FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

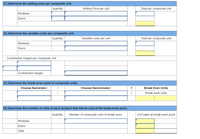

Transcribed Image Text:(1) Determine the selling price per composite unit.

Quantity

Selling Price per unit

Total per composite unit

Windows

Doors

(2) Determine the variable costs per composite unit.

Quantity

Variable costs per unit

Total per composite unit

Windows

Doors

Contribution margin per composite unit

Contribution margin

(3) Determine the break-even point in composite units.

Choose Numerator:

Choose Denominator:

Break Even Units

Break even units

(4) Determine the number of units of each product that will be sold at the break-even point.

Quantity

Number of composite units to break even.

Unit sales at break-even point

Windows

Doors

Total

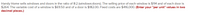

Transcribed Image Text:Handy Home sells windows and doors in the ratio of 8:2 (windows:doors). The selling price of each window is $114 and of each door is

$264. The variable cost of a window is $69.50 and of a door is $182.00. Fixed costs are $416,000. (Enter your "per unit" values in two

decimal places.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please explain your answerarrow_forwardA bag has a cost of 400 and a mark up rate base on cost of 25%. What is the selling price, mark up and mark up rate based on selling price? Please answer it completely.arrow_forwardTinatoots Store sells dumbbells for P79.99 a pair. The store consistently sells 5,700 pairs of these dumbbelis every year. The fixed costs to order more skates is P68 andthe carrying costs are P1.95 per pair. 8. What is the economic order quantity?arrow_forward

- Angel Corporation produce calculators selling for $25.99. Its unit cost is $18.95 Assuming a fixed cost of $80,960, what is the breakeven point in units?arrow_forwardGIVE PROPER EXPLANATION OF COST OF GOODS AND GROSS MARGIN. YOU MADE A SALE FOR $588,000. THE CUSTOMER PAID IN CASH. YOUR GROSS MARGIN IS 61%. WHAT IS YOUR COST OF GOODS SOLD?arrow_forwardIvanhoe's sells two products, a pepper relish with a selling price of $4.26 and a variable cost per jar of $1.84 and a blackberry marmalade with a selling price of $4.26 and a variable cost per jar of $1.74. Ivanhoe's expected sales are 860 jars of pepper relish and 1290 jars of blackberry marmalade. Fixed expenses are $7326. How many jars of blackberry marmalade will Ivanhoe's need to sell to break-even? O 886 O 1772 O 1063 O 2150arrow_forward

- An item has a 29% markup based on selling price. The markup is $400. a. Find the selling price. b. Find the cost. Round to the nearest cent. a. The selling price is $ (Round to the nearest cent as needed.) b. The cost is Sarrow_forwardHeather Hudson makes stuffed teddy bears. Recent information for her business follows: Selling price per bear Total fixed costs per month Variable cost per bear $31.50 1,729.00 18.50 Required: If she sells 289 bears next month, determine the margin of safety in units, in sales dollars, and as a percentage of sales. Note: Round your intermediate calculations to the nearest whole number and round your "Percentage of Sales" answer to 2 decimal places. (i.e. 0.1234 should be entered as 12.34%. Round your "Margin of safety (Dollars)" answer to the nearest whole number.) Margin of safety (Units) Margin of safety (Dollars) Margin of safety percentage %arrow_forwardLowes Farm Supply paid $73 for a large bag of fertilizer. Expenses are 13% of cost and the profit is 21% of cost. Round the answers to the nearest cent if necessary. 1) What is the regular selling price? 2) To help clear inventory, the fertilizer was sold at break-even during a sale. What is the break-even selling price?arrow_forward

- What is the selling price of a dining room set at Macy's? Assume actual cost is $800 and 42% markup on selling price. Note: Round your answer to the nearest cent. Selling pricearrow_forwardA jeans maker is designing a new line of jeans called Slams. Slams will sell for $315 per unit and cost $214.20 per unit in variable costs to make. Fixed costs total $66,000. (Round your answers to 2 decimal places.) 1. Compute the contribution margin per unit. Contribution margin 2. Compute the contribution margin ratio. Numerator: Denominator: 3. Compute Income if 6,200 units are produced and sold Income Contribution Margin Ratio Contribution margin ratio 0arrow_forwardA store pays $60 for a set of cookware. Overhead expense on each cookware is 6% of the selling price and the profit is 17% of the selling price. Fill in the missing values in the given merchandizing-calculation table. (Round your answers to two decimal places if needed) Profit (P) Amount ($) Expenses (E) Markup (M) $ Cost (C) Selling Price (S) $ S SA Next Question On cost Markup Rate (%) % On Selling price %arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education