FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Please do not give solution in image format ? And Fast Answering Please And Explain Proper Step by Step.

Transcribed Image Text:Balance sheet-debit balance accounts

Cash

Accounts receivable

Inventory

Equipment

Balance sheet-credit balance accounts

Accumulated depreciation Equipment

Accounts payable

Income taxes payable

Common stock, $2 par value

Paid-in capital in excess of par value, common stock

Retained earnings

Statement of cash flows

Operating activities

Show Transcribed Text

Retained earnings

Statement of cash flows

Operating activities

Investing activities

GOLDEN CORPORATION

Spreadsheet for Statement of Cash Flows

For Current Year Ended December 31

December 31, Prior

Year

Financing activities

$

$

$

$

$

109,200

73,000

528,000

301,000

1,011,200

105,000

73,000

26,100

570,000

163,000

74,100

1,011,200

c

74,100

1,011,200

$

Analysis of Changes

Credit

Debit

0 $

0

December 31,

Current Year

$

79

$

$

$

166,000

166,000

0

0

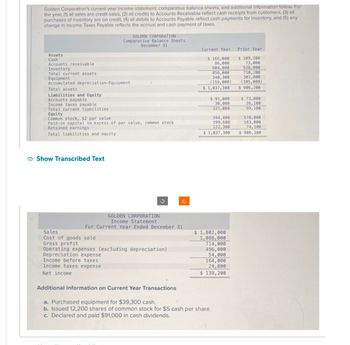

Transcribed Image Text:Golden Corporation's current year income statement, comparative balance sheets, and additional information follow. For

the year, (1) all sales are credit sales, (2) all credits to Accounts Receivable reflect cash receipts from customers, (3) all

purchases of inventory are on credit, (4) all debits to Accounts Payable reflect cash payments for inventory, and (5) any

change in Income Taxes Payable reflects the accrual and cash payment of taxes.

Assets

Cash

Accounts receivable

Inventory

Total current assets

Equipment

Accumulated depreciation-Equipment

Total assets

Liabilities and Equity

Accounts payable

Income taxes payable

Total current liabilities.

GOLDEN CORPORATION

Comparative Balance Sheets

December 31

Equity

Common stock, $2 par value

Paid-in capital in excess of par value, common stock

Retained earnings.

Total liabilities and equity

Show Transcribed Text

Sales

Cost of goods sold

Gross profit

3

GOLDEN CORPORATION

Income Statement

For Current Year Ended December 31

Operating expenses (excluding depreciation)

Depreciation expense

Income before taxes

Income taxes expense

Net income

Additional Information on Current Year Transactions

Current Year

$ 166,000

86,000

604,000

856,000

340,300

(159,000)

$ 1,037,300

$ 91,000

30,000

121,000

594,400

199,600

122,300

$1,037,300

$ 1,802,000

1,088,000

714,000

496,000

54,000

164,000

24,800

$ 139,200

a. Purchased equipment for $39,300 cash.

b. Issued 12,200 shares of common stock for $5 cash per share.

c. Declared and paid $91,000 in cash dividends.

Prior Year

$ 109,200

73,000

528,000

710,200

301,000

(105,000)

$ 906,200

$ 73,000

26,100

99,100

570,000

163,000

74,100

$906,200

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- What is the advantage of selecting the “Only Create Connection" option when importing data?arrow_forwardCan you please enter the information clearly without so many spaces? The information is hard to read.arrow_forwardWhy is it necessary to continue to maintain and improve an existing Web site?arrow_forward

- Can you solve it in an Excel spreadsheet? because something is wrong with the asnwer. tyhank you,arrow_forwardCould you show me to solve this problem step by step. Pleasearrow_forwardRequired information [The following information applies to the questions displayed below.] Consider the following narrative describing the process of filling a customer's order at a Starbucks branch: Identify the start and end events and the activities in the following narrative, and then draw the business process model using BPMN: the Starbucks customer entered the drive-through lane and stopped to review the menu. He then ordered a Venti coffee of the day and a blueberry muffin from the barista. The barista recorded the order in the cash register. While the customer drove to the window, the barista filled a Venti cup with coffee, put a lid on it, and retrieved the muffin from the pastry case and placed it in a bag. The barista handed the bag with the muffin and the hot coffee to the customer. The customer has an option to pay with cash, credit card, or Starbucks gift card. The customer paid with a gift card. The barista recorded the payment and returned the card along with the…arrow_forward

- Please show and explain all steps to solve this problem.arrow_forwardPlease help me,arrow_forwardPlease don't use chat gpt and other ai other wise I give multiplie downvote Which of the following is sometimes called a currently attainable standard? O a. par b. normal standard O c. theoretical standard d. ideal standardarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education