FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

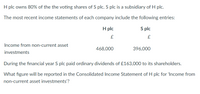

Transcribed Image Text:H plc owns 80% of the the voting shares of S plc. S plc is a subsidiary of H plc.

The most recent income statements of each company include the following entries:

H plc

S plc

£

£

Income from non-current asset

468,000

396,000

investments

During the financial year S plc paid ordinary dividends of £163,000 to its shareholders.

What figure will be reported in the Consolidated Income Statement of H plc for 'Income from

non-current asset investments'?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- .Miner Ltd acquired 75% of the share capital of Iver Ltd (Iver) for £1.2m three years ago, when Iver 's net assets were £1.4m. As at 31 August 2020, Iver has net assets of £1.75m.What figures would be included in the consolidated Statement of FinancialPosition as at 31 August 2020 for the Miner Group to reflect the ownership of Iver Ltd?a) Goodwill £200,000Non-controlling interest £1,312,500b) Goodwill £150,000Non-controlling interest £437,500c) Goodwill £150,000Non-controlling interest £1,312,500d) Goodwill £200,000Non-controlling interest £437,500 Show workingarrow_forwardAs at 31 December 20x8, A Ltd's net assets are represented by share capital of $500 million and retained profit of $500 million, B Ltd's net assets are represented by share capital of $200 million and retained profit of $500 million, and C Ltd's net assets are represented by share capital of $100 million and retained profit of $300 million. B Ltd acquired 70% of C Ltd in 20x5 when C Ltd's retained profit was $200 million. A Ltd acquired 80% of B Ltd in 20x6 when B Ltd's retained profit was $400 million and C Ltd's retained profit was $250 million. The amount of "non-controlling interest” in A Ltd's consolidated statement of financial position as at 31 December 20x8 should be: $260 million. $274 million. $270 million. None of the listed choices. $267 million.arrow_forwardOn 1/1/2022, P Co acquired 90% of S Co stock at an amount equal to its book value.Selected balance sheet data at 1/1/ 2022, are as follows: P CO S Co Total Assets 180,000 Liabilities 60,000 Common Stock 50,000 Select one: Retained Earnings 200,000 70,000 O 420,000 In the 1/1/2022, consolidated balance sheet, what amount should be reported as non-controlling interest in net assets? a. 12,000 b. 10,500 120,000 c. 0 d. 30,000 100,000arrow_forward

- Meldrum Pty Limited (a private company) had the following transactions in relation to its franking account: DateDetailsAmount1 July 2018Opening balance$2,0006 Sept 2018Received a fully franked dividend from BHP Limited$49,0007 Sept 2018Paid Goods and Service Tax$25,0009 Sept 2018Paid a dividend franked to 50%$56,0002 Oct 2018Paid income tax instalment$6,00011 Nov 2018Received a refund of income tax$49,0007 Feb 2019Paid income tax instalment$5,00014 Mar 2019Paid a dividend fully franked$56,0008 April 2019Paid income tax instalment$6,0003 May 2019Paid fringe benefits tax$50,00015 June 2019Paid a dividend 30% franked$42,000Required: (a)What is the closing balance of the franking account on 30 June 2019? (b)What are the consequences of the closing balance of the franking account? (c)What other tax consequences are there for Meldrum Pty Ltd? 3 / 3 125%arrow_forwardComputing consolidated earnings per share (EPS) Assume the following facts about a parent and its 75% owned subsidiary company: Parent Net income Common shares outstanding Convertible preferred stock Convertible bonds $180,000 50,000 Dividends = $17,100 Convertible into 9,000 shares of common stock a. Compute basic earnings per share $ b. Compute diluted earnings per share LA Subsidiary $45,000 22,000 (16,500 = 75% owned by parent) Interest expense after tax = $7,200 Convertible into 4,500 shares of common stockarrow_forwardREQUIRED: Prepare consolidated balance sheet workpapers for Per Corporation and Subsidiary for December 31, 2011.arrow_forward

- A owns 80% of B & 40% of C, purchased when B's reserve was £6,000, & C's £1,000. B's net assets at acquisition were £25,000. Balance Sheets at 31-Dec-21 Investment in B Investment in C Other Net Assets ₤1NV Shares Reserves Profit/Loss Required: For the ABC group at Ye-Dec-21 prepare a) Group Balance Sheet, A Ltd B Ltd C Ltd 24,000 13,000 34,000 29,000 16,000 71,000 29,000 16,000 40,000 15,000 10,000 25,000 10,000 4,000 6,000 4,000 2,000 71,000 29,000 16,000 b) Group Income Statement, and c) Explain subsidiary and associate accounting treatments in group accounting. For group and parent interests calculate d) Return on Equity, and e) Earnings per Sharearrow_forwardComputing consolidated earnings per share (EPS) Assume the following facts about a parent and its 75% owned subsidiary company: Net income $210,000 Common shares outstanding 50,000 Convertible preferred stock Dividends $20,100 Convertible into 9,000 shares of common stock Convertible bonds a. Compute basic earnings per share $ Parent b. Compute diluted earnings per share Subsidiary $49,000 28,000 (21,000 = 75% owned by parent) Interest expense after tax = $7,100Convertible Into 6,000 shares of common stockarrow_forwardCompute for the non-controlling interest in Net Incomearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education