FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

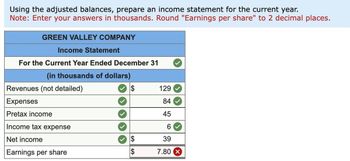

Can someone please help me figure out JUST the EARNINGS PER SHARE part that I keep getting wrong(in red) please, thank you!

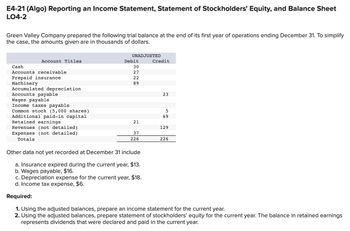

Transcribed Image Text:E4-21 (Algo) Reporting an Income Statement, Statement of Stockholders' Equity, and Balance Sheet

LO4-2

Green Valley Company prepared the following trial balance at the end of its first year of operations ending December 31. To simplify

the case, the amounts given are in thousands of dollars.

Account Titles

Cash

Accounts receivable

Prepaid insurance

Machinery

Accumulated depreciation

Accounts payable

Wages payable

Income taxes payable

Common stock (5,000 shares)

Additional paid-in capital

Retained earnings

Revenues (not detailed)

Expenses (not detailed)

Totals

UNADJUSTED

Debit

30

27

22

89

21

37

226

Other data not yet recorded at December 31 include

a. Insurance expired during the current year, $13.

b. Wages payable, $16.

c. Depreciation expense for the current year, $18.

d. Income tax expense, $6.

Credit

23

5

69

129

226

Required:

1. Using the adjusted balances, prepare an income statement for the current year.

2. Using the adjusted balances, prepare statement of stockholders' equity for the current year. The balance in retained earnings

represents dividends that were declared and paid in the current year.

Transcribed Image Text:Using the adjusted balances, prepare an income statement for the current year.

Note: Enter your answers in thousands. Round "Earnings per share" to 2 decimal places.

GREEN VALLEY COMPANY

Income Statement

For the Current Year Ended December 31

(in thousands of dollars)

Revenues (not detailed)

Expenses

Pretax income

Income tax expense

Net income

Earnings per share

$

$

$

129

84

45

6

39

7.80

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- T/F Person A works for Global Payments Inc. They will take a portion of their pay check to buy Global Payments Stock every pay period. This is an example of Gain sharing.arrow_forwardReview the scripture below. Does God's word here have relevance to the concepts being studied in Managerial Accounting, or do spiritual and business concepts just not mix? Please share your ideas and give examples. Feel free to cite other sources. Luke 14:28-30 in the Bible reads: “But don’t begin until you count the cost. For who would begin construction of a building without first calculating the cost to see if there is enough money to finish it? Otherwise, you might complete only the foundation before running out of money, and then everyone would laugh at you. They would say, ‘There’s the person who started that building and couldn’t afford to finish it!’" Explain the meaning of (a) differential revenue, (b) differential cost, and (c) differential income. A company is offered incremental business at a special price that exceeds the variable cost. What other issues must the company consider in deciding whether to accept the business? Although the cost-plus approach to product…arrow_forwardDiscuss at least 2 ways that you can help protect our environment while generating profit for the company.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education