FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Note:-

- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism.

- Answer completely.

- You will get up vote for sure.

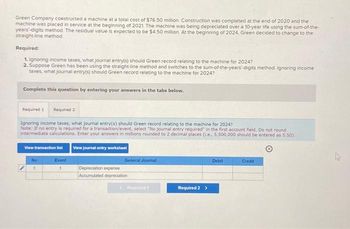

Transcribed Image Text:Green Company constructed a machine at a total cost of $76.50 million. Construction was completed at the end of 2020 and the

machine was placed in service at the beginning of 2021. The machine was being depreciated over a 10-year life using the sum-of-the-

years'-digits method. The residual value is expected to be $4 50 million. At the beginning of 2024, Green decided to change to the

straight-line method.

Required:

1. Ignoring income taxes, what journal entry(s) should Green record relating to the machine for 2024?

2. Suppose Green has been using the straight-line method and switches to the sum-of-the-years-digits method. Ignoring income

taxes, what journal entry(s) should Green record relating to the machine for 2024?

Complete this question by entering your answers in the tabs below.

Required 1 Required 2

Ignoring income taxes, what journal entry(s) should Green record relating to the machine for 2024?

Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Do not round

intermediate calculations. Enter your answers in millions rounded to 2 decimal places (i.e., 5,500,000 should be entered as 5.50).

View transaction list

View journal entry worksheet

No

Event

General Journal

Depreciation expense

Accumulated depreciation

Required 1

Required 2 >

Debit

Credit

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- David Savage asked you to write a memo presenting the issues and the risks associated withconsultants. Further, outline a set of procedures that could be used as a guide in selecting aconsultant.arrow_forwardWhich of the following statements about ethical choices and dilemmas are true, according to the text? MARK ALL THAT APPLY An ethical dilemma is defined as a situation where two or more "right" values are in conflict. Ethics can be defined in terms of individual and/or group principles, norms, and standards of conduct. Ethical choices can be considered highly personal and relative. All ethical choices are clear-cut enough that we can decide what to do rather easily because they pit "right" against "wrong." Ethical dilemmas represent conflicts in values.arrow_forwardThe legal environment has little impact on human resource management decision making. Question 22 options: True Falsearrow_forward

- Assume that you accept the following ethical rule: “Failure to tell the whole truth is wrong.” In the textbook illustration about Santos’s problem with Ellis’s instructions, (a) what would this rule require Santosto do and (b) why is an unalterable rule such as this classified as an element of imperative ethical theory?arrow_forwarddiscuss how critical thinking skills will make you less likely to be influenced by arguments that are based on fallacies and faulty reasoning.arrow_forwardProvide best Answer As per posible fastarrow_forward

- Critically evaluate how the breach of ethics by auditors could contribute to expand the audit expectation gap. Your report should include/address the following concerns: 1. Introduce/analyze ethical aspect of auditors and audit expectation gap. 2. Critically examine how different threats to ethics enlarge the audit expectation gap. 3. Propose ways to minimize the threats to ethics and thus the expectation gap of audits. 4. Determine the current developments and future direction of ethical aspects of auditors, and explain how such developments contribute to safeguard the audit profession as a concluding remarks. Include a cover page, an executive summary, a table of contents and references. You may include an appendix if necessary.arrow_forwardKaren finds that many claim forms were rejected because important information was omitted. How might Karen suggest corrections for these omissions?arrow_forwardWhat is risk of incorrect acceptance? A. The risk that the auditor concludes that a material misstatement exists when it does not exist. B. The risk that the auditor concludes that a material misstatement does not exist when it actually does not. C. The risk that the auditor concludes that a material misstatement does not exist when it does exist. D. The risk that the auditor concludes that a material misstatement exists when it actually does.arrow_forward

- Urgent Please answer a soon as possible. Answer must be plagirism free What is the role of auditors and explain the importance of the role.arrow_forward1. Choose the ethical considerations that Amahle Khumalo should recognize in deciding how to proceed. Note: You may select more than one answer. Single click the box with the question mark to produce a check mark for a correct answer and double click the box with the question mark to empty the box for a wrong answer. Any boxes left with a question mark will be automatically graded as incorrect. Check my work is not available. Khumalo should exercise initiative and good judgment in providing management with information having a potentially adverse economic impact Khumalo should determine whether the controller's request violates her professional or personal standards or the company's code of ethics. ? Khumalo should protect proprietary information and should not violate the chain of command by discussing this matter with the controller's superiors ?Khumalo should not try to convince the controller regarding the probable failure of reworks.arrow_forwardMatch each of the components of faithful representation with its definition.Faithful Representation Definition1 . Freedom from error a. All information necessary to describe an item is reported. 2. Neutrality b. Information that does not bias the decision maker. 3. Completeness c. Reported amounts reflect the best available information.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education