ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

Hand written solutions are strictly prohibited

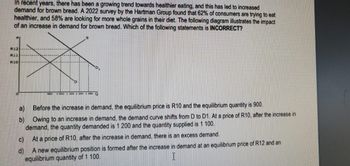

Transcribed Image Text:In recent years, there has been a growing trend towards healthier eating, and this has led to increased

demand for brown bread. A 2022 survey by the Hartman Group found that 62% of consumers are trying to eat

healthier, and 58% are looking for more whole grains in their diet. The following diagram illustrates the impact

of an increase in demand for brown bread. Which of the following statements is INCORRECT?

R12

R11

R10

a)

b)

Before the increase in demand, the equilibrium price is R10 and the equilibrium quantity is 900.

Owing to an increase in demand, the demand curve shifts from D to D1. At a price of R10, after the increase in

demand, the quantity demanded is 1 200 and the quantity supplied is 1 100.

At a price of R10, after the increase in demand, there is an excess demand.

A new equilibrium position is formed after the increase in demand at an equilibrium price of R12 and an

equilibrium quantity of 1 100.

I

1 000 1 100 1 200 300 Q

C)

d)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Question 9arrow_forwardAcquiring a supplier because it becomes more profitable Question 4 options: will raise the asking price to offset any increase in cash flow over time will increase your profits will decrease your profits will make you alter operationsarrow_forwardA particular style of sunglasses costs the retaller $90 per pair. At what price should the retaller mark them so he can sell them at a 10% discount off the original price and still make 40% profit on his cost?arrow_forward

- The state of New Jersey has in circulation (as of 2011) an instant lottery game called $1,000 Downpour. The cost of each ticket for this lottery game is $5.00. A player can instantly win $75,000, $1,000, $100, $50, $20, $10, or $5. Each ticket has 19 spots covered by latex coating, and the top four spots contain numbers that, if matched by the player's numbers, win money. The remaining 15 spots belong to the player. A player wins if any of the numbers in the player's 15 spots matches any of the four winning numbers. Number of tickets that can win Prizes 0 (i.e. not a winner) 2,853,533 621,075 10 327,600 20 58,500 50 31,200 100 5525 1,000 2561 75,000 6. Total= 3,900,000 tickets sold Find and interpret the expected outcome of this game. [Write your answer as a complete sentence]arrow_forwardDoes providing customized products generally involve less capital investment or less skilled labor, when compared to more standardized products?arrow_forwardWhich is not a fixed cost? Group of answer choices an insurance premium of $50 per year, paid last month. monthly rent of $1,000 contractually specified in a one-year lease. a worker's wage of $15 per hour. an attorney's retainer of $50,000 per year.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education