Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

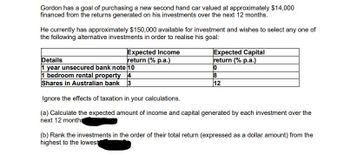

Transcribed Image Text:Gordon has a goal of purchasing a new second hand car valued at approximately $14,000

financed from the returns generated on his investments over the next 12 months.

He currently has approximately $150,000 available for investment and wishes to select any one of

the following alternative investments in order to realise his goal:

Expected Income

return (% p.a.)

Details

1 year unsecured bank note 10

1 bedroom rental property 4

Shares in Australian bank 3

Expected Capital

return (% p.a.)

0

8

12

Ignore the effects of taxation in your calculations.

(a) Calculate the expected amount of income and capital generated by each investment over the

next 12 months

(b) Rank the investments in the order of their total return (expressed as a dollar amount) from the

highest to the lowest

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- sanjaarrow_forwardIn 25 years, you are hoping to have saved $120 000 towards your child’s university education. If you are able to save $3000 at the end of each year for the next 25 years, what rate of return must you earn on your investments in order to achieve your goal? a. 5% b. 6% c. None of answers given d. 4%arrow_forwardAshviniarrow_forward

- Akeem Joffer hopes to a new cabin on Webb Lake in Maine. Akeem has $13,000 saved today and wants to save $7,000 every year for the next nine years. Assume Akeem can earn 11% on his investments. Compute the amount Akeem expects to have available to purchase the cabin in 9 years. 5. Reggie Hammond has $300,000 in cash located in a suitcase in the trunk of his car.Reggie deposits this amount in Gibraltar Bank. The bank offers a 6.7% annual rate and pays interest quarterly. Reggie hopes to have $1,600,000 at the end of five years. Compute the quarterly savings Reggie must deposit into this account in order to achieve his goal. 6. Billy Ray Valentine promises to pay his friend Louis Winthorpe a deferred annuity of $60,000 beginning in year five and continuing through year eleven plus a three-year deferred annuity of $7,000 that begins in year 15. Interest rate is 8.2 % . Compute the amount Billy Ray needs today to fulfill his obligation to his friendarrow_forwardames is starting to take his financial future seriously after studying finance at university. He is currently 25 years of age and wishes to retire from full-time work at the age of 55 with $2 000 000 in savings. b) How much will James need to contribute at the start of each month in order to receive $2 000 000 in 30 years’ time at a compound interest rate of 7.25% p.a.? Show formula, variables, calculation and a concluding statement in your response.arrow_forwardPlease step by step answer.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education