FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Could you help me solve this financial accounting question using appropriate calculation techniques?

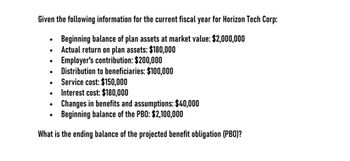

Transcribed Image Text:Given the following information for the current fiscal year for Horizon Tech Corp:

•

•

.

•

Beginning balance of plan assets at market value: $2,000,000

Actual return on plan assets: $180,000

Employer's contribution: $200,000

Distribution to beneficiaries: $100,000

Service cost: $150,000

Interest cost: $180,000

Changes in benefits and assumptions: $40,000

•

Beginning balance of the PBO: $2,100,000

What is the ending balance of the projected benefit obligation (PBO)?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Can you please give me correct answer this general accounting question?arrow_forwardGiven the following information for current fiscal yeararrow_forwardGiven the following items and amounts, compute the actual return on plan assets: fair value of plan assets at the beginning of the period $9,200,000; benefits paid during the period $1,400,000; contributions made during the period $1,000,000; and fair value of the plan assets at the end of the period $10,150,000. O a. $ 1,250,000 O b. $ 1,350,000 $ 1,400,000 O d. $ 1,450,000arrow_forward

- Fair value of plan assets 4,750,000Unamortized past service cost 1,250,000Projected benefit obligation 5,500,000Unrecognized actuarial gain 850,000The transactions for the current year relating to the defined benefit plan are as follows:Current service cost 925,000Discount rate 6%Actual return on plan assets 485,000Contribution to the plan 1,350,000Benefits paid to retirees 995,000Increase in projected benefit obligation due to changes in actuarial assumptions 150,000Effective in the current year, the entity has applied the provisions of revised PAS 19 in relation to the definedbenefit plan.REQUIRED:15. Prepare journal entry to recognize the transitional effect of adopting revised PAS 19.16. Determine the employee benefit expense for the current year.17. Compute the remeasurement related to the defined benefit plan.18. Prepare journal entry to record the employee benefit expense.19. Compute for the Fair Value Plan Asset (FVPA) as of December 31.20. Compute for the projected benefit…arrow_forwardGiven the following information for current fiscal yeararrow_forwardWhat is PBO?arrow_forward

- Haresharrow_forward2 ($ in thousands) Discount rate, 7% Expected return on plan assets, 8% Actual return on plan assets, 7% Service cost, current year January 1, current year: Projected benefit obligation Accumulated benefit obligation Plan assets (fair value)" Prior service cost- AOCI (current year amortization, $30) Net gain- AOCI (current year amortization, $12) There were no changes in actuarial assumptions. December 31, current year: Cash contributions to pension fund, December 31, current year Benefit payments to retirees, December 31, current year Required: 1. Determine pension expense for the current year. $ 500 3,250 2,950 3,350 420 520 435 460 2. Prepare the journal entries to record (a) pension expense, (b) gains and losses (if any), (c) funding, and (d) retiree benefits for the current year. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Determine pension expense for the current year. Note: Amounts to be deducted should be indicated with a minus sign.…arrow_forwardd. Prepare a reconciliation of the beginning and ending balances The following information is taken from the actuarial valuation report of Daddy, Inc.'s defined benefit plan: Fair value of plan assets, Jan. 1 Present value of defined benefit obligation, Jan. 1 Past service cost from plan amendment during the year (the vesting period is 5 yrs.)es 2,100,000 2,400,000 300,000 Current service cost 600,000 Benefits paid to retirees during the Actuarial gain during the period Return on plan assets during the period Contributions to the fund during the year Discount rate based on high quality corporate bonds year 450,000 15,000 270,000 480,000 12% Requirements: a. Determine net defined benefit liability/asset as of Jan. 1, 20x1 and Dec. 31, 20x1, respectively. b. Compute for the defined benefit cost in 20x1, showing amoúnts recognized in P/L and OCI, respectively. c. Provide the journal entries in 20x1. Prepare a reconciliation of the beginning and ending balances с. d. of net defined benefit…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education