FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:Globo-Chem Co. reported net sales of $600 million last year and generated a net income of $132.00 million. Last year's accounts receivable increased

by $17 million. What is the maximum amount of cash that Globo-Chem Co. received from sales last year?

$583.00 million

O$291.50 million

$437.25 million

O $149.00 million

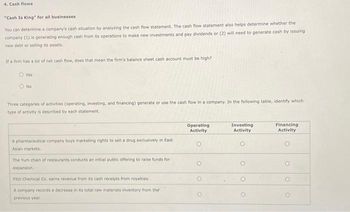

Transcribed Image Text:4. Cash flows

"Cash Is King" for all businesses

You can determine a company's cash situation by analyzing the cash flow statement. The cash flow statement also helps determine whether the

company (1) is generating enough cash from its operations to make new investments and pay dividends or (2) will need to generate cash by issuing

new debt or selling its assets.

If a firm has a lot of net cash flow, does that mean the firm's balance sheet cash account must be high?

Yes

No

Three categories of activities (operating, investing, and financing) generate or use the cash flow in a company. In the following table, identify which

type of activity is described by each statement.

A pharmaceutical company buys marketing rights to sell a drug exclusively in East

Asian markets.

The Yum chain of restaurants conducts an initial public offering to raise funds for

expansion.

Fitzi Chemical Co. earns revenue from its cash receipts from royalties.

A company records a decrease in its total raw materials inventory from the

previous year

Operating

Activity

Investing

Activity

Financing

Activity

O

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Use the table for the question(s) below. FCF Forecast ($ million) Year Sales 1 270 12.5% 32.40 Less: Income Tax (37%) (6.48) Less Increase in NWC (12% of Change in Sales) 3,60 Free Cash Flow 22.32 Growth versus Prior Year EBIT (10% of Sales) 0 240 OA. $4.27 OB. $7.47 OC. $12.8 OD. $5.12 2 290 7.4% 34.80 (6.96) 2.40 25.44 ACCE 3 310 6.9% 37.20 (7.44) 2.40 27.36 Banco Industries expect sales to grow at a rapid rate over the next 3 years, but settle to an industry growth rate of 4% in year 4. The spreadsheet above shows a simplified pro forma for Banco Industries. Banco industries has a weighted average cost of capital of 10%, $30 million in cash, $60 million in debt, and 18 million shares outstanding. If Banco Industries can reduce its operating expenses so that EBIT becomes 12% of sales, by how much will its stock price increase? 4 325.5 5.0% 39.06 (7.81) 1.86 29.388arrow_forwardPlease see image to solve question.arrow_forwardYour company collected $340.00 million and spent $381.00 million this month. If previous month's cash position (cumulative cash) is $14.31 million and your company target cash position is $20.00 million. What's your company's cash surplus/shortage at the end of this month, with positive number indicates a surplus and negative number indicates a shortage? Note: your answer should be in millions of dollarsarrow_forward

- Alpha Ltd has a gross profit margin of 40%. At the start and end of the year, stock was valued at £17,000 and £20,000. During the year Alpha Ltd made cash purchases of £15,000 and credit purchases of £50,000. What was the value of sales for the year? a) £62,000 b) £103,333 c) £99,200 d) £161,200arrow_forwardWant the Answer with calculationarrow_forwardConn Man's Shops, a national clothing chain, had sales of $340 million last year. The business has a steady net profit margin of 8 percent and a dividend payout ratio of 35 percent. The balance sheet for the end of last year is shown. Cash Accounts receivable Inventory Plant and equipment Total assets Assets Balance Sheet End of Year (in $ millions) $ 24 39 81 $145 $289 Required new funds Liabilities and Stockholders' Equity Accounts payable Accrued expenses Other payables Common stock Retained earnings Total liabilities and stockholders' equity $ 63 20 36 48 122 $289 The firm's marketing staff has told the president that in the coming year there will be a large increase in the demand for overcoats and wool slacks. A sales increase of 10 percent is forecast for the company. All balance sheet items are expected to maintain the same percent-of-sales relationships as last year,* except for common stock and retained earnings. No change is scheduled in the number of common stock shares…arrow_forward

- A business had a +10% variance in cash flow from investing activities this year as compared to last year. The dollar amount of cash flow from investing activities last year was $900,000. What was the dollar amount of cash flow from investing activities for this business in this year?arrow_forwardProvide Answer in text modearrow_forwardSolve this onearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education