FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Answer problems 2-18 and 2-19.

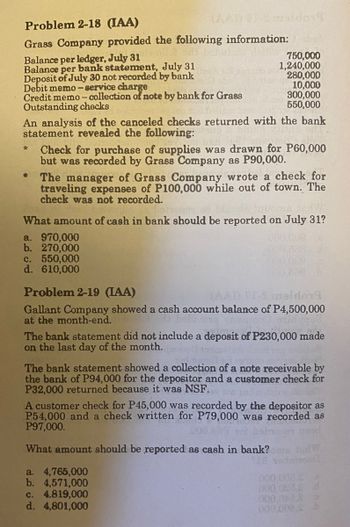

Transcribed Image Text:Problem 2-18 (IAA)

Grass Company provided the following information:

Balance per ledger, July 31

Balance per bank statement, July 31

Deposit of July 30 not recorded by bank

Debit memo-service charge

(AA) 1-sidor

Credit memo-collection of note by bank for Grass

Outstanding checks

*

750,000

1,240,000

280,000

An analysis of the canceled checks returned with the bank

statement revealed the following:

10,000

300,000

550,000

Check for purchase of supplies was drawn for P60,000

but was recorded by Grass Company as P90,000.

a. 970,000

b. 270,000

c. 550,000

d. 610,000

The manager of Grass Company wrote a check for

traveling expenses of P100,000 while out of town. The

check was not recorded.

Tariego

What amount of cash in bank should be reported on July 31?

Problem 2-19 (IAA)

AD FT-Smaldor

Gallant Company showed a cash account balance of P4,500,000

at the month-end.

The bank statement did not include a deposit of P230,000 made

on the last day of the month.

The bank statement showed a collection of a note receivable by

the bank of P94,000 for the depositor and a customer check for

P32,000 returned because it was NSF.on tudottw.

A customer check for P45,000 was recorded by the depositor as

P54,000 and a check written for P79,000 was recorded as

P97,000.

What amount should be reported as cash in bank?

a. 4,765,000

b. 4,571,000

c. 4.819,000

d. 4,801,000

000,000 &#

000,045

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education