FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Transcribed Image Text:Halifax Manufacturing allows its customers to return merchandise for any reason up to 90 days after delivery and receive a credit to

their accounts. All of Halifax's sales are for credit (no cash is collected at the time of sale). The company began 2024 with a refund

llability of $390,000. During 2024, Halifax sold merchandise on account for $12,400,000. Halifax's merchandise costs are 65% of

merchandise selling price. Also during the year, customers returned $368,000 in sales for credit, with $203,000 of those being returns

of merchandise sold prior to 2024, and the rest being merchandise sold during 2024. Sales returns, estimated to be 3% of sales, are

recorded as an adjusting entry at the end of the year.

Required:

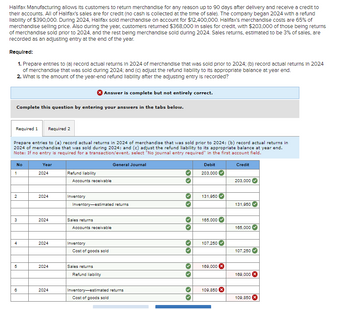

1. Prepare entries to (a) record actual returns in 2024 of merchandise that was sold prior to 2024; (b) record actual returns in 2024

of merchandise that was sold during 2024; and (c) adjust the refund liability to its appropriate balance at year end.

2. What is the amount of the year-end refund liability after the adjusting entry is recorded?

Complete this question by entering your answers in the tabs below.

Required 1 Required 2

Prepare entries to (a) record actual returns in 2024 of merchandise that was sold prior to 2024; (b) record actual returns in

2024 of merchandise that was sold during 2024; and (c) adjust the refund liability to its appropriate balance at year end.

Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field.

Credit

No

1

2

3

4

5

6

Year

2024

2024

2024

2024

2024

2024

Refund liability

Accounts receivable

Inventory

Answer is complete but not entirely correct.

Sales returns

Inventory-estimated returns

Accounts receivable

Inventory

Cost of goods sold

Sales returns

Refund liability

General Journal

Inventory-estimated returns

Cost of goods sold

>>

Debit

203,000

131,950

165,000

107,250

169,000 X

109,850

203,000

131,950

165,000

107,250

169,000 X

109,850

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Giorgio Italian Market bought $5,000 worth of merchandise from Food Suppliers and signed a 90-day, 10% promissory note for the $5,000. Food Supplier's journal entry to record the collection on the maturity date is: (Use 360 days a year.)arrow_forwardCornProducts Corporation ended the year 2018 with an average collection period of 40 days. The firm's credit sales for 2018 were $9 million. What is the approximate year-end 2018 balance in accounts receivable for Corn Products?arrow_forwardalifax Manufacturing allows its customers to return merchandise for any reason up to 90 days after delivery and receive a credit to their accounts. All of Halifax's sales are for credit (no cash is collected at the time of sale). The company began 2024 with a refund liability of $470,000. During 2024, Halifax sold merchandise on account for $13,200,000. Halifax's merchandise costs are 60% of merchandise selling price. Also during the year, customers returned $524,000 in sales for credit, with $289,000 of those being returns of merchandise sold prior to 2024, and the rest being merchandise sold during 2024. Sales returns, estimated to be 4% of sales, are recorded as an adjusting entry at the end of the year. Required: Prepare entries to (a) record actual returns in 2024 of merchandise that was sold prior to 2024; (b) record actual returns in 2024 of merchandise that was sold during 2024; and (c) adjust the refund liability to its appropriate balance at year end. What is the amount of…arrow_forward

- Halifax Manufacturing allows its customers to return merchandise for any reason up to 90 days after delivery and receive a credit to their accounts. All of Halifax's sales are for credit (no cash is collected at the time of sale). The company began 2021 with a refund liability of $340,000. During 2021, Halifax sold merchandise on account for $11,600,000. Halifax's merchandise costs it 75% of merchandise selling price. Also during the year, customers returned $575,000 in sales for credit, with $319,000 of those being returns of merchandise sold prior to 2021, and the rest being merchandise sold during 2021. Sales returns, estimated to be 5% of sales, are recorded as an adjusting entry at the end of the year. Required: 1. Prepare entries to (a) record actual returns in 2021 of merchandise that was sold prior to 2021; (b) record actual returns in 2021 of merchandise that was sold during 2021; and (c) adjust the refund liability to its appropriate balance at year end.2. What is the amount…arrow_forwardLibscomb Technologies' annual sales are $5,024,963 and all sales are made on credit, it purchases $3,844,500 of materials each year (and this is its cost of goods sold). Libscomb also has $547,231 of inventory, $532,629 of accounts receivable, and beginning and ending of year $421,009 and $481,435 accounts payables (respectively). Assume a 365 day year. What is Libscomb’s Cash Cycle (in days)?arrow_forwardInstructions in the picturearrow_forward

- Evergreen Company sells lawn and garden products to wholesalers. The company's fiscal year-end is December 31. During 2021, the following transactions related to receivables occurred: Feb. 28 Sold merchandise to Lennox, Inc., for $20,000 and accepted a 6%, 7-month note. 6% is an appropriate rate for this type of note. Mar. 31 Sold merchandise to Maddox Co. that had a fair value of $15,040, and accepted a noninterest-bearing note for which $16,000 payment is due on March 31, 2022. Apr. 3 Sold merchandise to Carr Co. for $14,000 with terms 2/10, n/30. Evergreen uses the gross method to account for cash discounts. 11 Collected the entire amount due from Carr Co. 17 A customer returned merchandise costing $4,800. Evergreen reduced the customer’s receivable balance by $6,600, the sales price of the merchandise. Sales returns are recorded by the company as they occur. 30 Transferred receivables of $66,000 to a factor without recourse. The…arrow_forwardListed below are selected transactions of Ben’s HomeGoods Store for the current year ending December 31, 2022. a) During December, credit card sales totaled $675,000, which includes the 8% sales tax that must be remitted to the state by the fifteenth day of the following month. (At time of sale, the total amount is recorded in Sales.) b) On December 1, the store received $5,000 from the local community theater for the rental of certain furniture to be used in a stage production during December and January. The furniture will be returned on February 1. c) On December 31 the store was notified it will be required to restore the area (considered a land improvement) surrounding one of its parking lots, when the store moves in 5 years. Ben determined it will cost $78,000 in 2027. Ben estimates the fair value of the asset retirement obligation on December 31, 2022 is $61,500. Prepare the necessary journal entries necessary to record the above transactions as they occurred and any adjusting…arrow_forwardDouglas Corporation reports it sold merchandise on account for a total of $800,000 for the current year. The cost to Douglas for the merchandise was $300,000. To encourage early payment, Douglas offers its customers credit terms of 1/10, n/30. At year-end, there is $150,000 of sales on account still eligible for the 1 percent discount. Douglas believes that all customers will pay within the discount period to receive the discount. Prepare the adjusting journal entry needed for Douglas Corporation to comply with the new revenue recognition standard. Assume Douglas’s fiscal year-end is December 31.arrow_forward

- A business sells $100,000 of products to a customer on account and collects 6% sales tax. Cost of the merchandise sold was $70,000. At the end of the month, the company pays the total sales tax collected ($185,000) to the state department of revenue. Required: Record the entries for (a) 'the sale' and for (b) 'the payment of the sales tax.' Indicate Dr. or Cr. in front of each account.arrow_forwardHalifax Manufacturing allows its customers to return merchandise for any reason up to 90 days after delivery and receive a credit to their accounts. All of Halifax's sales are for credit (no cash is collected at the time of sale). The company began 2021 with a refund liability of $390,000. During 2021, Halifax sold merchandise on account for $12,400,000. Halifax's merchandise costs it 65% of merchandise selling price. Also during the year, customers returned $368,000 in sales for credit, with $203,000 of those being returns of merchandise sold prior to 2021, and the rest being merchandise sold during 2021. Sales returns, estimated to be 3% of sales, are recorded as an adjusting entry at the end of the year. a) Record the year-end adjusting entry for estimated returns. b) Record the adjusting entry for the estimated return of merchandise to inventory. c) What is the amount of the year-end refund liability after the adjusting entry is recorded?arrow_forwardSentry Transport Inc. of Atlanta provides in-town parcel delivery services in addition to a fullrange of passenger services. Sentry engaged in the following activities during the current year:a. Sentry received $5,000 cash in advance from Rich’s Department Store for an estimated 250deliveries during December 2019 and January and February of 2020. The entire amountwas recorded as unearned revenue when received. During December 2019, 110 deliverieswere made for Rich’s.b. Sentry operates several small buses that take commuters from suburban communities to thecentral downtown area of Atlanta. The commuters purchase, in advance, tickets for 50 onewayrides. Each 50-ride ticket costs $500. At the time of purchase, Sentry credits the cashreceived to unearned revenue. At year end, Sentry determines that 10,160 one-way rideshave been taken.c. Sentry operates several buses that provide transportation for the clients of a social service agencyin Atlanta. Sentry bills the agency quarterly at the…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education