FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

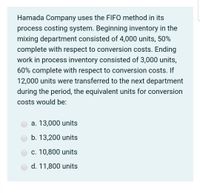

Transcribed Image Text:Hamada Company uses the FIFO method in its

process costing system. Beginning inventory in the

mixing department consisted of 4,000 units, 50%

complete with respect to conversion costs. Ending

work in process inventory consisted of 3,000 units,

60% complete with respect to conversion costs. If

12,000 units were transferred to the next department

during the period, the equivalent units for conversion

costs would be:

a. 13,000 units

b. 13,200 units

c. 10,800 units

d. 11,800 units

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Hi-Test Company uses the weighted-average method of process costing to assign production costs to its products. Information for the company’s first production process for September follows. Assume that all materials are added at the beginning of this production process, and that conversion costs are added uniformly throughout the process. Work in process inventory, September 1 (2,000 units, 100% complete with respect to direct materials, 80% complete with respect to conversion; consists of $45,000 of direct materials cost and $56,320 conversion cost) $101,320 Costs incurred in September Direct materials . $375,000 Conversion . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $341,000 Work in process inventory, September 30 (7,000 units, 100% complete with respect to direct materials, 40% complete with respect to conversion) . $ ? Units started in September . 28,000 Units completed…arrow_forwardAshvinarrow_forwardhe costs per equivalent unit of direct materials and conversion in the Filling Department of Ivy Cosmetics Company are $0.60 and $0.25, respectively. The equivalent units to be assigned costs are as follows: Equivalent Units Direct Materials Conversion Inventory in process, beginning of period 0 2,400 Started and completed during the period 62,000 62,000 Transferred out of Filling (completed) 62,000 64,400 Inventory in process, end of period 10,000 2,500 Total units to be assigned costs 72,000 66,900 The beginning work in process inventory had a cost of $4,500. Determine the cost of completed and transferred-out production and the ending work in process inventory. Completed and transferred out of production $fill in the blank 1 Inventory in process, ending $fill in the blank 2arrow_forward

- New Image Sports uses a process-costing system. For March, the company had the following activities: Beginning work-in-process inventory (1/3 complete) 6,000 units Units placed in production 24,000 units Good units completed 18,000 units Ending work-in-process inventory 10,000 units Cost of beginning work in process $ 5,000 Direct material costs, current $18,000 Conversion costs, current $13,800 Direct materials are placed into production at the beginning of the process. All spoilage is normal and is detected at the end of the process. Ending WIP is 50% completed as to conversion. Required: Prepare a production cost worksheet using the FIFO method. (Summarize the calculation of physical unit equivalent and cost that is assigned to each component of inventory)arrow_forwardCost of units transferred out and ending work in process. The costs per equivalent unit of direct materials and conversion in the Filling Department of Eve Cosmetics Company are $0.40 and $0.10, respectively. The equivalent units to be assigned costs are as follows: EquivalentUnits Direct Materials Conversion Inventory in process, beginning of period 0 1,600 Started and completed during the period 42,000 42,000 Transferred out of Filling (completed) 42,000 43,600 Inventory in process, end of period 8,000 2,000 Total units to be assigned costs 50,000 45,600 The beginning work in process inventory had a cost of $l,800. Determine the cost of completed and transferred-out production and the ending work in process inventory.arrow_forward(Refer to Fox Corp.) Assume that FIFO process costing is utilized. What is the cost per equivalent unit for conversion?arrow_forward

- ANS.arrow_forwardThe Bottling Department of Mountain Springs Water Company had 5,300 liters in beginning work in process inventory (20% complete). During the period, 58,100 liters were completed. The ending work in process inventory was 3,200 liters (60% complete). All inventories are costed by the first-in, first-out method. What are the equivalent units for conversion costs under the FIFO method? equivalent units All work saved. 1 Previous Next > Submit Test for Grading Darrow_forwardThe Bottling Department of Mountain Springs Water Company had 4,100 liters in beginning work in process that were 30% complete. During the period, 56,800 liters were completed. The ending work in process inventory had 2,800 liters that were 60% complete. Assume that Mountain Springs uses the FIFO cost flow method and that materials are added at the beginning of the process. What are the conversion equivalent units of production for the period?arrow_forward

- Cost of Units Transferred Out and Ending Work in Process The costs per equivalent unit of direct materials and conversion in the Filling Department of Ivy Cosmetics Company are $2.10 and $0.45, respectively. The equivalent units to be assigned costs are as follows: Equivalent Units Direct Materials Conversion Inventory in process, beginning of period 0 2,200 Started and completed during the period 43,000 43,000 Transferred out of Filling (completed) 43,000 45,200 Inventory in process, end of period 4,000 1,200 Total units to be assigned costs 47,000 46,400 The beginning work in process inventory had a cost of $1,500. Determine the cost of completed and transferred-out production and the ending work in process inventory. If required, round to the nearest dollar. Completed and transferred out of production $fill in the blank 1 Inventory in process, ending $fill in the blank 2arrow_forwardParks Company uses the weighted-average method in its process costing system. At the start of the year, the company had 5,000 units in process in Department A that were 60% complete with respect to conversion costs. At the end of the year, 6,500 units were in process, 40% complete with respect to conversion costs. During the year, 30,000 units were completed and transferred on to the next department. The equivalent units for conversion costs would be: Select one: O a. 32,600 units O b. 29,600 units O c. 33,000 units O d. 30,000 unitsarrow_forwardDengararrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education