FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

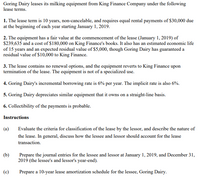

Transcribed Image Text:Goring Dairy leases its milking equipment from King Finance Company under the following

lease terms.

1. The lease term is 10 years, non-cancelable, and requires equal rental payments of $30,000 due

at the beginning of each year starting January 1, 2019.

2. The equipment has a fair value at the commencement of the lease (January 1, 2019) of

$239,635 and a cost of $180,000 on King Finance's books. It also has an estimated economic life

of 15 years and an expected residual value of $5,000, though Goring Dairy has guaranteed a

residual value of $10,000 to King Finance.

3. The lease contains no renewal options, and the equipment reverts to King Finance upon

termination of the lease. The equipment is not of a specialized use.

4. Goring Dairy's incremental borrowing rate is 6% per year. The implicit rate is also 6%.

5. Goring Dairy depreciates similar equipment that it owns on a straight-line basis.

6. Collectibility of the payments is probable.

Instructions

(а)

Evaluate the criteria for classification of the lease by the lessor, and describe the nature of

the lease. In general, discuss how the lessee and lessor should account for the lease

transaction.

(b)

Prepare the journal entries for the lessee and lessor at January 1, 2019, and December 31,

2019 (the lessee's and lessor's year-end).

(c)

Prepare a 10-year lease amortization schedule for the lessee, Goring Dairy.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Federated Fabrications leased a tooling machine on January 1, 2021, for a three-year period ending December 31, 2023. The lease agreement specified annual payments of $32,000 beginning with the first payment at the beginning of the lease, and each December 31 through 2022. The company had the option to purchase the machine on December 30, 2023, for $41,000 when its fair value was expected to be $56,000, a sufficient difference that exercise seems reasonably certain. The machine's estimated useful life was six years with no salvage value. Federated was aware that the lessor’s implicit rate of return was 10%. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1)arrow_forwardTechnoid Inc. sells computer systems. Technoid leases computers to Lone Star Company on January 1, 2021. The manufacturing cost of the computers was $18 million. This noncancelable lease had the following terms: • Lease payments: $3,035,786 semiannually; first payment at January 1, 2021; remaining payments at June 30 and December 31 each year through June 30, 2025. •Lease term: 5 years (10 semiannual payments). • No residual value; no purchase option. • Economic life of equipment: 5 years. Implicit interest rate and lessee's incremental borrowing rate: 8% semiannually. Fair value of the computers at January 1, 2021: $22 million. What is the interest revenue that Technoid would report for this lease in its 2021 income statement? (Round your answer to the nearest whole dollar.)arrow_forwardJensen Corporation leased industrial equipment to Francis Manufacturing on January 1, 2019. The following facts pertain to the lease: The lease term is 4 years. The annual lease payment is due at the beginning of each year starting on January 1, 2019. Each annual lease payment is $269,282 Ownership does not transfer at the end of the lease term and there is no bargain purchase option. The asset is not of a specialized nature. The industrial equipment has a fair value of $1,000,000, a book value to Jensen Corporation of $900,000, and a useful life of 5 years. Francis Manufacturing depreciates similar equipment using the straight-line method. The lease contains a guaranteed residual value of $50,000. The expected residual value is greater than $50,000. Jensen Corporation wants to earn a return of 8% on the lease, and collectability of the payments is probable. This rate is known by Francis…arrow_forward

- On January 1, 2023, Murray Manufacturing leased a building for use in its operations from Associated Realty. The 7-year, noncancellable lease requires annual lease payments of $22,000, beginning January 1, 2023, and at each December 31 thereafter through 2028.The lease payment includes costs related to property taxes of $2000. They also include payments for common area maintenance. The observable standalone price for the lease (including the property taxes) is $20,000 and the observable standalone price for the common area maintenance is $4000.In addition, Murray agrees to pay insurance on the building. Murray pays the insurance each year when it receives an invoice from Associated Realty for the insurance amount. On December 15, 2023, Murray was billed and paid $2500 for this insurance. Murray does not make the election to account for each separate lease component, along with its associated nonlease components, as a single lease component.The lease agreement does not transfer…arrow_forwardFederated Fabrications leased a tooling machine on January 1, 2024, for a three-year period ending December 31, 2026. . The lease agreement specified annual payments of $34,000 beginning with the first payment at the beginning of the lease, and each December 31 through 2025. . The company had the option to purchase the machine on December 30, 2026, for $43,000 when its fair value was expected to be $58,000, a sufficient difference that exercise seems reasonably certain. . The machine's estimated useful life was six years with no salvage value. Federated was aware that the lessor's implicit rate of return was 12%. Note: Use tables, Excel, or a financial calculator. (EV of $1. PV of $1. FVA of $1. PVA of $1. FVAD of $1 and PVAD of $1) Required: 1. Calculate the amount Federated should record as a right-of-use asset and lease llability for this finance lease. 2. Prepare an amortization schedule that describes the pattern of interest expense for Federated over the lease term. 3. Prepare…arrow_forwardMarin Corporation manufactures drones. On December 31, 2019, it leased to Althaus Company a drone that had cost $118,900 to manufacture. The lease agreement covers the 5-year useful life of the drone and requires 5 equal annual rentals of $41,800 payable each December 31, beginning December 31, 2019. An interest rate of 9% is implicit in the lease agreement. Collectibility of the rentals is probable.Prepare Marin’s December 31, 2019, journal entries.arrow_forward

- Cullumber Company, a machinery dealer, leased a machine to Ivanhoe Corporation on January 1, 2025. The lease is for an 8-year period and requires equal annual payments of $30,840 at the beginning of each year. The first payment is received on January 1, 2025. Cullumber had purchased the machine during 2024 for $103,000. Collectibility of lease payments by Cullumber is probable. Cullumber set the annual rental to ensure a 6% rate of return. The machine has an economic life of 10 years with no residual value and reverts to Cullumber at the termination of the lease. Suppose the collectibility of the lease payments was not probable for Cullumber. Prepare the necessary journal entry for the company in 2025. (List debit entry before credit entry. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Date Account Titles and Explanation 1/1/25 (d) * Your…arrow_forwardOn December 31, 2019, Oriole Company leased machinery from Terminator Corporation for an agreed upon lease term of 3 years. Oriole agreed to make annual lease payments of $18,500, beginning on December 31, 2019. The expected residual value of the machinery at the end of the lease term is $9,250. Oriole guarantees a residual value of $9,250 at the end of the lease term, which equals the expected residual value of the machinery. What amount will Oriole record as its lease liability if the expected residual value at the end of the lease term is $6,250 and Oriole guarantees a residual of $9,250. Its incremental borrowing rate is 6% and the implicit rate of the lease is unknown? Lease liability = $________ please explain howarrow_forwardWildhorse Limited has signed a lease agreement with Lantus Corp. to lease equipment with an expected lifespan of eight years, no estimated salvage value, and a cost to Lantus, the lessor of $199,000. The terms of the lease are as follows: ● The lease term begins on January 1, 2019, and runs for 5 years. ● The lease requires payments of $45,359 at the beginning of each year starting January 1, 2019. ● At the end of the lease term, the equipment is to be returned to the lessor. ● Lantus’ implied interest rate is 7%, while Wildhorse’s borrowing rate is 8%. Wildhorse uses straight-line depreciation for similar equipment. The year-end for both companies is December 31. Assume that both companies follow ASPE. (a)Determine the present value of the minimum lease payments Ans 199,000 B.) Prepare Wildhorse’s lease amortization schedule using the effective interest method. (Round answers to 0 decimal places, e.g. 5,275.) Date Payment Interest Principal Balance…arrow_forward

- Crosley Company, a machinery dealer, leased a machine to Dexter Corporation on 1 January 2019. The lease is for an 8-year period and requires equal annual payments of $35,004 at the beginning of each year. The first payment is received on 1 January 2019. Crosley had purchased the machine during 2018 for $160,000. Collectibility of lease payments by Crosley is probable. Crosley set the annual rental to ensure a 6% rate of return. The machine has an economic life of 10 years with no residual value and reverts to Crosley at the termination of the lease. Instructions: (a) Compute the amount of the lease receivable. (b) Prepare all necessary journal entries for Crosley for 2019. (c) Suppose the collectibility of the lease payments was not probable for Crosley. Prepare all necessary journal entries for the company in 2019. (d) Suppose at the end of the lease term, Crosley receives the asset and determines that it actually has a fair value of $1,000 instead of the anticipated…arrow_forwardOn January 1, 2020, Mountain Inc. leases a machine used in its operations. The annual lease payment is $10,000 due on December 31 of 2020, 2021, and 2022. The fair value of the machine on January 1, 2020 is $26,730. The machine has no residual value. Mountain could borrow on a three-year collateralized loan at 6%. If the lease is accounted for as a finance lease, the total expenses related to this lease contract that Mountain Inc. will report in its income statement for the year ending December 31, 2020 is Select one: a. $10,600 b. $10,514 c. $10,717 d. $10,000arrow_forwardFederated Fabrications leased a tooling machine on January 1, 2024, for a three-year period ending December 31, 2026. The lease agreement specified annual payments of $34,000 beginning with the first payment at the beginning of the lease, and each December 31 through 2025. The company had the option to purchase the machine on December 30, 2026, for $43,000 when its fair value was expected to be $58,000, a sufficient difference that exercise seems reasonably certain. The machine's estimated useful life was six years with no salvage value. Federated was aware that the lessor's implicit rate of return was 12 %. Note: Use tables, Excel, or a financial calculator. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) Required: 1. Calculate the amount Federated should record as a right-of-use asset and lease liability for this finance lease. 2. Prepare an amortization schedule that describes the pattern of interest expense for Federated over the lease term. 3. Complete this…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education