Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

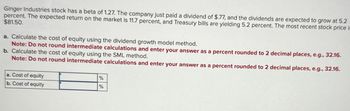

Transcribed Image Text:Ginger Industries stock has a beta of 1.27. The company just paid a dividend of $.77, and the dividends are expected to grow at 5.2

percent. The expected return on the market is 11.7 percent, and Treasury bills are yielding 5.2 percent. The most recent stock price is

$81.50.

a. Calculate the cost of equity using the dividend growth model method.

Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.

b. Calculate the cost of equity using the SML method.

Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.

a. Cost of equity

b. Cost of equity

%

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- The Penny Corporation's common stock has a beta of 1.8. If the risk-free rate is 6.9% and the expected return on the market is 20%, what is the company's cost of equity capital? (Do not round intermediate calculations. Enter answer as a percent rounded to 2 decimal places.)arrow_forwardSaved Help Stock in Eduardo Industries has a beta of 1.14. The market risk premium is 7.4 percent, and T-bills are currently yielding 4.4 percent. The most recent dividend was $3.80 per share, and dividends are expected to grow at an annual rate of 5.4 percent, indefinitely. If the stock sells for $60 per share, what is your best estimate of the company's cost of equity? Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16. Cost of equity %arrow_forwardEpley Industries stock has a beta of 1.25. The company just paid a dividend of $.40, and the dividends are expected to grow at 5 percent. The expected return on the market is 12 percent, and Treasury bills are yielding 6.1 percent. The most recent stock price for the company is $78. a. Calculate the cost of equity using the DCF method. (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) DCF method % b. Calculate the cost of equity using the SML method. (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) SML method % eBook & Resources eBook: 14.2. The Cost of Equity Check my workarrow_forward

- Suppose Wacken, Limited just issued a dividend of $2.60 per share on its common stock. The company paid dividends of $2.10, $2.17, $2.34, and $2.44 per share in the last four years. If the stock currently sells for $79, what is your best estimate of the company's cost of equity capital using arithmetic and geometric growth rates? Note: Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16. Cost of equity using arithmetic growth rate Cost of equity using geometric growth rate % %arrow_forwardGinger Industries stock has a beta of 1.33. The company just paid a dividend of $.83, and the dividends are expected to grow at 5.3 percent. The expected return on the market is 11.8 percent, and Treasury bills are yielding 5.3 percent. The most recent stock price is $83.00. Calculate the cost of equity using the dividend growth model method. Calculate the cost of equity using the SML method.arrow_forwardSuppose you recently performed a short sale on IBM stock at $174/share. Initial margin 55 %, maintenance margin 35%. Suppose after the short sale, IBM stock price immediately increasesto $200/share. Will there be a margin call? Show all margin calculations.arrow_forward

- The Swanson Corporation's common stock has a beta of 1.8. If the risk-free rate is 4.9 percent and the expected return on the market is 11 percent, what is the company's cost of equity capital? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) Cost of equity capital %arrow_forwardS. Bouchard and Company hired you as a consultant to help estimate its cost of common equity. You have obtained the following data: DO $0.85; PO $22.00; and g 6.00% (constant). The CEO thinks, however, that the stock price is temporanly depressed, and that it will soon rise to $34.00. Based on the DCF approach, by how much would the cost of common from retained earnings change if the stock price changes as the CEO expects?.arrow_forwardThe Fraber Corporation's common stock has a beta of 0.6. If the risk-free rate is 1.7% and the expected return on the market is 10%, what is the company's cost of equity capital? (Do not round intermediate calculations. Enter answer as a percent rounded to 2 decimal places.)arrow_forward

- Ran Company wants to determine its cost of common stock equity using the CAPM. The company's investment advisors indicate that the firm’s beta is equals to 1.3;the risk-free rate is 6%; and the market return is 10%. (Do not round off between computations. Round off the final answer to two decimal places. Example of writing your answer 2.58%)arrow_forwardA share of common stock just paid a dividend of $5. If the expected long-run growth rate for this stock is 2%, and if investors' required rate of return is 8.5%, then what is the stock price? Round your final answer to 2 decimal places. Do not round any intermediate calculation.arrow_forwardHelparrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education