FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:genow.com/ilm/takeAssignment/takeAssignmentMain.do?inprogress-true

stom Order

♥

e

<

eBook

costs.

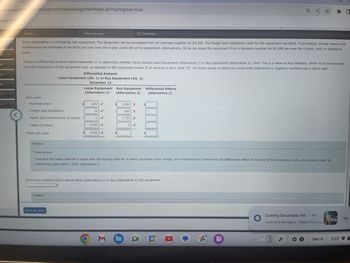

Gilroy Corporation is considering new equipment. The equipment can be purchased from an overseas supplier for $3,200. The freight and installation costs for the equipment are $650. If purchased, annual repairs and

maintenance are estimated to be $430 per year over the 4-year useful life of the equipment. Alternatively, Gilroy can lease the equipment from a domestic supplier for $1,580 per year for 4 years, with no additional

Unit costs:

Purchase price

Freight and installation

Repair and maintenance (4 years)

Lease (4 years)

Prepare a differential analysis dated December 11 to determine whether Gilroy should Lease Equipment (Alternative 1) or Buy Equipment (Alternative 2). Hint: This is a lease-or-buy decision, which must be analyzed

from the perspective of the equipment user, as opposed to the equipment owner. If an amount is zero, enter "0". For those boxes in which you must enter subtracted or negative numbers use a minus sign.

Differential Analysis

Lease Equipment (Alt. 1) or Buy Equipment (Alt. 2)

December 11

Lease Equipment

(Alternative 1)

Total unit costs

Feedback

Show Me How

Feedback

Check My Work

0.00

-0

O

0

✓

✓

✓

6,320 X

6,320 X

Buy Equipment

(Alternative 2)

$

M

3,200 X

650 X

Print Item

1,720 X

0 ✓

Check My Work

Compare the lease costs for 4 years with the buying costs for 4 years (purchase price, freight, and maintenance). Determine the differential effect on income of the revenues, costs, and income (loss) by

subtracting alternative 1 from alternative 2.

Determine whether Gilroy should lease (Alternative 1) or buy (Alternative 2) the equipment.

Differential Effects

(Alternative 2)

0

Q <

31

A

Coming December 9th 16h

Love and Monsters - Watch the tra...

Dec 8

MONS

2:22

D

V

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Mowbot Company is evaluating the production of a new part. It would require the acquisition of a special CNC lathe costing $375,000. The machine would be used for five years then sold for $135,000. Mowbot’s MARR is 18%. In addition to the sales quotation, the sales representative has quoted a five year lease for $81,000 per year, with the first year’s payment due on delivery. Based on pretax analysis, should Mowbot choose leasing or buying?arrow_forwardThe Titanic Shipbuilding Company has a noncancelable contract to build a small cargo vessel. Construction involves a cash outlay of $270,000 at the end of each of the next two years. At the end of the third year, the company will receive payment of $620,000. The company can speed up construction by working an extra shift. In this case, there will be a cash outlay of $584,000 at the end of the first year followed by a cash payment of $620,000 at the end of the second year. Use the IRR rule to show the (approximate) range of opportunity costs of capital at which the company should work the extra shift. Note: Enter your answers as a percent rounded to 2 decimal places. Enter the smallest percent first. The company should work the extra shift if the cost of capital is between % and %.arrow_forwardWildhorse Company manufactures a check-in kiosk with an estimated economic life of 10 years and leases it to Sheffield Chicken for a period of 9 years. The normal selling price of the equipment is $172,124, and its unguaranteed residual value at the end of the lease term is estimated to be $26,200. Sheffield will pay annual payments of $20,800 at the beginning of each year. Wildhorse incurred costs of $141,100 in manufacturing the equipment and $2,400 in sales commissions in closing the lease. Wildhorse has determined that the collectibility of the lease payments is probable and that the implicit interest rate is 5%. Sheffield Chicken has an incremental borrowing rate of 5%. The lessor's implicit rate is unknown to the lessee.arrow_forward

- DSSS CorporationDSSS Corporation is considering a new project to manufacture widgets. The cost of the manufacturing equipment is $135,000. The cost of shipping and installation is an additional $2,600. The asset will fall into the 3-year MACRS class. The year 1- 4 MACRS percentages are 33.33%, 44.45%, 14.81%, and 7.41%, respectively. Sales are expected to be $215,000 per year. Cost of goods sold will be 64% of sales. The project will require an increase in net working capital of $2,600. At the end of three years, DSSS plans on ending the project and selling the manufacturing equipment for $30,000. The marginal tax rate is 36% and DSSS Corporation’s appropriate discount rate is 12%. The fixed expenses is $12,000.Refer to DSSS Corporation. What is the initial investment outlay for this project? Group of answer choices $140200 $150,200 $35,000 $130,200arrow_forwardDSSS CorporationDSSS Corporation is considering a new project to manufacture widgets. The cost of the manufacturing equipment is $135,000. The cost of shipping and installation is an additional $2,600. The asset will fall into the 3-year MACRS class. The year 1- 4 MACRS percentages are 33.33%, 44.45%, 14.81%, and 7.41%, respectively. Sales are expected to be $215,000 per year. Cost of goods sold will be 64% of sales. The project will require an increase in net working capital of $2,600. At the end of three years, DSSS plans on ending the project and selling the manufacturing equipment for $30,000. The marginal tax rate is 36% and DSSS Corporation’s appropriate discount rate is 12%. The fixed expenses is $12,000.Refer to DSSS Corporation. What is the after-tax cash flow from selling the machine at the end of year 3? Group of answer choices $21,935 $30,000 $8,065 $2,600arrow_forwardDSSS CorporationDSSS Corporation is considering a new project to manufacture widgets. The cost of the manufacturing equipment is $135,000. The cost of shipping and installation is an additional $5,300. The asset will fall into the 3-year MACRS class. The year 1- 4 MACRS percentages are 33.33%, 44.45%, 14.81%, and 7.41%, respectively. Sales are expected to be $230,000 per year. Cost of goods sold will be 61% of sales. The project will require an increase in net working capital of $5,300. At the end of three years, DSSS plans on ending the project and selling the manufacturing equipment for $20,000. The marginal tax rate is 39% and DSSS Corporation’s appropriate discount rate is 15%. The fixed expenses is $12,000.Refer to DSSS Corporation. What is the total cash flow generated in year 3? Group of answer choices $71,719 $74,988 $19,488 $55,501arrow_forward

- Xtra Mechanical, Inc. is a manufacturer of machine parts with locations in the United States. It is considering entering into an eight year supply agreement with a customer where it will supply certain parts to the customer for their products. The project will require Xtra to purchase a new machine at the begining of the project and the cost of the machine is $8,500,000. At the end of the project, the machine is expected to be sold in the used market for 20% of the original cost before paying taver. The five year MACRS depreciation will be used for tax purposes. The depreciate rates are shown below. There is an initial networking capital investment of $15,000 and no further investment in not working capital is required. We assume that all the money tied up in the networking capital account will be recovered by the end of the project Revenues from the contract per year are shown below. Cost of goods sold is expected to be 50% of revenues. In addition to cost of goods seld, the project…arrow_forwardCaramel Spa Company sells prefabricated pools that cost $80,000 to customers for $144,000. The sales price includes an installation fee, which is valued at $20,000. The fair value of the pool is $128,000. The installation is considered a seperate performance obligation and is expected to take 3 months to complete. The transaction price allocated to the pool and the installation isarrow_forwardYour client, Keith Bridgeport Leasing Company, is preparing a contract to lease a machine to Souvenirs Corporation for a period of 25 years. Bridgeport has an investment cost of $428,800 in the machine, which has a useful life of 25 years and no salvage value at the end of that time. Your client is interested in earning an 12% return on its investment and has agreed to accept 25 equal rental payments at the end of each of the next 25 years. Click here to view factor tables You are requested to provide Bridgeport with the amount of each of the 25 rental payments that will yield an 12% return onarrow_forward

- DSSS CorporationDSSS Corporation is considering a new project to manufacture widgets. The cost of the manufacturing equipment is $135,000. The cost of shipping and installation is an additional $2,600. The asset will fall into the 3-year MACRS class. The year 1- 4 MACRS percentages are 33.33%, 44.45%, 14.81%, and 7.41%, respectively. Sales are expected to be $215,000 per year. Cost of goods sold will be 64% of sales. The project will require an increase in net working capital of $2,600. At the end of three years, DSSS plans on ending the project and selling the manufacturing equipment for $30,000. The marginal tax rate is 36% and DSSS Corporation’s appropriate discount rate is 12%. The fixed expenses is $12,000.Refer to DSSS Corporation. What is the depreciation expense in year 2? Group of answer choices $10,196 $20,379 $61,163 $45,862arrow_forwardDSSS CorporationDSSS Corporation is considering a new project to manufacture widgets. The cost of the manufacturing equipment is $135,000. The cost of shipping and installation is an additional $2,600. The asset will fall into the 3-year MACRS class. The year 1- 4 MACRS percentages are 33.33%, 44.45%, 14.81%, and 7.41%, respectively. Sales are expected to be $215,000 per year. Cost of goods sold will be 64% of sales. The project will require an increase in net working capital of $2,600. At the end of three years, DSSS plans on ending the project and selling the manufacturing equipment for $30,000. The marginal tax rate is 36% and DSSS Corporation’s appropriate discount rate is 12%. The fixed expenses is $12,000.Refer to DSSS Corporation. What is the total cash flow generated in year 3? Group of answer choices $63,875 $73,727 $49,192 $24,535arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education