Practical Management Science

6th Edition

ISBN: 9781337406659

Author: WINSTON, Wayne L.

Publisher: Cengage,

expand_more

expand_more

format_list_bulleted

Question

please provide a visual illustration of question b

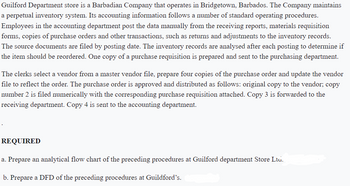

Transcribed Image Text:Guilford Department store is a Barbadian Company that operates in Bridgetown, Barbados. The Company maintains

a perpetual inventory system. Its accounting information follows a number of standard operating procedures.

Employees in the accounting department post the data manually from the receiving reports, materials requisition

forms, copies of purchase orders and other transactions, such as returns and adjustments to the inventory records.

The source documents are filed by posting date. The inventory records are analysed after each posting to determine if

the item should be reordered. One copy of a purchase requisition is prepared and sent to the purchasing department.

The clerks select a vendor from a master vendor file, prepare four copies of the purchase order and update the vendor

file to reflect the order. The purchase order is approved and distributed as follows: original copy to the vendor; copy

number 2 is filed numerically with the corresponding purchase requisition attached. Copy 3 is forwarded to the

receiving department. Copy 4 is sent to the accounting department.

REQUIRED

a. Prepare an analytical flow chart of the preceding procedures at Guilford department Store Ltd.

b. Prepare a DFD of the preceding procedures at Guildford's.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

- Guilford Department store is a Barbadian Company that operates in Bridgetown, Barbados. The Company maintains a perpetual inventory system. Its accounting information follows a number of standard operating procedures. Employees in the accounting department post the data manually from the receiving reports, materials requisition forms, copies of purchase orders and other transactions, such as returns and adjustments to the inventory records. The source documents are filed by posting date. The inventory records are analysed after each posting to determine if the item should be reordered. One copy of a purchase requisition is prepared and sent to the purchasing department. The clerks select a vendor from a master vendor file, prepare four copies of the purchase order and update the vendor file to reflect the order. The purchase order is approved and distributed as follows: original copy to the vendor; copy number 2 is filed numerically with the corresponding purchase requisition attached.…arrow_forwardPerpetual Inventory Using LIFO Beginning inventory, purchases, and sales data for DVD players are as follows: November 1 Inventory 79 units at $63 10 Sale 63 units 15 Purchase 102 units at $67 20 Sale 57 units 24 Sale 14 units 30 Purchase 21 units at $70 The business maintains a perpetual inventory system, costing by the last-in, first-out method. Determine the cost of merchandise sold for each sale and the inventory balance after each sale, presenting the data in the form illustrated in Exhibit 4. Under LIFO, if units are in inventory at two different costs, enter the units with the HIGHER unit cost first in the Cost of Goods Sold Unit Cost column and LOWER unit cost first in the Inventory Unit Cost column. Schedule of Cost of Goods Sold LIFO Method DVD Players Quantity Date Purchased Purchases Unit Cost Purchases Total Cost Quantity Sold Cost of Goods Cost of Goods Sold Unit Cost Sold Total Cost Inventory Quantity Inventory Unit Cost Inventory Total Cost Nov. 1 Nov. 10 Nov. 000…arrow_forwardA clothing manufacturing company requires raw materials for 8 consecutive weeks as follows: 30, 40, 50, 35, 60, 30, 40, and 30 units with a one-time order cost of $50,000 and a storage fee of $500 per unit/week. From these data calculate the total cost of procurement using:a. Lot For Lot (LFL) Methodb. Economic Order Quantity (EOQ) Methodc. Period Order Quantity (POQ) Method Using this table format: Week 1 2 3 4 5 6 7 8 Gross requirements Schedule receipts Projected on hand Net requirements Planned order receipts Planned order releasesarrow_forward

- A clothing manufacturing company requires raw materials for 8 consecutive weeks as follows: 30, 40, 50, 35, 60, 30, 40, and 30 units with a one-time order cost of $50,000 and a storage fee of $500 per unit/week. From these data calculate the total cost of procurement using:a. Lot For Lot (LFL) Methodb. Economic Order Quantity (EOQ) Methodc. Period Order Quantity (POQ) Methodd. In your opinion as an operations manager at the company which method would you choose? Explain, why?arrow_forwardInventory information for Part 9000 of Norton Corp. discloses the following information for the month of June: 500 units @ June 200 units @ June 1 Balance Sold $20 10 $30 June Purchased 11 400 units @ $22 June 300 units @ Sold 15 $35 a) Assuming that the PERPETUALinventory method is used, compute the cost of goods sold AND ending inventoryunder LIFO. Show your calculation? b) Assuming that the PERIODICinventory method is used, compute the cost of goods sold AND ending inventory.under LIFO. Show your calculation? c) Compute the cost of goods sold AND ending inventoryunder FIFO. Show your calculation? d) Compute the cost of goods sold AND ending inventory under the weighted-average method. Show your calculation? Edit View Insert Format Tools Tablearrow_forwardAlgro Inc. keeps a wide range of parts and materials on hand for use in its production processes. Management has recently had difficulty managing parts inventory as demand for its finished goods has increased; they frequently run out of some critical parts while having an endless supply of others. They would like to classify their parts inventory according to the ABC approach to better control inventory. The following is a list of parts, along with their annual usage and unit value: Item Annual Unit Item Annual Unit Number Usage Cost Number Usage Cost 1 36 $350 2 510 30 3 50 23 4 300 45 5 18 1900 6 500 8 7 710 4 8 80 26 9 344 28 10 67 440 11 510 2 12 682 35 13 1216 95 50 14 10 3 15 820 1 KARAN2222222222 16 60 $610 17 120 20 18 270 15 19 45 50 20 19 3200 21 910 3 12 4750 23 30 2710 24 24 1800 25 870 105 26 244 30 27 750 15 28 45 110 29 46 160 30 165 25 a. Classify the inventory items according to the ABC approach using the dollar value of annual demand. b. Clearly explain why you…arrow_forward

- please answer in details within 30 minutes.arrow_forwardDescribe the key principles of the Wilson approach in inventory management.arrow_forward2. The following table contains figures on the monthly volume and unit costs for a random sampla et 16 items from a list of 2,000 inventory items at a health care facility: Unit Cost Usage Item Unit Cost Usage Item K34 $10 200 F99 20 60 К35 25 600 D45 10 550 K36 36 150 D48 12 M10 16 25 D52 15 110 M20 20 80 D57 40 120 Z45 80 200 N08 30 40 F14 20 300 P05 16 500 F95 30 800 P09 10 30 a. Develop an A-B-C classification for these items.arrow_forward

- Ram Roy's firm has developed the following supply, demand, cost, and inventory data Period 1 2 3 Regular Time 30 30 40 Supply Available Overtime Subcontract 5 15 15 15 5 5 Demand Forecast 40 20 units $100 $150 $200 $6 45 55 Initial inventory Regular-time cost per unit Overtime cost per unit Subcontract cost per unit Carrying cost per unit per month Assume that the initial inventory has no holding cost in the first period and backorders are not permitted Allocating production capacity to meet demand at a minimum cost using the transportation method, the total cost is $ (enter your response as a whole number)arrow_forwardBecky Shelton, a teacher at kemp middle school is in charge of ordering the T-shirts to be sold for the school's annual fund-raising project the t-shirts are printed with a special kemp school logo. In some years the supply of T-shirts has been insufficient to satisfy the number of sales orders. In other years, T-shirts have been left over. excess T-shirts are normally donated to some charitable organization. T-shirts cost the school $7 each and are normally sold for $14 each. Ms Shelton has decided to order 790 shirts. Required 1) if the school receives actual sales orders for 715 shirts, what amount of profit will the school earn?what is the cost of waste due to excess inventory? 2) If the school receives actual sales orders for 830 shits, what amount of profit will the school earn? What amount of opportunity cost will the school incur? a) Profit $1,050 waste due to excess inventory b) Profit opportunity costarrow_forwardThe Frist Corporation has the followinginternal controls related to inventory:1. Only authorized inventory warehousing personnel are allowed in inventory storageareas.2. All inventory products are stored in warehousing areas that are segregated fromother storage areas used to house equipment and supplies.3. All inventory held on consignment at Frist Corporation is stored in a separatearea of the warehouse.4. The inventory purchasing system only allows purchases from pre-approved vendors.5. The perpetual inventory system tracks the average number of days each inventoryproduct number has been in the warehouse.6. Microchips are embedded in each product and when inventory items are removedfrom the warehouse to shipping, radio-frequencies signal a deduction of inventoryto the perpetual inventory system.7. On a weekly basis, inventory accounting personnel take samples of inventoryproducts selected from the perpetual inventory system and verify that the inventoryis on-hand in the warehouse…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Practical Management ScienceOperations ManagementISBN:9781337406659Author:WINSTON, Wayne L.Publisher:Cengage,

Practical Management ScienceOperations ManagementISBN:9781337406659Author:WINSTON, Wayne L.Publisher:Cengage, Operations ManagementOperations ManagementISBN:9781259667473Author:William J StevensonPublisher:McGraw-Hill Education

Operations ManagementOperations ManagementISBN:9781259667473Author:William J StevensonPublisher:McGraw-Hill Education Operations and Supply Chain Management (Mcgraw-hi...Operations ManagementISBN:9781259666100Author:F. Robert Jacobs, Richard B ChasePublisher:McGraw-Hill Education

Operations and Supply Chain Management (Mcgraw-hi...Operations ManagementISBN:9781259666100Author:F. Robert Jacobs, Richard B ChasePublisher:McGraw-Hill Education

Purchasing and Supply Chain ManagementOperations ManagementISBN:9781285869681Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. PattersonPublisher:Cengage Learning

Purchasing and Supply Chain ManagementOperations ManagementISBN:9781285869681Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. PattersonPublisher:Cengage Learning Production and Operations Analysis, Seventh Editi...Operations ManagementISBN:9781478623069Author:Steven Nahmias, Tava Lennon OlsenPublisher:Waveland Press, Inc.

Production and Operations Analysis, Seventh Editi...Operations ManagementISBN:9781478623069Author:Steven Nahmias, Tava Lennon OlsenPublisher:Waveland Press, Inc.

Practical Management Science

Operations Management

ISBN:9781337406659

Author:WINSTON, Wayne L.

Publisher:Cengage,

Operations Management

Operations Management

ISBN:9781259667473

Author:William J Stevenson

Publisher:McGraw-Hill Education

Operations and Supply Chain Management (Mcgraw-hi...

Operations Management

ISBN:9781259666100

Author:F. Robert Jacobs, Richard B Chase

Publisher:McGraw-Hill Education

Purchasing and Supply Chain Management

Operations Management

ISBN:9781285869681

Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. Patterson

Publisher:Cengage Learning

Production and Operations Analysis, Seventh Editi...

Operations Management

ISBN:9781478623069

Author:Steven Nahmias, Tava Lennon Olsen

Publisher:Waveland Press, Inc.