FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

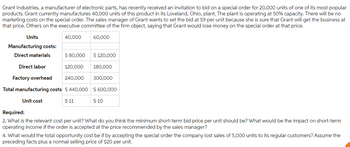

Transcribed Image Text:Grant Industries, a manufacturer of electronic parts, has recently received an invitation to bid on a special order for 20,000 units of one of its most popular

products. Grant currently manufactures 40,000 units of this product in its Loveland, Ohio, plant. The plant is operating at 50% capacity. There will be no

marketing costs on the special order. The sales manager of Grant wants to set the bid at $9 per unit because she is sure that Grant will get the business at

that price. Others on the executive committee of the firm object, saying that Grant would lose money on the special order at that price.

Units

40,000

Manufacturing costs:

Direct materials

$ 80,000

Direct labor

Factory overhead 240,000

Total manufacturing costs $ 440,000

$ 11

Unit cost

60,000

$ 120,000

120,000 180,000

300,000

$ 600,000

$ 10

Required:

2. What is the relevant cost per unit? What do you think the minimum short-term bid price per unit should be? What would be the impact on short-term

operating income if the order is accepted at the price recommended by the sales manager?

4. What would the total opportunity cost be if by accepting the special order the company lost sales of 5,000 units to its regular customers? Assume the

preceding facts plus a normal selling price of $20 per unit.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Similar questions

- Grant Industries, a manufacturer of electronic parts, has recently received an invitation to bid on a special order for 20,500 units of one of its most popular products. Grant currently manufactures 41,000 units of this product in its Loveland, Ohio, plant. The plant is operating at 50% capacity. There will be no marketing costs on the special order. The sales manager of Grant wants to set the bid at $15 because she is sure that Grant will get the business at that price. Others on the executive committee of the firm object, saying that Grant would lose money on the special order at that price. Units Manufacturing costs: Direct materials Direct labor Factory overhead 41,000 61,500 $ 164,000 205,000 328,000 $ 246,000 307,500 430,500 $ 984,000 Total manufacturing costs $ 697,000 $ 17 Unit cost $ 16 Required: 2. What is the relevant cost per unit? What do you think the minimum short-term bid price per unit should be? What would be the impact on short-term operating income if the order is…arrow_forwardCassandra Boat Builders builds and sells powerboats with a hull constructed primarily of teak wood. The boat building season is during Spring and Summer. The company begins building each boat only after a firm commitment was made by a specific buyer. Since the price of teak wood tends to fluctuate, Cassandra purchases several future contracts with different due dates during the building season to hedge the risk of fluctuating wood prices. During the 20X1 boat building season, the price of teak wood increased and reduced the Company's gross margin by $250,000. However, due to the increases in the teak wood prices, Cassandra realized a $240,00 gain on the related future contracts. Cassandra designates the futures as a cash flow hedge of an anticipated transaction. Which of the following entries (presented in summary format) should Cassandra Boat Builders make to recognize the gain from the future contracts? Multiple Choice Future contract 240,000 Gain on future…arrow_forwardThe Shirt Works sells a large variety of tee shirts and sweatshirts. Steve Hooper, the owner, is thinking of expanding his sales by hiring high school students, on a commission basis, to sell sweatshirts bearing the name and mascot of the local high school. These sweatshirts would have to be ordered from the manufacturer six weeks in advance, and they could not be returned because of the unique printing required. The sweatshirts would cost Hooper $22.00 each with a minimum order of 196 sweatshirts. Any additional sweatshirts would have to be ordered in increments of 196. Since Hooper's plan would not require any additional facilities, the only costs associated with the project would be the costs of the sweatshirts and the costs of the sales commissions. The selling price of the sweatshirts would be $44.00 each. Hooper would pay the students a commission of $5.00 for each shirt sold. Required: 1. What level of unit sales and dollar sales is needed to attain a target profit of $13,328?…arrow_forward

- Apple Incorporated, the worlds leading manufacturer of mobile phones, currently sells their cellphones for 90,000 per unit. This phone costs 60,000 to manufacture. Pineapple Company, the second leading manufacturer of cellphones, revealed that they would be unveiling a new model of phone that will sell for 70,000. This new phone contains all the features and performs at par with Apple’s phones. To keep up with the competition, Apple management believes that they should lower the price to 70,000. The Marketing Department also believes that the new price will cause sales to increase by 10% even with a new cellphone in the market. Apple currently sells 150,000 units of their phones annually. What is the target cost of Apple’s products if the target operating income is 20% of sales?arrow_forwardThe Shirt Works sells a large variety of tee shirts and sweatshirts. Steve Hooper, the owner, is thinking of expanding his sales by hiring high school students, on a commission basis, to sell sweatshirts bearing the name and mascot of the local high school. These sweatshirts would have to be ordered from the manufacturer six weeks in advance, and they could not be returned because of the unique printing required. The sweatshirts would cost Hooper $24.00 each with a minimum order of 186 sweatshirts. Any additional sweatshirts would have to be ordered in increments of 186. Since Hooper's plan would not require any additional facilities, the only costs associated with the project would be the costs of the sweatshirts and the costs of the sales commissions. The selling price of the sweatshirts would be $48.00 each. Hooper would pay the students a commission of $6.00 for each shirt sold. Required: 1. What level of unit sales and dollar sales is needed to attain a target profit of $13,392?…arrow_forwardGrant Industries, a manufacturer of electronic parts, has recently received an invitation to bid on a special order for 25,000 units of one of its most popular products. Grant currently manufactures 50,000 units of this product in its Loveland, Ohio, plant. The plant is operating at 50% capacity. There will be no marketing costs on the special order. The sales manager of Grant wants to set the bid at $14 because she is sure that Grant will get the business at that price. Others on the executive committee of the firm object, saying that Grant would lose money on the special order at that price. Units Manufacturing costs: Direct materials Direct labor Factory overhead Total manufacturing costs Unit cost 50,000 Required 2 Required 4 75,000 $ 200,000 250,000 350,000 $ 800,000 $ 1,125,000 $ 16 $15 Required: 2. What is the relevant cost per unit? What do ou think the minimum short-term bid price per unit should be? What would be the impact on short-term operating income if the order is…arrow_forward

- sdarrow_forwardHannah Ortega is considering expanding her business. She plans to hire a salesperson to cover trade shows. Because of compensation, travel expenses, and booth rental, fixed costs for a trade show are expected to be $10,660. The booth will be open 26 hours during the trade show. Ms. Ortega also plans to add a new product line, ProOffice, which will cost $190 per package. She will continue to sell the existing product, EZRecords, which costs $103 per package. Ms. Ortega believes that the salesperson will spend approximately 16 hours selling EZRecords and 10 hours marketing ProOffice. Required a. Determine the estimated total cost and cost per unit of each product, assuming that the salesperson is able to sell 73 units of EZRecords and 59 units of ProOffice.arrow_forwardThe Bathtub Division of Pronghorn Plumbing Corporation has recently approached the Faucet Division with a proposal. The Bathtub Division would like to make a special "ivory" tub with gold-plated fixtures for the company's 50-year anniversary. It would make only 5,200 of these units. It would like the Faucet Division to make the fixtures and provide them to the Bathtub Division at a transfer price of $164. If sold externally, the estimated unit variable cost would be $148. However, by selling internally, the Faucet Division would save $7 per unit on variable selling expenses. The Faucet Division is currently operating at full capacity. Its standard unit sells for $52 per unit and has variable costs of $35. Compute the minimum transfer price that the Faucet Division should be willing to accept. Minimum transfer price $ Should they accept this offer? They this offer.arrow_forward

- manager of Dutch’s Sporting Goods Company is considering accepting an order from an overseas customer. This customer has requested an order for 20,000 dozen golf balls at a price of $15.00 per dozen. The variable cost to manufacture a dozen golf balls is $13.00 per dozen. The full cost is $17.00 per dozen. Dutch’s has a normal selling price of $23.00 per dozen. Dutch’s plant has just enough excess capacity on the second shift to make the overseas order. What are some considerations in accepting or rejecting this order?arrow_forwardFlower Industries, a manufacturer of electronic parts, has recently received an invitation to bid on a special order for 17,500 units of one of its most popular products. Flower currently manufactures 35,000 units of this product in its Loveland, Ohio, plant. The plant is operating at 50% capacity. There will be no marketing costs on the special order. The sales manager wants to set the bid at $13 because she is sure that Flower will get the business at that price. Others on the executive committee of the firm object, saying that Flower would lose money on the special order at that price. Units 35,000 52,500 Manufacturing costs: Direct materials $ 175,000 $ 262,500 Direct labor 210,000 315,000 Factory overhead 140,000 157,500 Total manufacturing costs $ 525,000 $ 735,000 Unit cost $ 15 $ 14 2. What is the relevant cost per unit? What do you think the minimum short-term bid price per unit should be? What would be the impact on short-term operating income if the…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education