FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Haresh

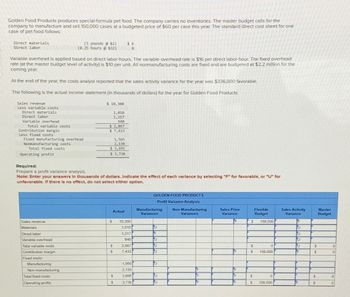

Transcribed Image Text:Golden Food Products produces special-formula pet food. The company carries no inventories. The master budget calls for the

company to manufacture and sell 150,000 cases at a budgeted price of $60 per case this year. The standard direct cost sheet for one

case of pet food follows:

Direct materials

Direct labor

(3 pounds @$2)

(8.25 hours @ $32)

$ 6

8

Variable overhead is applied based on direct labor-hours. The variable overhead rate is $16 per direct labor-hour. The fixed overhead

rate (at the master budget level of activity) is $10 per unit. All nonmanufacturing costs are fixed and are budgeted at $2.2 million for the

coming year.

At the end of the year, the costs analyst reported that the sales activity variance for the year was $336,000 favorable.

The following is the actual income statement (in thousands of dollars) for the year for Golden Food Products:

Sales revenue

Less variable costs

Direct materials

Direct labor

Variable overhead

Total variable costs

Contribution margin

Less fixed costs

Fixed manufacturing overhead

Nonmanufacturing costs

Total fixed costs

Operating profit

$ 10,300

1,010

1,217

640

$ 2,867

$ 7,433

1,565

2,130

$3,695

$ 3,738

Required:

Prepare a profit variance analysis.

Note: Enter your answers in thousands of dollars. Indicate the effect of each varlance by selecting "F" for favorable, or "U" for

unfavorable. If there is no effect, do not select either option.

GOLDEN FOOD PRODUCTS

Profit Variance Analysis

Actual

Manufacturing

Variances

Sales revenue

S

10,300

Materials

1,010

D

Direct labor

1.217

F

Variable overhead

640

P

Total variable costs

$

2,867

Contribution margin

S

7,433

Ս

Fixed costs:

Non-Manufacturing

Variances

Sales Price

Variance

Flexible

Budget

Sales Activity

Variance

Master

Budget

F

$

158,000

F

E

2

2

$

0

$

0

$

158,000

F

$

0

Manufacturing

1,565

2

Non-manufacturing

2,130

F

Total fixed costs

$

3,605

U

F

$

0

$

0

Operating profits

S

3,738

2

$

158,000

$

0

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Similar questions

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education