FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

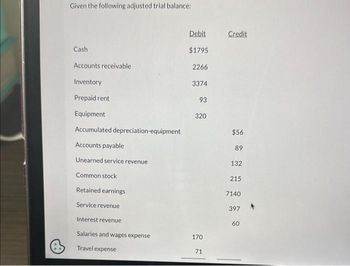

Transcribed Image Text:Given the following adjusted trial balance:

Cash

Accounts receivable

Inventory

Prepaid rent

Equipment

Accumulated depreciation-equipment

Accounts payable

Unearned service revenue

Common stock

Retained earnings

Service revenue

Interest revenue

Salaries and wages expense

Travel expense

Debit

$1795

2266

3374

93

320

170

71

Credit

$56

89

132

215

7140

397

60

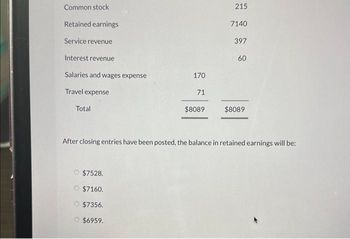

Transcribed Image Text:Common stock

Retained earnings

Service revenue

Interest revenue

Salaries and wages expense

Travel expense

Total

170

$7528.

$7160.

$7356.

$6959.

71

$8089

215

7140

397

60

$8089

After closing entries have been posted, the balance in retained earnings will be:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Sales Revenue Cost of Goods Sold Gross Profit Depreciation Expense Salaries and Wages Expense Net Income Accounts Receivable. Inventory Accounts Payable Salaries and Wages Payable Net Income: Adjustments to Reconcile Net Income to Net Cash Provided by Operating Activities Changes in Assets and Liabilities Case A Year 2 $ 11,000 6,000 5,000 1,000 2,500 $1,500 $ 300 750 800 1,000 Case A Year 1 $ 9,000 5,500 3,500 1,000 2,000 $ 500 Case B $ 400 500 700 1,200 I... Case Year 2 $ 21,000 12,000 9,000 1,500 5,000 $ 2,500 Required: Show the operating activities section of the statement of cash flows for year 2 using the indirect method. (Amoun should be indicated with a minus sign.) $750 730 800 200 B Year 1 $ 18,000 11,000 7,000 1,500 5,000 $ 500 $ 600 800 850 250arrow_forwardErgonomics Supply Inc., a wholesaler of office products, was organized on July 1 of the current year, with an authorization of 27,000 shares of preferred 2% stock, $100 par, and 600,000 shares of $10 par common stock. The following selected transactions were completed during the first year of operations: July 1. Issued 213,000 shares of common stock at par for cash. 1. Issued 400 shares of common stock at par to an attorney in payment of legal fees for organizing the corporation. Aug. Issued 69,400 shares of common stock in exchange for land, buildings, and equipment with fair market 7. prices of $149,100, S505,120 and $164,700 respectively. Sept. 20. Issued 17,600 shares of preferred stock at $105 for cash. Required: Journalize the transactions. Refer to the chart of accounts for the exact wording of the account titles. CNOW journals do not use lines for journal explanations. Every line on a journal page is used for debit or credit entries. CNOW journals will automatically indent a…arrow_forwardX Company reports these account balances on December 31, 2021 Accounts Payable Accounts Receivable Accumulated depreciation $450,000 150.000 180,000 600,000 80.000 300,000 Cash Drawings Operating Expenses Goodwill 90,000 000 080 Service Revenne Owner's capital Unearmed Service Reventie S00,000 720.000 50,000arrow_forward

- 1arrow_forwardBased on the accounts shown below in the Partial Adjusted Trial Balance dated 12/31/20xx, what is the total dollar ($) amount of the Debits? Normal Account Balance Account Name Cash $15,000 Inventory $9,000 Equipment $90,738 Accumulated Depreciation $1,396 Deferred Revenue $4,000 Common Stock $75,267 Revenue $40,000 Sales Return $3,858 Cost of Goods Sold $3,000 Interest Expense $15,000 Fill in the blank with your calculated number. DO NOT include commas, $ signs, period, decimal points, etc., just enter the raw number. Webcourses will add commas to your answer automatically. For example, if you calculated the answer to be $24,123, you would only input: 24123 ASUSarrow_forwardA Accounts Payable AA Losses due to fire B Accounts Receivable BB Merchandise Inventory E Accumulated Depreciation—Equip EE Notes Payable F Allowance for Doubtful Accounts FF Payroll Tax Expense G Bad Debt Expense GG Premium on Bonds Payable H Bonds Payable HH Prepaid Insurance I Building II Prepaid Rent J Capital Lease Payable JJ Rent Expense K Cash KK Rent Revenue L Cost of Goods Sold LL Retained Earnings M Depreciation Expense MM Salaries and Wages Expense N Discount on Bonds Payable NN Salaries and Wages Payable O Dividends OO Sales Commission Expense P Equipment PP Sales Commission Payable Q Fed Income Tax Payable QQ Sales Returns R Fed Unemployment Tax Payable RR Sales Revenues S FICA Taxes Payable SS Sales Taxes Payable T Income Summary TT Service Revenue U Insurance Expense UU State Income Tax Payable V Interest Expense VV State Unemployment Tax Payable W Interest Payable WW Supplies X Interest Receivable XX Supplies Expense Y…arrow_forward

- A Accounts Payable AA Losses due to fire B Accounts Receivable BB Merchandise Inventory E Accumulated Depreciation—Equip EE Notes Payable F Allowance for Doubtful Accounts FF Payroll Tax Expense G Bad Debt Expense GG Premium on Bonds Payable H Bonds Payable HH Prepaid Insurance I Building II Prepaid Rent J Capital Lease Payable JJ Rent Expense K Cash KK Rent Revenue L Cost of Goods Sold LL Retained Earnings M Depreciation Expense MM Salaries and Wages Expense N Discount on Bonds Payable NN Salaries and Wages Payable O Dividends OO Sales Commission Expense P Equipment PP Sales Commission Payable Q Fed Income Tax Payable QQ Sales Returns R Fed Unemployment Tax Payable RR Sales Revenues S FICA Taxes Payable SS Sales Taxes Payable T Income Summary TT Service Revenue U Insurance Expense UU State Income Tax…arrow_forwardWhich of the following entries properly closes a temporary account? Select one: a. Income Summary XX Cash b. C. Debit Credit Expense Accumulated Depreciation XX Income Summary Income Summary d. e. XX Retained Earnings XX Dividends Debit Credit Debit Credit XX Debit Credit Income Summary XX Revenue XX XX Debit Credit XX XXarrow_forwardeceivables in the Balance Sheet The following partial balance sheet contains errors. ZABEL COMPANYBalance SheetDecember 31, 20Y4 Assets Current assets: Cash $76,000 Notes receivable $117,500 Less interest receivable 9,300 108,200 Account receivable $477,000 Plus allowance for doubtful accounts 21,750 498,750 Prepare a corrected partial balance sheet for Zabel Company.arrow_forward

- The two independent cases are listed below: Sales Revenue Cost of Goods Sold Gross Profit Depreciation Expense Salaries and Wages Expense Net Income Accounts Receivable Inventory Accounts Payable Salaries and Wages Payable Adjustments to Reconcile Net Income to Net Cash Provided by Operating Activities Changes in Assets and Liabilities $ Case Year 2 $ 10,100 5,190 4,910 1,100 1,600 $ 2,210 Case A $ 255 705 710 955 A 0 $ Year 1 $ 4,500 1,900 2,600 1,100 1,100 $ 400 $ 310 410 655 1,110 Required: Show the operating activities section of the statement of cash flows for year 2 using the indirect method. (Amounts to be d should be indicated with a minus sign.) Case B Case Year 2 $ 20,100 11,190 8,910 1,050 4,100 $ 3,760 0 $ 660 685 890 385 B Year 1 $ 13,500 7,720 5,780 1,050 4,100 $ 630 $ 555 710 945 440arrow_forwardTB SA Qu. 16-59 (Static) Complete: Complete: Current Assets Cash Accounts receivable Prepaid rent Merchandise inventory Total current assets $ Amount $ $ $ 12,000 9,000 5,000 28,000 Round to Nearest Hundredth Percent % % % % 100 %arrow_forwardA Accounts Payable AA Losses due to fire B Accounts Receivable BB Merchandise Inventory E Accumulated Depreciation—Equip EE Notes Payable F Allowance for Doubtful Accounts FF Payroll Tax Expense G Bad Debt Expense GG Premium on Bonds Payable H Bonds Payable HH Prepaid Insurance I Building II Prepaid Rent J Capital Lease Payable JJ Rent Expense K Cash KK Rent Revenue L Cost of Goods Sold LL Retained Earnings M Depreciation Expense MM Salaries and Wages Expense N Discount on Bonds Payable NN Salaries and Wages Payable O Dividends OO Sales Commission Expense P Equipment PP Sales Commission Payable Q Fed Income Tax Payable QQ Sales Returns R Fed Unemployment Tax Payable RR Sales Revenues S FICA Taxes Payable SS Sales Taxes Payable T Income Summary TT Service Revenue U Income Tax Payable UU State Income Tax Payable V Interest Expense VV State Unemployment Tax Payable W Interest Payable WW Supplies X Interest Receivable XX Supplies Expense Y…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education