FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

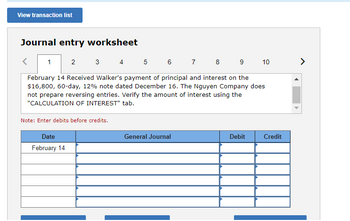

Transcribed Image Text:View transaction list

Journal entry worksheet

1

2

6 7 8

9 10

February 14 Received Walker's payment of principal and interest on the

$16,800, 60-day, 12% note dated December 16. The Nguyen Company does

not prepare reversing entries. Verify the amount of interest using the

"CALCULATION OF INTEREST" tab.

3

Note: Enter debits before credits.

Date

February 14

4 5

General Journal

Debit

Credit

>

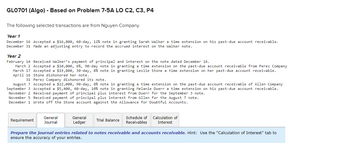

Transcribed Image Text:GL0701 (Algo) - Based on Problem 7-5A LO C2, C3, P4

The following selected transactions are from Nguyen Company.

Year 1

December 16 Accepted a $16,800, 60-day, 12% note in granting Sarah Walker a time extension on his past-due account receivable.

December 31 Made an adjusting entry to record the accrued interest on the Walker note.

Year 2

February 14 Received Walker's payment of principal and interest on the note dated December 16.

March 2 Accepted a $10,000, 6%, 90-day note in

March 17 Accepted a $19,800, 30-day, 8% note in

April 16 Stone dishonored her note.

31 Perez Company dishonored its note.

August 7 Accepted a $22,000, 90-day, 8% note in granting a time extension on the past-due account receivable of Allen Company

September 3 Accepted a $5,400, 60-day, 10 % note in granting Melanie Duerr a time extension on his past-due account receivable.

November 2 Received payment of principal plus interest from Duerr for the September 3 note.

November 5 Received payment of principal plus interest from Allen for the August 7 note.

December 1 Wrote off the Stone account against the Allowance for Doubtful Accounts.

Requirement

General

Journal

General

Ledger

granting a time extension on the past-due account receivable from Perez Company

granting Leslie Stone a time extension on her past-due account receivable.

Trial Balance

Schedule of Calculation of

Receivables Interest

Prepare the journal entries related to notes receivable and accounts receivable. Hint: Use the "Calculation of Interest" tab to

ensure the accuracy of your entries.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Following are transactions of The Barnett Company: 2023 Dec. 16 Accepted a $22,900, 60-day, 5% note dated this day in granting Carmel Karuthers a time extension on her past-due account. Made an adjusting entry to record the accrued interest on the Karuthers note. Closed the Interest income account. Dec. 31 Dec. 31 2024 Feb. 14 Mar. 2 Mar. 17 May 31 Received Karuthers' payment for the principal and interest on the note dated December 16. Accepted an $8,800, 4%, 90-day note dated this day in granting a time extension on the past-due account of ATW Company. Accepted a $4,000, 30-day, 4.5% note dated this day in granting Leroy Johnson a time extension on past-due account. Received ATW's payment for the principal and interest on the note dated March 2. Prepare journal entries to record The Barnett Company's transactions. (Assume 365 days in a year. Round your answers to 2 decimal places.) View transaction listarrow_forwardOn July 8, Jones Inc. issued an $72,300, 7%, 120-day note payable to Miller Company. Assume that the fiscal year of Jones ends July 31. Using a 360-day year, what is the amount of interest expense recognized by Jones in the current fiscal year? When required, round your answer to the nearest dollar. a.$646 b.$5,061 c.$969 d.$323arrow_forward99) On November 1, Casey's Snowboards signed a $12,000, 90-day, 5% note payable to cover a past due account payable. a. What amount of interest expense on this note should Casey's Snowboards report on year-end December 31? b. Prepare Casey's journal entry to record the issuance of the note payable. c. Prepare Casey's adjusting journal entry at the end of the year December 31. d. Prepare Casey's journal entry to record the payment of the note on January 30 of the following year.arrow_forward

- nces On 1 October 20X6, Halpern Co borrowed $180,000 from Canada Bank The note has a two-year term, and requires that interest of 9% be paid each 30 September, with the principal payable 30 September 20X8 Required: Provide all entries for the note from 20X6 to 20X8 (If no entry is required for a transaction/event. select "No journal entry required" in the first account field.) View transaction list 1 Record the borrowings from Canada Bank. 2 Record the accrual of intest for the period ending 31st December 20x6. a Record the interest payment on 30 September 20x7. 4 Record the accrual of interest for the period ending 31st December 20X7 5 Record the interest payment on 30 September 20X8. Record the repayment of borrowings to Canada Bank 6 Note: journal entry has been entered Record entry Clear entry EX - - 2 Credit View gener al journalarrow_forwardces Required information [The following information applies to the questions displayed below.] Following are transactions of Danica Company. December 13 Accepted a $20,000, 45-day, 4% note in granting Miranda Lee a time extension on her past-due account receivable. December 31 Prepared an adjusting entry to record the accrued interest on the Lee note. Complete the table to calculate the interest amounts at December 31st and use the calculated value to prepare your journal entries. Note: Do not round your intermediate calculations. Use 360 days a year. Complete this question by entering your answers in the tabs below. Interest Amounts General Journal Complete the table to calculate the interest amounts at December 31st, Interest Recognized December 31 20,000 4% 18/360 Principal Rate (%) Time Total interest Total Through Maturity $ 20,000 $ 4% 45/360 Check my workarrow_forwardE4-29 Mattson Loan Company completed these transactions: 2019 Apr. Dec. 2020 Apr. 1 Loaned $20,000 to Charlene Baker on a one-year, 5% note. 31 Accrued interest revenue on the Baker note. 1 Collected the maturity value of the note from Baker (principal plus interest). Show what Mattson would report for these transactions on its 2019 and 2020 balance sheets and income statements. Mattson's accounting year ends on December 31.arrow_forward

- K Cheap Inc. borrowed $95,000 on October 1 by signing a note payable to Scotiabank. The interest expense for each month is $554. The loan agreement requires Cheap Inc. to pay interest on December 31. 1. Make Scotiabank's adjusting entry to accrue interest revenue and interest receivable at October 31, at November 30, and at December 31. Date each entry and include its explanation. 2. Post all three entries to the Interest Receivable account. You need not take the balance of the account at the end of each month. 3. Record the receipt of three months' interest at December 31. 1. Make Scotiabank's adjusting entry to accrue interest revenue and interest receivable at October 31, at November 30, and at December 31. Date each entry and include its explanation. (Record debits first, then credits. Enter explanations on the last line.) Start by making the adjusting entry to accrue monthly interest revenue for October. Date Oct Journal Entry Accounts and Explanation Debit Creditarrow_forwardEntries for Installment Note Transactions On January 1, Year 1, Wedekind Company issued a $66,000, 4-year, 8% installment note to Shannon Bank. The note requires annual payments of $19,927, beginning on December 31, Year 1. Journalize the entries to record the following: Year 1 Jan. 1 Issued the note for cash at its face amount. Dec. 31 Paid the annual payment on the note, which consisted of interest of $5,280 and principal of $14,647. Year 4 Dec. 31 Paid the annual payment on the note, including $1,476 of interest. The remainder of the payment reduced the principal balance on the note. Issued the note for cash at its face amount. If an amount box does not require an entry, leave it blank. Year 1, Jan. 1 Paid the annual payment on the note, which consisted of interest of $5,280 and principal of $14,647. If an amount box does not require an entry, leave it blank. Year 1, Dec. 31 12:09arrow_forward8arrow_forward

- Rosewood Company made a loan of $12,200 to one of the company's employees on April 1, Year 1. The one-year note carried a 6% rate of interest. What is the amount of interest revenue that Rosewood would report in Year 1 and Year 2, respectively? Multiple Choice $0 in Year 1 and $732 in Year 2 $732 in Year 1 and $0 in Year 2 $183 in Year 1 and $549 in Year 2 $549 in Year 1 and $183 in Year 2arrow_forwardFollowing are transactions of Danica Company. Dec. 13 Accepted a $18,000, 45-day, 10% note in granting Miranda Lee a time extension on her past-due account receivable. 31 Prepared an adjusting entry to record the accrued interest on the Lee note.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education