FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

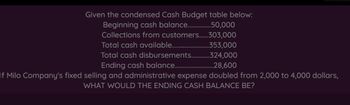

Transcribed Image Text:Given the condensed Cash Budget table below:

Beginning cash balance..............50,000

Collections from customers.......303,000

Total cash available.….….….........

Total cash disbursements..

Ending cash balance..

353,000

.324,000

..28,600

If Milo Company's fixed selling and administrative expense doubled from 2,000 to 4,000 dollars,

WHAT WOULD THE ENDING CASH BALANCE BE?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- A cash budget, by quarters, is given below for a retail company (000 omitted). The company requires a minimum cash ba of $7,000 to start each quarter. Required: Fill in the missing amounts. Note: Enter your answers in thousands of dollars. Cash deficiencies and Repayments should be indicated by a minus Quarter (000 omitted) (000 omitted) 1 2 3 4 Year Cash balance, beginning $ 7 $ 7 Add collections from customers 84 88 105 378 Total cash available 91 95 Less disbursements: Purchase of inventory 44 54 28 Selling and administrative expenses Equipment purchases 41 32 30 124 8 8 19 45 Dividends 2 2 2 2 Total disbursements 95 96 Excess (deficiency) of cash available over disbursements (2) (1) 12arrow_forwardam. 116.arrow_forwardam. 104.arrow_forward

- 2. Cash Receipts Budget and Accounts Receivable Aging Schedule Shalimar Company manufactures and sells industrial products. For next year, Shalimar has budgeted the following sales: Quarter 1 $4,620,000 Quarter 2 5,610,000 Quarter 3 1,190,000 Quarter 4 7,840,000 In Shalimar’s experience, 10 percent of sales are paid in cash. Of the sales on account, 65 percent are collected in the quarter of sale, 25 percent are collected in the quarter following the sale, and 7 percent are collected in the second quarter after the sale. The remaining 3 percent are never collected. Total sales for the third quarter of the current year are $5,640,000 and for the fourth quarter of the current year are $7,320,000. Required: Question Content Area 1. Calculate cash sales and credit sales expected in the last two quarters of the current year, and in each quarter of next year. Quarter Cash Sales Credit Sales 3, current year $fill in the blank 0b62a1fb700f07d_1 $fill in the blank…arrow_forwardAm. 1113.arrow_forwardCorp. Is working on its cash budget for March. The budgeted beginning cash balance is $26,000. budgeted cash receipts total $198,000 and budgeted cash disbursements total $197,000. The desired ending cash balance is $45,000. Q) The excess (deficiency) of cash available over disbursements for March will be: Multiple Cholce $25,000 $1,000 $27,000 $224,000arrow_forward

- Edelmar Corp. has prepared a preliminary cash budget for the third quarter as shown below: Cash Budget Beginning cash balance Plus: Cash collections Cash available Less: Cash payments: Purchases of direct materials July $36,000 $56,000 92,000 Operating expenses Capital expenditures Ending cash balance Aug $17,000 $52,000 $69,000 34,000 41,000 0 $17,000 Subsequently, the marketing department revised its figures for cash collections. New data are as follows: $54,000 in July, $55,000 in August, and $44,000 in September. Based on the new data, calculate the new projected cash balance at the end of July Sep $21,500 47,800 $69,300 9,000 30,500 8,000 $21,500 10,000 30,800 7,700 $20,800arrow_forwardCash Flow Budget Assumptions: Beginning balance is $20,000 Cost of goods sold is 80% of sales Building rent is $3,000 a month Accounts payable turnover ratio is 12 Accounts receivable ratio is 6 Inventory turnover ratio is 6 A quarter of sales are paid in cash Minimum cash balance is never less than $5,000arrow_forwardFayette Medical Clinic has budgeted the following cash flows. February $232,000 January March Cash receipts Cash payments For inventory purchases For S&A expenses $240,000 $272,000 220,000 62,000 164,000 64,000 190,000 54,000 Fayette Medical had a cash balance of $16,000 on January 1. The company desires to maintain a cash cushion of $10,000. Funds are assumed to be borrowed, in increments of $2,000, and repaid on the last day of each month; the interest rate is 1 percent per month. Repayments may be made in any amount available. Fayette pays its vendors on the last day of the month also. The company had a monthly $80,000 beginning balance in its line of credit liability account from this year's quarterly results. Required Prepare a cash budget. (Any repayments/shortage should be indicated with a minus sign. Round intermediate and final answers to the nearest whole dollar amounts.) X Answer is not complete. Cash Budget January February March Section 1: Cash receipts Beginning cash…arrow_forward

- The following information was used by the Long Corporation to prepare a cash budget for April: Cash balance beginning of April $ 16,000 Expected cash receipts in April 272,000 Sales salaries paid 62,000 Material purchases (all cash) 94,000 Depreciation charges 44,000 Other expenses (all cash) 96,000 What is the budgeted ending cash balance in April? Multiple Choice None of these. $36,000 $45,000 $22,000 $ (8,000)arrow_forwardA cash budget, by quarters, is given below for a retail company (000 omitted). The company requires a minimum cash balance of $7,000 to start each quarter. Required: Fill in the missing amounts. Note: Enter your answers in thousands of dollars. Cash deficiencies and Repayments should be indicated by a minus sign. Quarter (000 omitted) 4 (000 omitted) Year 1 2 Cash balance, beginning $ 7 Add collections from customers 105 378 Total cash available 91 Less disbursements: Purchase of inventory 44 54 28 Selling and administrative expenses 32 30 124 Equipment purchases 8 8 19 45 Dividends 2 2 2 2 Total disbursements Excess (deficiency) of cash available over disbursements 96 (2) 12 Financing: Borrowings Repayments (including interest) Total financing Cash balance, ending "Interest will total $1,000 for the year. 8 (13)arrow_forwardmn.2arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education