FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Gloria dimen company paid 18,000 for 6 months insurance premium

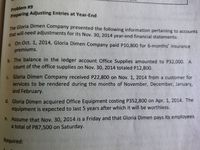

Transcribed Image Text:Preparing Adjusting Entries at Year-End

Problem #9

zhe Gloria Dimen Company presented the following information pertaining to accounts

hat will need adjustments for its Nov. 30, 2014 year-end financial statements:

, On-Oct. 1, 2014, Gloria Dimen Company paid P10,800 for 6-months' insurance

premiums.

h. The balance in the ledger account Office Supplies amounted to P32,000. A

count of the office supplies on Nov. 30, 2014 totaled P12,800.

c. Gloria Dimen Company received P22,800 on Nov. 1, 2014 from a customer for

services to be rendered during the months of November, December, January,

and February.

d. Gloria Dimen acquired Office Equipment costing P352,800 on Apr. 1, 2014. The

equipment is expected to last 5 years after which it will be worthless.

e. Assume that Nov. 30, 2014 is a Friday and that Gloria Dimen pays its employees

a total of P87,500 on Saturday.

Required:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Landscape Corp borrows $100,000 Signs a 5-month, 12% note on March 1 Record the following journal entry for the interest accrual at June 30 year end.arrow_forwardFink Insurance collected premiums of $18,300,000 from its customers during the current year. The adjusted balance in the Deferred premiums revenue account increased from $5.0 million to $9.3 million dollars during the year. What is Fink's revenue from insurance premium recognized for the current year? Multiple Choice $9,000,000. $22,600.000. $14,000,000arrow_forwardA company purchased new equipment for $31,000 with a two-year installment note requiring 5% interest. The required monthly payment is $1,360. After the first month’s payment, what is the balance of the note? a. $30,723. b. $29,640. c. $29,769. d. $30,871.arrow_forward

- Innovative Engineering received a promissory note of $15500 at 11% simple interest for 15 months from one of its customers. After 3 months union Bank discounted the note at a discount rate of 13% calculate the proceeds that Innovative Engineering will receive from the discounted note $18,855.17 $16,495.62 $15,339.19 $12,456.22arrow_forwardLyon County Bank agrees to len Grimwood Brick Company $100,000 on January 1. Grimwood Brick Company signs a $100,000, 8% 9-month note. The entry made by Grimwood Brick Company on January 1 to recor the proceeds and insurance of the note is?arrow_forwardAn employee has $75 withheld from each monthly paycheck that is deposited in an account. The account earns 12% interest annually, and the interest is compounded monthly. Assuming the employee makes deposits for two and a half years, determine the total account balance on the date of the final deposit.arrow_forward

- On October 22 the company signed a $450,000 10 years 5% note to purchase equipment. The note will be due in annual installments starting on September 30 of the next year. journal entry is requiredarrow_forwardon december 1 a six month liability insurance policy was purchased for 900arrow_forwardFocarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education