Prepare journal entries for this lawsuit for the years ending December 31, 2020, and December 31, 2021, under (1) U.S. GAAP

and (2) IFRS.

b. Prepare the entry(ies) that Harrington would make on the December 31, 2020, and December 31, 2021, conversion worksheets

to convert U.S. GAAP balances to IFRS.

Complete this question by entering your answers in the tabs below.

Required A

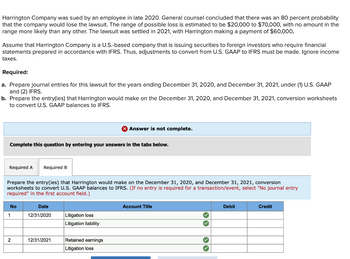

No

Prepare the entry(ies) that Harrington would make on the December 31, 2020, and December 31, 2021, conversion

worksheets to convert U.S. GAAP balances to IFRS. (If no entry is required for a transaction/event, select "No journal entry

required" in the first account field.)

1

Required B

2

Date

12/31/2020 Litigation loss

12/31/2021

Answer is not complete.

Litigation liability

Retained earnings

Litigation loss

Account Title

30 00

Debit

Credit

Transcribed Image Text:Harrington Company was sued by an employee in late 2020. General counsel concluded that there was an 80 percent probability that

the company would lose the lawsuit. The range of possible loss is estimated to be $20,000 to $70,000, with no amount in the range

more likely than any other. The lawsuit was settled in 2021, with Harrington making a payment of $60,000.

Assume that Harrington Company is a U.S.-based company that is issuing securities to foreign investors who require financial

statements prepared in accordance with IFRS. Thus, adjustments to convert from U.S. GAAP to IFRS must be made. Ignore income

taxes.

Required:

a. Prepare journal entries for this lawsuit for the years ending December 31, 2020, and December 31, 2021, under (1) U.S. GAAP and (2)

IFRS.

b. Prepare the entry(ies) that Harrington would make on the December 31, 2020, and December 31, 2021, conversion worksheets to

convert U.S. GAAP balances to IFRS.

Complete this question by entering your answers in the tabs below.

Required A Required B

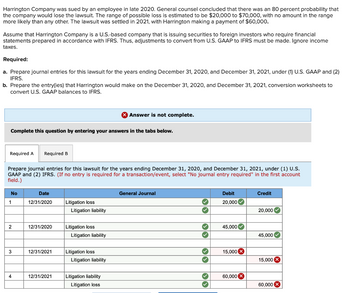

Prepare journal entries for this lawsuit for the years ending December 31, 2020, and December 31, 2021, under (1) U.S.

GAAP and (2) IFRS. (If no entry is required for a transaction/event, select "No journal entry required" in the first account

field.)

No

1

2

3

4

Date

12/31/2020

12/31/2020

12/31/2021

12/31/2021

Litigation loss

Litigation liability

Litigation loss

Litigation liability

Litigation loss

X Answer is not complete.

Litigation liability

Litigation liability

Litigation loss

General Journal

33 33

››

✓

✓

Debit

20,000✔

45,000 ✓

15,000 X

60,000 X

Credit

20,000✔

45,000✔

15,000 X

60,000 X

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Eastern Manufacturing is involved with several situations that possible involve contingencies. Each is described below. Eastern’s fiscal year ends December 31, and the 2021 financial statements are issued on March 15, 2022. Eastern is involved in a lawsuit resulting from a dispute with a supplier. On February 3, 2022, judgment was rendered against Eastern in the amount of $124 million plus interest, a total of $139 million. Eastern plans to appeal the judgment and is unable to predict its outcome though it is not expected to have a material adverse effect on the company. In November 2020, the State of Nevada filed suit against Easter, seeking civil penalties and injunctive relief for violations of upon discussions with legal counsel, the Company feels it is probable that $157 million will be required to cover the cost of violations. Eastern believes that the ultimate settlement of this claim will not have a material adverse effect on the company. Eastern is the plaintiff in a $217…arrow_forwardBefore any debt cancellation, the insolvent KuhnCo holds business equipment, its only asset, with a fair market value of $1 million and related liabilities of $1.25 million. The lender agrees to cancel $400,000 of the liabilities. KuhnCo has no other liabilities. a. How much gross income does KuhnCo report as a result of the debt cancellation? b. How would your answer change, if at all, had the lender cancelled $200,000 of the debt?arrow_forwardMikkeli OY acquired a brand name with an indefinite life in 2021 for 43,600 markkas. At December 31, 2020, the brand name could be sold for 35,200 markkas, with zero costs to sell. Expected cash flows from the continued use of the brand are 45,870 markkas, and the present value of this amount is 34,200 markkas. Assume that Mikkeli OY is a foreign company using IFRS and is owned by a company using U.S. GAAP. Thus, IFRS balances must be converted to U.S. GAAP to prepare consolidated financial statements. Ignore income taxes. Required: Prepare journal entries for this brand name for the year ending December 31, 2020, under (1) IFRS and (2) U.S. GAAP. Prepare the entry(ies) that the U.S. parent would make on the December 31, 2020 conversion worksheet to convert IFRS balances to U.S. GAAP.arrow_forward

- accarrow_forwardElectrolux Group. has decided to close its oil and gas operations in Aberdeen on 1 March 2020 but retain the warehouse from which the operations were carried out as an investment property. The warehouse had a net book value at 30 September 2019 of £6.8m and a fair value of £7.2m at 1 March 2020. At the company's year end of 30 September 2020, the fair value of the warehouse was £8.0m. Assuming Electrolux group policy is to value investment property at fair value, the amount that the company would include in in the income statement for the year ended 30 September 2020 would be: O a. Debit £0.5m O b. Debit £0.4m O c. Credit £1.2m O d. Credit £0.8marrow_forwardA company buys a debt investment for $316, 000. At the end of 2023, the amortized cost of the investment is $315,000 and the fair value of the investment is $322, 000. The company intends to hold the investment until maturity and does not intend to use the fair value option. Therefore, the company must report the investment at $316,000 on its 2023 year-end balance sheet. True or Falsearrow_forward

- Cheyenne Ltd. is a Canadian publicly-traded business with a December 31 fiscal year end. In order to get a better return on some of its excess cash, Cheyenne purchased 130 common shares of AFS Corporation on July 1, 2023 at a price of $3 per share. Due to the nature of the investment, Cheyenne's management is accounting for the equity investment using the fair-value through other comprehensive income (FV-OCI) without recycling to net income. On August 1, 2023, AFS declared dividends of $2/share, and paid those dividends on August 20, 2023. On December 31, 2023, shares in AFS were trading at $5 per share. On September 15, 2024, Cheyenne sold the shares in AFS for $6 per share. Prepare the journal entries required to record the above transactions on the books of Cheyenne Ltd. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. List all debit…arrow_forward11arrow_forwardHarrington Company was sued by an employee in late 2020. General counsel concluded that there was an 80 percent probability that the company would lose the lawsuit. The range of possible loss is estimated to be $21,100 to $73,850, with no amount in the range more likely than any other. The lawsuit was settled in 2021, with Harrington making a payment of $63,300. Assume that Harrington Company is a U.S.- based company that is issuing securities to foreign investors who require financial statements prepared in accordance with IFRS. Thus, adjustments to convert from U.S. GAAP to IFRS must be made. Ignore income taxes. Required: Prepare journal entries for this lawsuit for the years ending December 31, 2020, and December 31, 2021, under (1) U.S. GAAP and (2) IFRS. Prepare the entry(ies) that Harrington would make on the December 31, 2020, and December 31, 2021, conversion worksheets to convert U.S. GAAP balances to IFRS.arrow_forward

- Da-Rocha Ltd is a listed manufacturing company which prepares its financial statements for the year ended 31 October, 2018 in accordance with IFRS. The financial statements are due to be authorized for issue on 15 January 2019. i.Da-Rocha Ltd holds an investment in the shares of a listed company, Shelga Ltd. During November 2018 there was a material fall in the value of Shelga Ltd’s shares. Analysts attribute the fall in value principally to a fraud dating back to December 2017 that was discovered by Shelga Ltd's management and announced publicly in November 2018. ii.In December 2018, the directors of Da-Rocha Ltd publicly announced a plan to reduce the workforce by 10% as a result of worsening economic conditions. Required: Discuss the effects of each of the above items on the financial statements of Da-Rocha Ltd for the year ended 31 October 2018 in accordance with IAS 10 Events after the Reporting Periodarrow_forwardEastern Manufacturing is involved with several situations that possibly involve contingencies. Each is described below. Eastern's fiscal year ends December 31, and the 2024 financial statements are issued on March 15, 2025, a. Eastern is involved in a lawsuit resulting from a dispute with a supplier. On February 3, 2025, judgment was rendered against Eastern in the amount of $118 million plus interest, a total of $133 million. Eastern plans to appeal the judgment and is unable to predict its outcome though it is not expected to have a material adverse effect on the company. b. In November 2023, the State of Nevada filed suit against Eastern, seeking civil penalties and injunctive relief for violations of environmental laws regulating hazardous waste. On January 12, 2025, Eastern reached a settlement with state authorities. Based upon discussions with legal counsel, the Company feels it is probable that $151 million will be required to cover the cost of violations. Eastern believes that…arrow_forwardWang Corporation purchased $290,000 of Hales Incorporated bonds at par in 2023 with the intent and ability to hold the bonds until the bonds mature in 2028, so Wang classifies its investment as held-to-maturity. Unfortunately, a combination of problems at Hales and in the debt market caused the fair value of the Hales investment to decline to $247,000 during 2024. Wang applies the CECL model to account for its investment and calculates that, of the $43,000 drop in fair value, $10,000 of it relates to credit losses for amounts not expected to be collected, and the $33,000 remainder relates to noncredit losses. Wang's accounting for this impairment will reduce before-tax net income for 2024 Multiple Choice $0. $10,000. $33,000. $43,000.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education