Financial Management: Theory & Practice

16th Edition

ISBN: 9781337909730

Author: Brigham

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

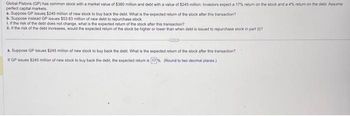

Transcribed Image Text:Global Pistons (GP) has common stock with a market value of $380 million and debt with a value of $245 million, Investors expect a 17% return on the stock and a 4% return on the debt. Assume

perfect capital markets.

a. Suppose GP issues $245 million of new stock to buy back the debt. What is the expected return of the stock after this transaction?

b. Suppose instead GP issues $53.63 million of new debt to repurchase stock.

1. If the risk of the debt does not change, what is the expected return of the stock after this transaction?

1. If the risk of the debt increases, would the expected return of the stock be higher or lower than when debt is issued to repurchase stock in part (0)7

a. Suppose GP issues $245 million of new stock to buy back the debt. What is the expected return of the stock after this transaction?

If GP issues $245 million of new stock to buy back the debt, the expected return is [17%. (Round to two decimal places.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- A. Suppose that Taco John’s equity is currently selling for $55 per share, with 4million shares outstanding. If the firm also has 17 thousand bonds outstanding,which are selling at 94 percent of par, what are the firm’s current capital structure weights? Use the capital structure weights equation:B. Suppose that Taco John’s is considering an active change to their capital structure so as to have a D/E of 0.4, which type of security (stocks or bonds) would they need to sell to accomplish this, and how much would they have to sell?arrow_forwardIndell stock has a current market value of $160 million and a beta of 1.50. Indell currently has risk-free debt as well. The firm decides to change its capital structure by issuing $69.34 million in additional risk-free debt, and then using this $69.34 million plus another $9 million in cash to repurchase stock. With perfect capital markets, what will the beta of Indell stock be after this transaction? The beta of Indell stock after the recapitalization is (Round to two decimal places.)arrow_forwardIndell stock has a current market value of $130 million and a beta of 1.50. Indell currently has risk-free debt as well. The firm decides to change its capital structure by issuing $27.79 million in additional risk-free debt, and then using this $27.79 million plus another $17 million in cash to repurchase stock. With perfect capital markets, what will the beta of Indell stock be after this transaction? The beta of Indell stock after the recapitalization is www (Round to two decimal places.)arrow_forward

- Use the following information to answer the question(s) below. Expected Liquidating Dividend Market Stock Capitalization Beta Taggart Transcontinental $800 $920 1.10 Rearden Metal $600 $720 1.20 Wyatt Oil $1000 $1100 0.80 Nielson Motors $400 $500 1.40 All amounts are in millions. If the risk - free rate is 3% and the market risk premium is 5%, then the CAPM's predicted expected return for Nielson Motors is closest to: A. 10.0% O B. 9.0% Oc. 9.5% O D. 8.5%arrow_forwardSuppose the risk-free rate is 2.61% and an analyst assumes a market risk premium of 6.65%. Firm A just paid a dividend of $1.19 per share. The analyst estimates the ẞ of Firm A to be 1.31 and estimates the dividend growth rate to be 4.79% forever. Firm A has 288.00 million shares outstanding. Firm B just paid a dividend of $1.89 per share. The analyst estimates the ẞ of Firm B to be 0.87 and believes that dividends will grow at 2.28% forever. Firm B has 196.00 million shares outstanding. What is the value of Firm B? Submit Answer format: Currency: Round to: 2 decimal places. Show Hintarrow_forwardWhat is cost of equity capital on these financial accounting question?arrow_forward

- 6. Company cost of capital (S9.2) Nero Violins has the following capital structure: Total Market Value ($ millions) $100 Security Debt Preferred stock Common stock Beta 0 0.20 1.20 40 299 a. What is the firm's asset beta? (Hint: What is the beta of a portfolio of all the firm's securities?) b. Assume that the CAPM is correct. What discount rate should Nero set for investments that expand the scale of its operations without changing its asset beta? Assume a risk-free interest rate of 5% and a market risk premium of 6%. Ignore taxes.arrow_forwardplease see attatched filearrow_forwardSuppose the risk-free rate is 3.91% and an analyst assumes a market risk premium of 6.52%. Firm A just paid a dividend of $1.11 per share. The analyst estimates the β of Firm A to be 1.20 and estimates the dividend growth rate to be 4.27% forever. Firm A has 264.00 million shares outstanding. Firm B just paid a dividend of $1.83 per share. The analyst estimates the β of Firm B to be 0.70 and believes that dividends will grow at 2.86% forever. Firm B has 197.00 million shares outstanding. What is the value of Firm B? Answer format: Currency: Round to: 2 decimal places.arrow_forward

- Suppose the risk-free rate (RF) is 3.64% and an analyst assumes a market risk premium (Rm - Rf) of 7.50% . Firm A just paid a dividend of $1.05 per share (i.e. 1.05). The analyst estimates the beta of Firm A to be 1.49 and estimates the dividend growth rate to be 4.13% forever. Firm A has 2.2 million shares outstanding . What is the market value of the equity of Firm A?arrow_forwardSuppose the risk-free rate is 2.67% and an analyst assumes a market risk premium of 6.91%. Firm A just paid a dividend of $1.21 per share. The analyst estimates the β of Firm A to be 1.45 and estimates the dividend growth rate to be 4.46% forever. Firm A has 295.00 million shares outstanding. Firm B just paid a dividend of $1.75 per share. The analyst estimates the β of Firm B to be 0.89 and believes that dividends will grow at 2.83% forever. Firm B has 188.00 million shares outstanding. What is the value of Firm A? Answer format: Currency: Round to: 2 decimal places.arrow_forwardWhat is the cost of equity on these financial accounting question?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you