Cornerstones of Financial Accounting

4th Edition

ISBN: 9781337690881

Author: Jay Rich, Jeff Jones

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Hi experts please answer the general accounting question

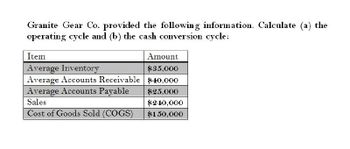

Transcribed Image Text:Granite Gear Co. provided the following information. Calculate (a) the

operating cycle and (b) the cash conversion cycle:

Item

Amount

Average Inventory

$35,000

Average Accounts Receivable $40,000

Average Accounts Payable

$25,000

Sales

$240,000

Cost of Goods Sold (COGS)

$150,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Teams MSFT Corporation has the following information: Inventory conversion period 79.02 days Receivables collection period 35.8 days Payables deferral period 9.6 days Can you determine the length of time (days) for them to cycle cash in the company? (represent your numeric result in two decimal places)arrow_forwardCompute for Receivable Collection Period, Inventory Conversion Period, Payables Deferral period and Cash Conversion Cycle of Company ABS for the following data Ave. Receivables P1,850,450 659,800 Net Credit Sales, Cost of Sales 3,180.430 1,740.200 Ave. Inventory Ave. Payables 520,300 Compare Company ABS's Cash Conversion Cycle to Company CBN which has 194 days of cC. Which company has better conversion cycle and why?arrow_forwardWhat is the cash conversion cycle for XYZ Company, based on the following information? Inventory: $20,000 Daily purchases: $1,000 Receivables: $12,000 Daily revenue: $4,000 Payables: $8,000 Daily purchases: $800arrow_forward

- Calculate the accounts receivable period, accounts payable period, inventory period, and cash conversion cycle for the following firm: Income statement data: Sales 5,000 Cost of goods sold 4,200 Balance Sheet Data: Beginning of Year End of Year Inventory 500 600 Accounts Receivable 100 120 Accounts Payable 250 290arrow_forwardA manufacturer reports the data below. Accounts payable Accounts receivable Inventory Net sales $ 9,649 18,474 5,455 233,607 Cost of goods sold 138,200 (1) Compute the number of days in the cash conversion cycle. (2) Is the company more efficient at managing cash than its competitor who has a cash conversion cycle of 14 days? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Compute the number of days in the cash conversion cycle. Note: Use 365 days in a year. Round calculations to the nearest whole day. Cash conversion cycle daysarrow_forwardCalculating Cycles Consider the following financial statement information for the Hop Corporation: Item Beginning Ending Inventory $16,284 $19,108 Accounts Receivable 11,219 13,973 Accounts Payable 13,960 16,676 Net Sales $219,320 Cost of Goods Sold 168,420 Calculate the operating and cash cycles. How do you interpret your answer?arrow_forward

- Calculating Cycles Consider the following financial statement information for the Hop Corporation: Item Beginning Ending Inventory $16,284 $19,108 Accounts receivable 11,219 13,973 Accounts payable 13,960 16,676 Net Sales $219,320 Cost of Goods sold 168,420 Calculate the operating and cash cycles. How can you interprete your answer?arrow_forwardYou are provided the following working capital information for the Ridge Company: Account Inventory $ $12,890 Accounts receivable 12,800 Accounts payable 12,670 Net sales $124,589 99,630 Cost of goods sold What is the cash conversion cycle for Ridge Company? a. 38.3 days b. 129.9 days c. 83.5 days d. 46.4 daysarrow_forwardAttached Questionarrow_forward

- MAKE THE NECCESSARY JOURNAL ENTRIES FOR THE FOLLOWING TRANSACTIONS... 1)Merchandise acquired cost is 114.000 +10 % VAT. Freight In was 6.000 TL +10% VAT Paid by the vendor. Purchase is completed by endorsing a check. 2) Machinary is purchased for 326.000 TL + %10 VAT, Note is endorced for purchase . Transportation and Installations invoice is 94.000 TL + %10 VAT half paid by check balance is on account. 3) Merchandise sold for 64.000 USD (rate 7.05 TL/ USD) + 10% VAT received note for sale. VAT paid cash. Cost of good Sold is 235.000 TL 4) Bank Credit Memorandum states that , 95.000 TL issued check is collected from the Bank. 5) 24 month rent contract, Starting 1st April 2020 is signed for 384.000 TL. Prepayment is made by half check and half note issued, 6) 25.000 USD is paid (cash) by the customer for USD Merchandise sale. Rate is 7.15 TL/USD. 7) Customer transferred 85 .000 TL to the Bank, to close the open account 8) Customer ordered to purchase 270.000 TL + %10 VAT Merchandise .…arrow_forwardMaple industries has the following operating solve this accounting questionsarrow_forwardMCQarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning